Cardano’s 18% Drop? Or a Comeback? The Drama Is Real! 📉✨

The chart has thrown a bearish party, but the on-chain guests are still sipping champagne and not fully committing to the dance. 🥂

The chart has thrown a bearish party, but the on-chain guests are still sipping champagne and not fully committing to the dance. 🥂

Despite joyous proclamations from the economic bards singing of rate cuts and liquidity injections (not to mention a waltzing US dollar index), the digital garden has yet to bear a fruitful resurgence. One might liken Bitcoin to a patient serf, overworked and undernourished, who, despite the king’s decrees, finds no relief nor relief. Yet, fresh tidings hint that perhaps the dark sorcery of excess leverage is being dismantled, brick by brick.

China’s onshore yuan, that stalwart sentinel of the East, has scaled heights unseen since May 2023, closing at 7.0066 per dollar. A whisker away from the sacred 7-per-dollar threshold, it mocks the greenback’s decline. A 5% appreciation since April-a mere sneeze in the grand theater of currency wars, yet enough to stir the pot of global finance. 🍜

Who can convert licences, pilots, and whitepapers into safe, scalable products that win customers and preserve capital? 🧩💰

A turbulent two-month tale has seen these losses sway like a pendulum, from $3.5 billion to nearly $4.2 billion, as ETH found itself lodged in a lullaby of $2.6K-$2.75K-a descent of some 40% that would even have the most stoic scribe brought to laughter, tears, or both. 😂

The price was going down, down, down – 18% this month! A disaster! But then, BAM! Penguins on a sphere and suddenly it goes up? I’m telling you, the market is irrational. Completely irrational. It’s like people just see a cartoon penguin and throw money at it. 🤦♂️

Here’s the TL;DR 🤓:

He noted, with the grave solemnity of a man reading a will at a family reunion, that Bitcoin was clinging to its 50-week moving average like a drunk uncle to a karaoke mic. But alas, it was only a matter of time. The price would slip to the 100-week MA-the financial equivalent of joining a book club-and possibly even plunge toward the 200-week MA, which sounds less like a trading indicator and more like a medieval torture device. 🔗📉

Now, this isn’t the first time Nvidia has played this game-three months ago, they did the same with another startup. It’s like they’re collecting competitors like Pokémon. 🎮

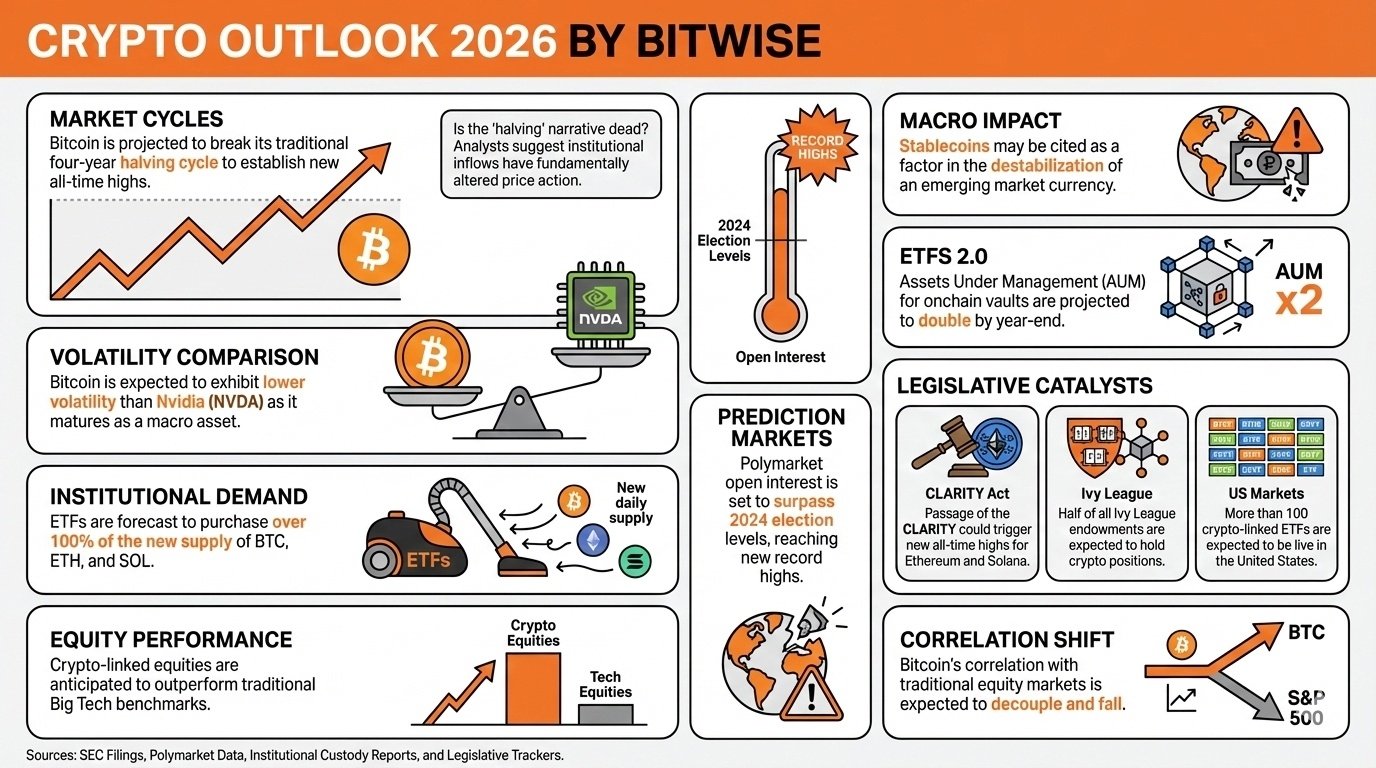

Bitwise Asset Management, that paragon of U.S. asset management, has published its “10 Crypto Predictions for 2026” report on Dec. 15, a document so bullish it makes a Siberian winter seem warm. Chief Investment Officer Matt Hougan and Head of Research Ryan Rasmussen, with the gravitas of Tolstoy dissecting peasant life, declare: