You Won’t Believe How These Crypto Villains Cashed Out $BAD Like Gentleman Rogues!

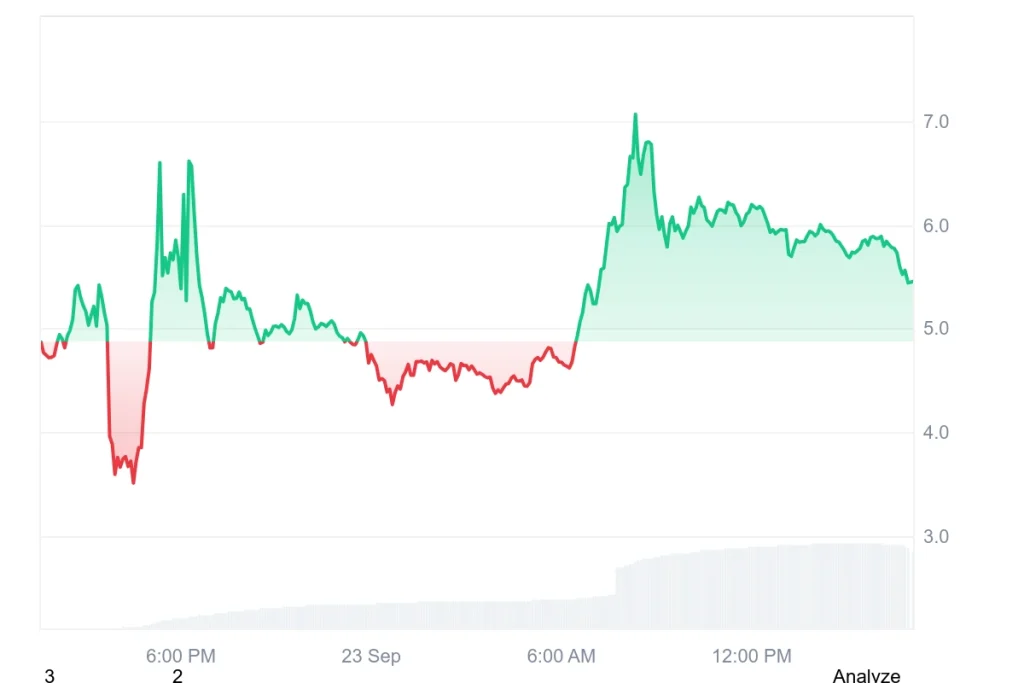

According to the man of the hour, Mr. Lightspeed (because why have one grandiose title when you can have two?), the wallets of the bridge charlatan are now emptier than Bertie Wooster’s patience after a string of Aunt Dahlia’s comical catastrophes.