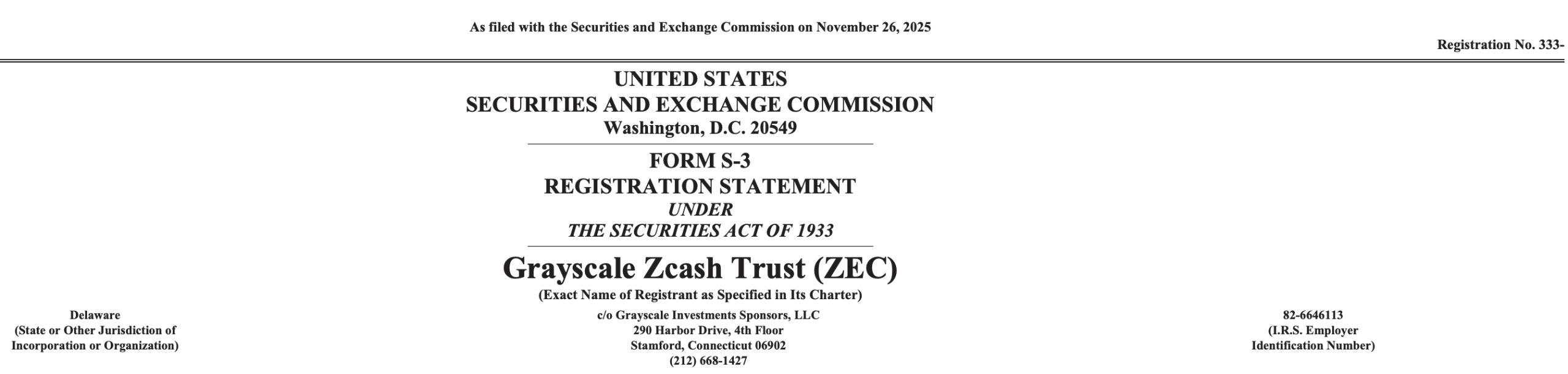

Pray tell, dear reader, for Grayscale hath proclaimed with great fanfare upon the platform of X, that they have submitted a Form S-3 for their Zcash Trust, a move they deem “an indispensable stride towards the debut of the inaugural ZEC ETPs.” 📰✨

Grayscale’s ZEC ETF: A Tale of Ambition and Cryptographic Charm

The esteemed company doth extol the virtues of Zcash, with its zero-knowledge cryptography and privacy features, declaring them essential to the token’s enduring relevance. They further opine, with a wink and a nod, that “as privacy becomes the very cornerstone of crypto, we regard ZEC as a vital component of a well-balanced digital asset portfolio.” 🛡️💎

This trust, born in the year 2017 as a private placement product, aspires to transform into an exchange-traded fund (ETF) upon the illustrious NYSE Arca, under the ticker ZCSH, according to its preliminary prospectus. The ETF, in its wisdom, shall track the price of Zcash held by the trust, less fees and expenses. Grayscale doth assert that this product is designed to offer cost-efficient exposure to ZEC, sans the necessity of direct token custody. 📈📉

Zcash, launched in the annus mirabilis of 2016, employeth zk-SNARKs to provide shielded transactions, which, like a masked ball, conceal sender, receiver, and transaction amounts, while permitting selective disclosure when the occasion demands. Grayscale, with a flourish, notes that this system is crafted to bring onchain privacy through cryptographic proofs, rather than relying on mixers or external technological contrivances. 🎭🔒

In their X proclamation, Grayscale doth include the requisite regulatory verbiage, reminding investors that the Zcash Trust “is speculative and fraught with significant risk, including the potential loss of principal,” and directing the curious to the SEC’s EDGAR database for official filings. A word to the wise, indeed! ⚠️📉

The prospectus reveals that the trust intends to issue and redeem shares in 10,000-unit baskets. At the time of filing, a basket required roughly 817 ZEC. The trust, in its current state, accepts only cash orders facilitated by a third-party liquidity provider, though in-kind creations and redemptions may be added in the future, should NYSE Arca secure additional regulatory approval. 🧺💰

Should this ETF be approved, it would join Grayscale’s broader endeavor to convert its single-asset trusts into fully regulated exchange-traded products. The firm posits that this move might alleviate the longstanding discount between the trust’s shares and the value of its underlying ZEC, a gap that hath fluctuated wildly over the years. 📉📈

The filing also delineates the ongoing risks for ZEC, including regulatory uncertainty, the potential classification of Zcash as a security, liquidity limitations, and the evolving treatment of privacy-focused digital assets in the United States and beyond. This news arrives amidst a veritable onslaught of crypto ETFs that have graced the scene. 🌪️💼

Grayscale’s X post doth emphasize Zcash’s role in the broader ecosystem and reaffirms its belief that privacy-preserving blockchains shall continue to play a significant role in digital asset markets. “Zcash brings onchain privacy via zk-SNARK-powered shielded transactions,” they declare with a flourish. 🛡️🔗

FAQ

- What did Grayscale file with the SEC?

Grayscale submitted a Form S-3 to commence the process of converting its Zcash Trust into an ETF. 📄✉️ - Where will the proposed Zcash ETF trade?

The company intends to list the shares on NYSE Arca under the ticker ZCSH. 🏛️💹 - Why is Zcash significant to Grayscale?

The firm cites Zcash’s zk-SNARK privacy features as a pivotal element in the evolving digital asset market. 🕵️♂️🔐

What risks did Grayscale highlight?

The trust warned of market volatility, regulatory uncertainty, and the possibility of losing principal. A cautionary tale, indeed! ⚠️📉

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin’s Chaotic Ballet: Will Bulls Survive the $102K Death Tango? 💸✨

- 🔥 XRP Staking: Firelight’s Bold Gamble Against DeFi Chaos! 🎲

- ETH CAD PREDICTION. ETH cryptocurrency

- 💰✨ Japan’s Dazzling Dance with Crypto: More Swoons and Fewer Tax Groans

2025-11-26 20:59