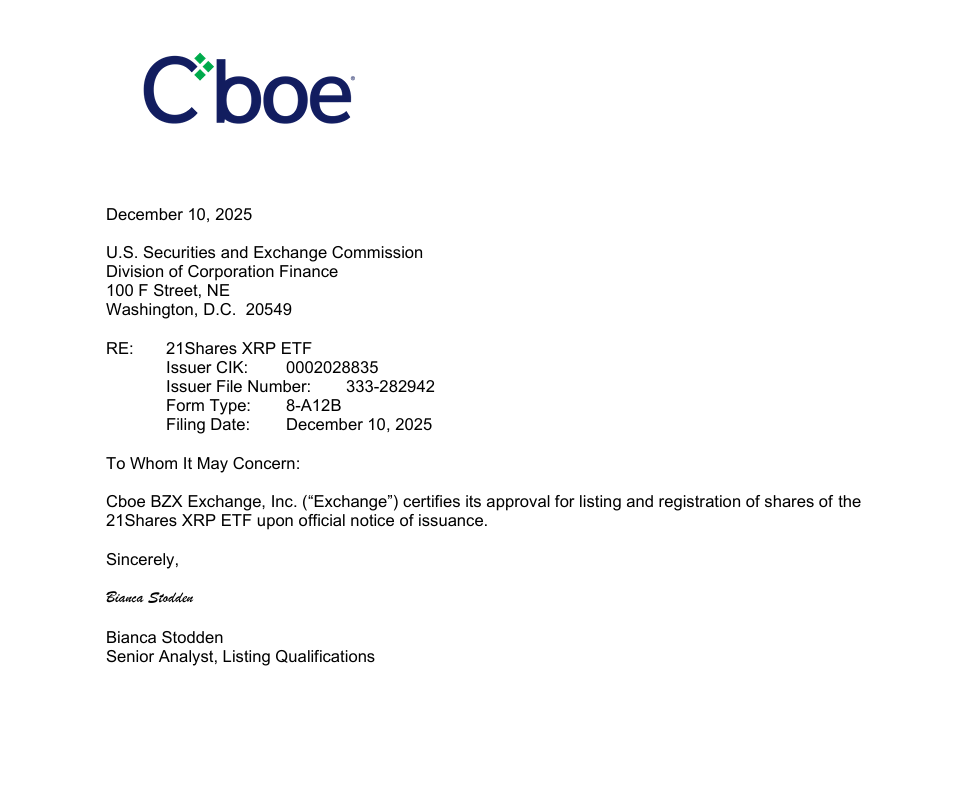

Cboe BZX Exchange just waved the 21Shares XRP ETF through the bureaucratic green light. The SEC filing? A mere formality, really. Now it’s off to the races-or at least to the trading floor.

Cboe BZX Exchange has officially said “yes” to the 21Shares XRP ETF, complete with a full registration pass. Thanks to a Wednesday SEC filing, this product is now technically “live,” pending the final paperwork. Because nothing says “urgency” like waiting for a notice that’s already been filed. 🤷♂️

Tracking a Benchmark That Sounds Like a Crypto Spreadsheet 📊

The 21Shares XRP ETF isn’t exactly reinventing the wheel-it’s just tracking the CME CF XRP-Dollar Reference Rate-New York Variant. Why “New York Variant,” though? Is there a Chicago one too? Anyway, the fund’s goal is to give investors direct XRP exposure, which is nice if you’re into fourth-largest crypto assets (by market cap). According to the prospectus, it’s “legit.”

Related Reading: Crypto News: NYSE Approves Grayscale DOGE and XRP ETFs for Monday Trading | Live Bitcoin News

Once the dust settles, shares of this ETF will trade on Cboe BZX under the ticker TOXR. The fee? A generous 0.3% annually (because who needs savings anyway?), paid weekly in XRP. Because nothing says “trust” like charging in the very asset you’re supposedly helping you invest in. 😂

The fund’s mission is to expose investors to “the price of XRP,” which it does by following the CME CF XRP-Dollar Reference Rate. This gives “transparency and accuracy in valuation”-a phrase that sounds impressive until you realize it’s just a fancy way of saying “we’re not making this up as we go along.”

The XRP in the fund is being guarded by Coinbase Custody Trust Company, Anchorage Digital Bank, and BitGo Trust. These names sound like they belong in a Bond villain’s monologue, but hey, at least they’re not keeping it in a shoebox under someone’s bed. The management fee? A modest 0.25%-0.40%. Because “modest” is what you call it when it’s still more than your neighbor’s lawn care budget. 🌱

Institutional Money Flows Like Water (or Maybe Crypto) 💸

The 21Shares XRP ETF is just one of many U.S. spot XRP ETFs launched recently. Companies like Canary Capital, Bitwise, Franklin Templeton, and Grayscale are all playing along. This isn’t just a market shift-it’s a full-blown revolution, or at least a very expensive PowerPoint slide. 📈

Collectively, these ETFs have sucked in over $666 million in institutional cash post-launch. Assets under management? Over $1.2 billion by December 2025. If you’re not invested, are you even trying to keep up? 🙄

This influx of money has been a key player in XRP’s recent price dance. With Cboe’s approval, expect the momentum to continue. Because nothing fuels a bull run like a bunch of suits nodding in unison. 👔

The rise of XRP ETFs speaks volumes about institutional love for the asset-especially after the U.S. regulatory climate suddenly became less “chaotic” and more “meh, okay.” Structured ETFs? Just another way to make crypto sound like something your grandmother would trust. 🤳

This final Cboe nod isn’t just a win for XRP-it’s a statement. It’s a neon sign flashing, “Hey, look at us! We’re legit now!” Whether that translates to actual legitimacy is another question. But hey, at least the fees are low(ish). 🚨

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Bitcoin’s $100K Break: A Spiritual Crisis? 😱🧠💸

- Bankman-Fried\’s Wild Excuse

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- When Tech Meets Tradition: Kraken & Deutsche Börse Salsa Together

- XRP: A Most Disappointing Turn of Events! 📉

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

2025-12-11 15:15