Standard Chartered’s very own digital oracle, Geoff Kendrick, has decreed that Ethereum treasury firms are now the belle of the investment ball-far outpacing their US spot ETF counterparts. Cue the violins-or maybe a kazoo symphony? 🎵✨

Kendrick, in his infinite wisdom (or perhaps just market savvy), suggests that publicly listed companies like Sharplink Gaming (SBET) are serving up a tastier slice of ETH exposure than those drab ol’ ETFs. Pass the caviar, please! 🍾💸

ETF vs. Stocks: The Eternal Ethereum Smackdown 🥊

In an exclusive tête-à-tête with BeInCrypto, Kendrick spilled the tea: Ethereum treasury firms and ETFs have been neck-and-neck since early June, each hoovering up 1.6% of ETH’s circulating supply. It’s like watching two toddlers fight over the last cookie. 🍪👊

Kendrick waxed poetic about NAV multiples-the financial equivalent of measuring your soul’s worth via Excel spreadsheets. Apparently, they’ve started to stabilize. SharpLink Gaming (NASDAQ: SBET), one of the OG ETH-holding firms, is trading just above a NAV multiple of 1.0. Bravo, capitalists! 👏📈

“Why would NAV multiples dip below 1.0? These firms are offering regulatory arbitrage wrapped in a bow for investors,” Kendrick mused. “Given the current state of affairs, I’d rather buy into these ETH treasury companies than touch US spot ETH ETFs.” 🙅♂️💼

According to Kendrick, these firms don’t just give you ETH exposure-they throw in staking rewards and increasing ETH per share like it’s a Black Friday sale. And oh, SBET’s Q2 earnings report on August 15? That’s the cherry on top of this capitalist sundae. 🍦📊

Ethereum Treasury Companies: The Quiet Accumulators 😶🌫️💎

These firms have been lurking in the shadows like cryptic ninjas, amassing over 2 million ETH since their stealthy debut earlier this year. Standard Chartered predicts another 10 million ETH could follow. Ten. Million. 🤯💸

Last month alone, they gobbled up 545,000 ETH-worth a cool $1.6 billion. SharpLink Gaming reportedly snatched 50,000 ETH, bringing its total stash to over 255,000 ETH. Someone get this company a trophy-or at least a participation ribbon. 🏆💳

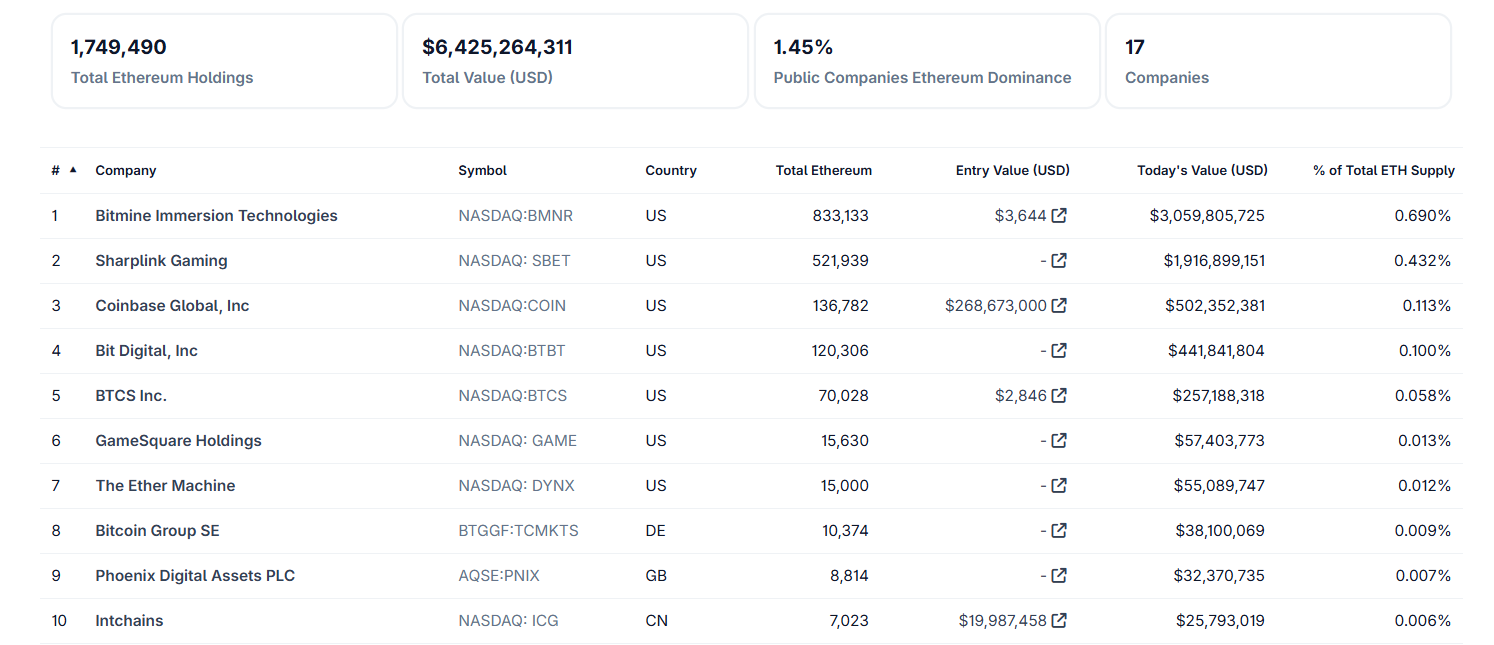

Kendrick’s musings align with a broader institutional trend. As of August, 12 public companies hold over 1 million ETH, including BitMine Immersion Technologies, Coinbase, and Bit Digital. Public firms now own 0.83% of the total ETH supply, according to CoinGecko. Take that, whales! 🐳🌐

Spot Ethereum ETFs: A Rollercoaster Ride 🎢🎢

Meanwhile, Ethereum spot ETFs have been living their best chaotic lives. After raking in $5.4 billion in July, they hit turbulence in August. On August 1, $152 million fled the scene; on August 4, $465 million followed suit-the largest single-day exodus ever. BlackRock’s ETHA bore the brunt, losing $375 million. Ouch. 💸🔥

But fear not! The market staged a mini-comeback on August 5, pulling in $73 million. BlackRock led the charge while Grayscale’s funds saw modest redemptions. Progress, perhaps? Or just another plot twist in this financial soap opera. 📉📈

Despite the chaos, structural improvements march on. In late July, the SEC approved in-kind creation and redemption mechanisms for crypto ETFs, making them operate more like traditional commodity ETFs. Baby steps toward sanity-or at least less insanity. 🤞🔄

Standard Chartered’s endorsement paints a picture of shifting sands in institutional Ethereum investments. With NAV multiples stabilizing and staking benefits piling up, ETH treasury firms are carving out their niche as high-efficiency alternatives to ETFs. Who needs ETFs when you can have… treasury firms? 🏦✨

Investors will be glued to SBET’s August 15 earnings report, hoping it validates Ethereum treasury firms as the next big thing in institutional-grade assets. Will Kendrick’s prophecy come true? Stay tuned for the sequel-or maybe just a really long PowerPoint presentation. 📊🎥

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD CNY PREDICTION

- Silver Rate Forecast

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- OKB PREDICTION. OKB cryptocurrency

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- USD GEL PREDICTION

2025-08-07 04:13