Ah, the cryptocurrency market-a place where fortunes are made and lost faster than you can say “blockchain.” As we teeter on the edge of that oh-so-important $3 trillion mark (which is about as stable as a Jenga tower on a bumpy road), it seems our beloved digital assets are undergoing a bit of a midlife crisis. Yes, folks, widespread selling pressure has knocked off a hefty chunk of January’s gains, leaving investors feeling as jittery as a cat in a room full of rocking chairs.

The State of the Market

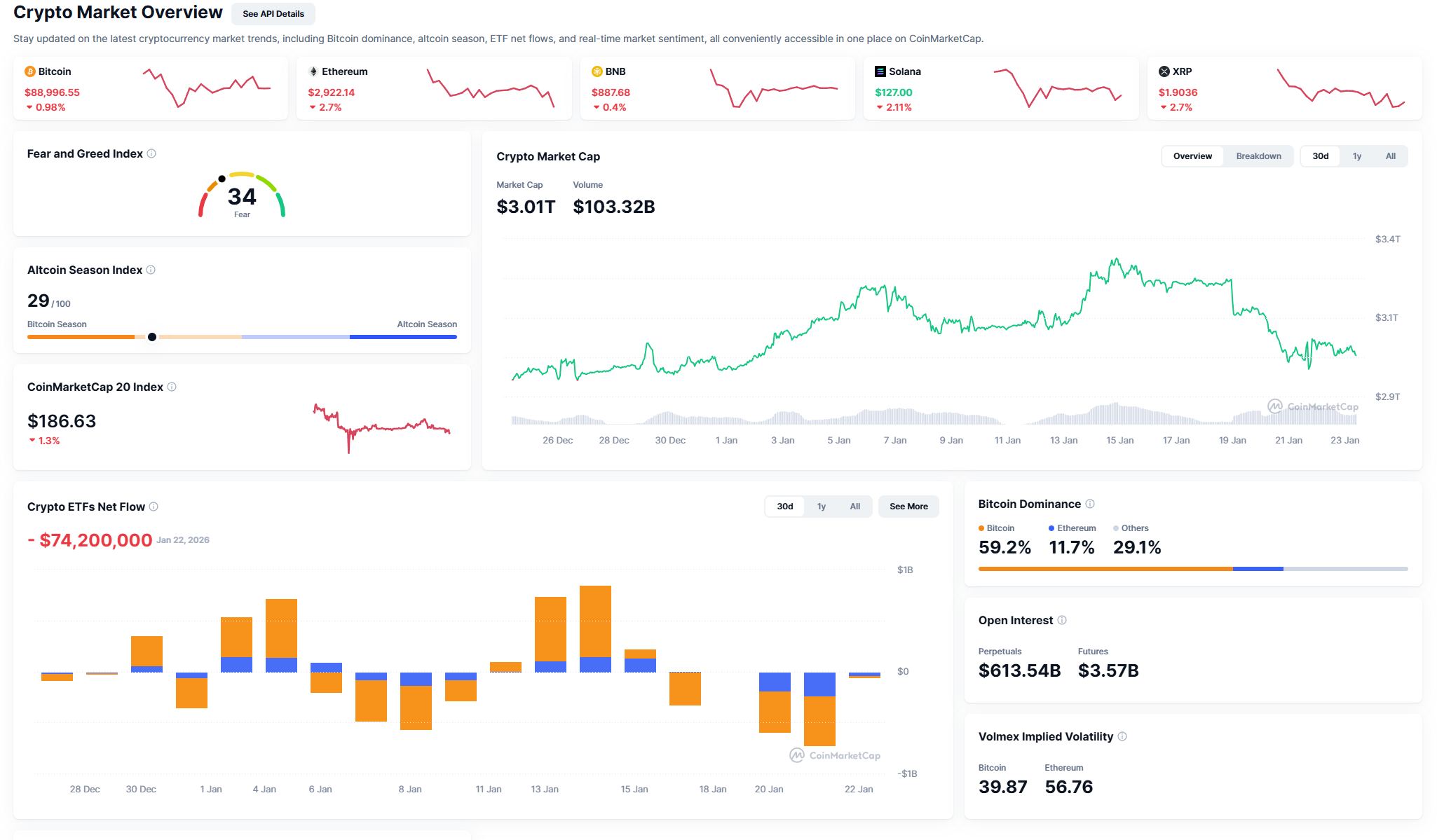

Now, before you start hyperventilating, let’s clarify: this isn’t a panic attack; it’s more of a structural pullback-think of it as the market’s way of saying, “Let’s have a little think about our life choices.” Bitcoin, being the diva of the cryptocurrency world, is still calling the shots, and right now it’s stuck in a bit of a traffic jam around the $90,000-$95,000 range, which, if I may add, might as well be the Bermuda Triangle for all the good it’s doing.

With Bitcoin’s inability to produce any follow-through buying above those pesky moving averages, it’s like watching a soap opera where the main character just can’t seem to make a decision. And because Bitcoin hogs so much of the market cap, it’s dragging everything down with it. It’s like that one friend who can’t decide where to eat and ends up making everyone late for dinner.

Ethereum‘s Troubled State

As for Ethereum, well, it’s having an identity crisis of its own. Plummeting below the psychologically crucial $3,000 mark is akin to getting dumped via text-nobody enjoys it, and it raises a lot of uncomfortable questions. The struggle to gain momentum has left ETH floundering like a fish out of water, and when Ethereum stumbles, it’s like watching a chain reaction of anxiety ripple through the whole altcoin crowd.

From a broader perspective, Ethereum’s failure to lead the charge during recoveries is a bit unsettling. Think of it as the kid at school who can’t quite figure out the group project, leaving everyone else scratching their heads. Until Ethereum can strut its stuff and reclaim some important resistance levels, don’t expect anyone to start pouring their hard-earned cash into smaller assets.

Market metrics are showing signs of defensive positioning. ETF flows and derivatives data indicate that investors are retreating faster than a squirrel at the first sound of thunder. The Fear and Greed Index has plummeted into fear territory, signaling that investors are sitting back and waiting for someone else to take the plunge first.

As we look ahead, expectations are split like a bad sitcom plot twist: the bears see the recent downturn as proof that the market needs a serious detox, while the bulls are crossing their fingers for a technical bounce that will keep the $3 trillion dream alive. Stay tuned, because in the world of crypto, anything can happen-just remember to keep your helmets on!

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- USD TRY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- DOGE PREDICTION. DOGE cryptocurrency

- USD DKK PREDICTION

2026-01-23 15:53