In a recent Q&A that could only be described as a masterclass in corporate jargon, David Schwartz of Ripple declared XRP the “undisputed champion of institutional payments,” while stablecoins sulked in the corner like forgotten relatives. 🤡 Meanwhile, banks tiptoe through compliance labyrinths, clutching permissioned tools like talismans against regulatory doom. XRP, however, remains the unsung hero of Ripple’s global strategy—because nothing says “future of finance” like a token that won’t let you buy a loaf of bread. 🍞

Why On-Chain Volume Doesn’t Tell the Whole Story

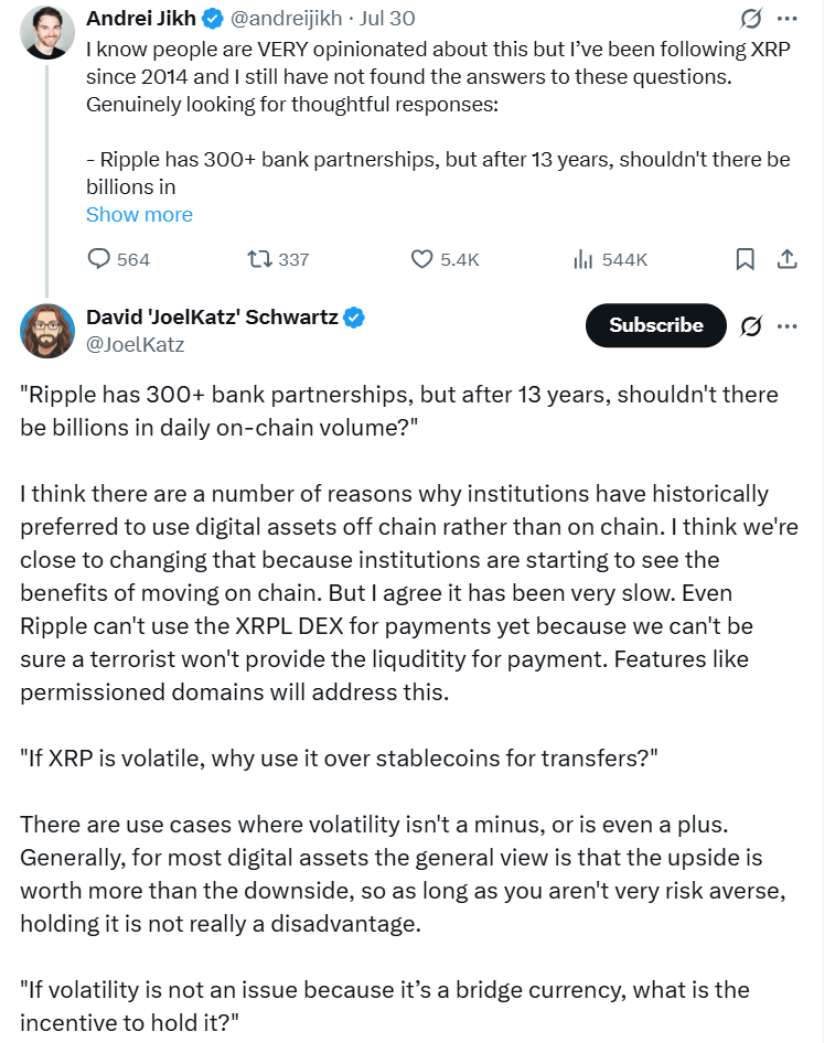

While skeptics demand XRP’s ledger activity to rival a circus, Schwartz explained that banks are still too afraid to move funds on-chain. Why? Compliance nightmares, of course! 🛑 Institutions crave the thrill of knowing exactly who they’re dealing with (spoiler: not a suspicious wallet labeled “Mysterious Whale 420”). Even Ripple itself avoids XRPL’s decentralized exchange like it’s a buffet line at a funeral. Tools like permissioned domains? Just another bureaucratic dance to appease the gods of trust. 🕺

“XRP’s price is like a rollercoaster—volatile, thrilling, and best enjoyed with a seatbelt of patience,” Schwartz quipped, as if volatility is just nature’s way of keeping investors humble. 🎢

XRP vs RLUSD: Different Roles, Same Ecosystem

RLUSD, the stablecoin everyone loves to hate, may offer “fiat stability,” but XRP is the star of the liquidity show. Why? Because nothing says “financial innovation” like using a token to bridge currencies no one’s heard of. 🌍 While RLUSD plays house with USD, XRP moonwalks through obscure currency pairings—because why settle for simple when you can be complex and mysterious? 🤷♂️

This revelation has crypto analysts scrambling for price predictions like it’s a treasure hunt. 🗺️

Institutional Confidence and the XRP Ledger’s Future

Schwartz posed a rhetorical question: “Why would BlackRock build its own blockchain when XRPL is already here?” 🤔 Because, dear reader, who wouldn’t want to ride on Ripple’s “scalable, neutral” Swiss Army knife of a ledger? Circle runs USDC on multiple chains, so why not let XRPL do the heavy lifting? It’s the crypto equivalent of hiring a professional instead of assembling IKEA furniture at 2 a.m. 🛠️

This strategy aligns with the latest XRP prediction: tokenized asset markets will bloom once regulators stop pretending they understand blockchain. 🌸

Compliance Still a Bottleneck—but Not for Long

Regulatory hurdles? Oh, just a minor inconvenience. Ripple’s lawyers are probably sipping champagne while permissioned domains and legal entities roll out like a well-rehearsed opera. 🍷 Meanwhile, the XRP lawsuit drags on like a never-ending TikTok drama, but hey—at least it’s keeping investors entertained. 🎬

Schwartz promised solutions will arrive faster than your neighbor’s Wi-Fi during peak streaming hours. 🚀

Looking Ahead: Will XRP Go Up?

As the crypto world debates XRP vs RLUSD and banks prepare to “plug in,” one truth emerges: XRP is the duct tape holding the financial universe together. 🤝 While stablecoins play nice, XRP thrives in chaos—because what’s a global payment network without a little drama? 🎭

For investors, today’s XRP price is just the overture to a grand symphony of gains. 🎶 As Schwartz mused, “XRP outlasts its challengers because it’s not their rival—it’s their understudy.” And if history teaches us anything, it’s that no one remembers the understudy until the main act collapses. 🎭

With innovation and regulatory clarity on the horizon, XRP’s 2025 and 2030 price predictions are written in glitter—because nothing says “future” like sparkles. ✨

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- XRP: A Most Disappointing Turn of Events! 📉

- Bitcoin’s Sleepy Whale Wakes Up with $44M Splurge 💸🤑

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

- 🤑 XRP’s Billion-Dollar Love Affair: Evernorth’s Wild Ride to Crypto Glory 🌪️

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- Crypto Chaos: Market Meltdown, Trade Twists & Central Bank Confusion

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

2025-07-31 23:15