Markets

What to know:

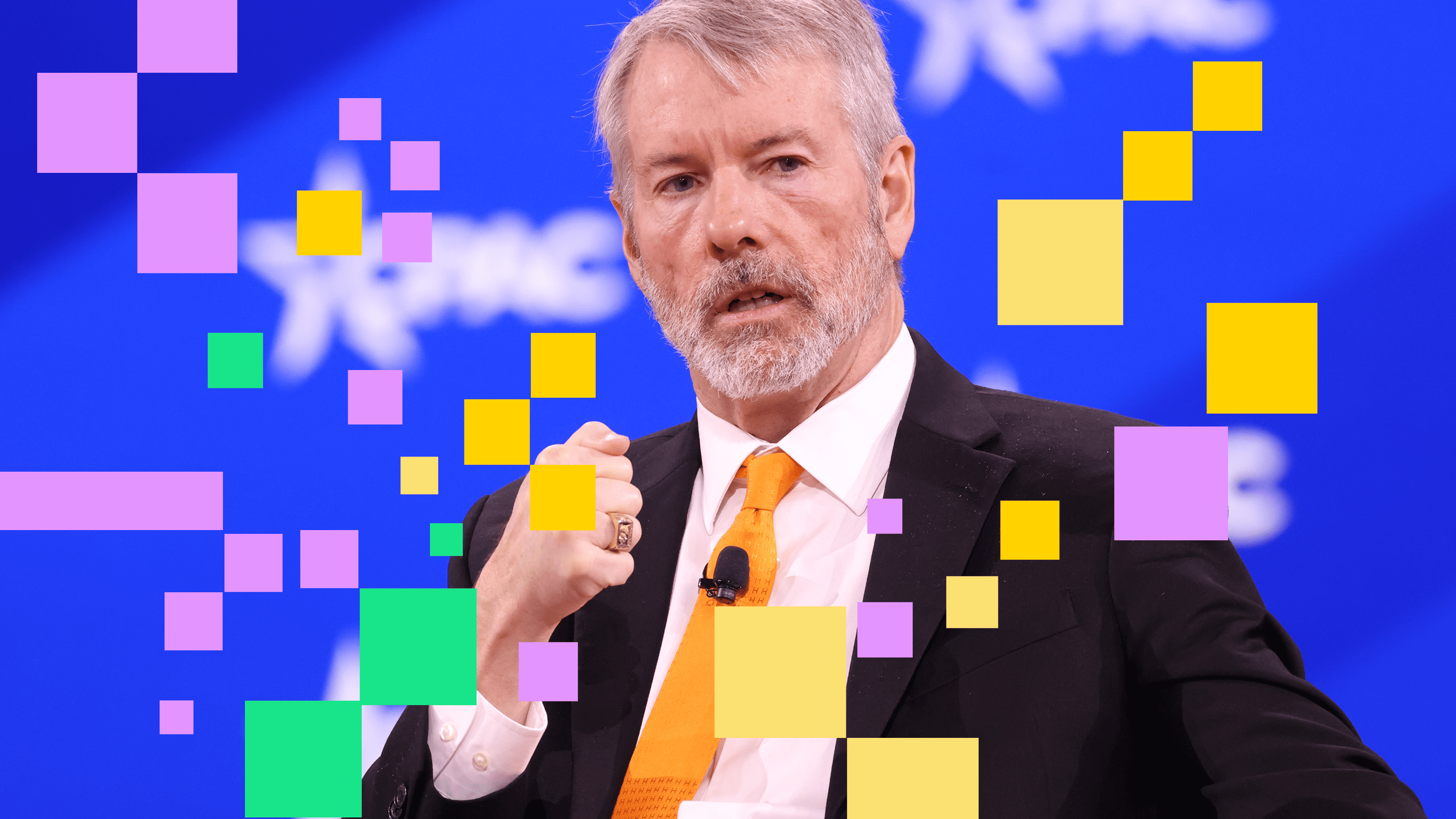

- MicroStrategy tried to crash the S&P 500 party and got politely shown the door-even though they checked all the boxes. Apparently, being a walking, talking bitcoin ATM isn’t fashionable yet.

- JPMorgan, the ever-so-jolly guardians of Wall Street, warned this snub might cause other index clubs to rethink their crypto guest lists.

- The corporate treasury model is wobblier than your uncle after three margaritas, according to analysts who definitely love spreadsheets.

MicroStrategy (ticker: MSTR) waved its invite around like it was the hottest ticket in town, only to be told, “Sorry, you don’t really fit in here.” Despite technically being eligible, the S&P 500 index committee decided they’d rather not mingle with a company that treats its balance sheet like a Bitcoin piggy bank.

According to JPMorgan (or JPM, to those who enjoy brevity), this little rejection is a cold splash of reality for MicroStrategy and the growing choir of corporate crypto enthusiasts who think their treasury should moonlight as a bitcoin vault.

MicroStrategy has managed to sneak bitcoin into fancy indexes like the Nasdaq 100 and MSCI, which is basically like sneaking kale into a birthday cake-nobody notices, but it’s there. So, retail and institutional investors have been unknowingly buying a side of crypto with their stocks.

But now, the S&P 500 is playing bouncer, making it clear that bitcoin-heavy firms might soon find themselves on the “not tonight, folks” list. Other index providers might follow suit faster than you can say “digital gold.”

Meanwhile, Nasdaq has started flexing its muscles, demanding shareholder approval before companies can issue new stock just to buy more crypto. It’s like needing your mom’s permission to buy candy. 🍬

In a dramatic plot twist, MicroStrategy abandoned its “no-dilution” vow, basically admitting it’s fine with selling shares at bargain-bin prices just to keep hoarding bitcoin. Because who needs shareholder love when you’ve got digital coins?

All this unfolds as corporate crypto treasuries watch their share prices do the limbo-how low can they go? Fundraising is slowing; investors seem to be suffering from crypto fatigue, which is less fun than it sounds.

Some companies are trying fancy moves: bitcoin-backed loans, token-linked convertibles-basically financial origami. But with risk premiums rising, investors and index gatekeepers might soon swap bitcoin-only zealots for companies that actually, you know, run businesses-like crypto exchanges and miners.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Steinbeck’s Take on Dogecoin’s Wild Ride 🐶🚀

- ETH PREDICTION. ETH cryptocurrency

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-09-11 15:37