So, apparently, Binance became the hottest crypto spa this week, with whales tossing around $2.4 billion in Bitcoin and Ether like it was Monopoly money. According to CryptoOnchain (because who doesn’t trust a source with “chain” in its name?), these transfers were split evenly between the two tokens, because, you know, diversity is key when you’re playing financial Jenga.

The average deposit size ballooned from eight to 10 Bitcoin up to a whopping 22 to 26 Bitcoin. Meanwhile, withdrawals shrunk faster than a wool sweater in hot water, with the Exchange Outflow Mean hovering between 5.5 and 8.3 Bitcoin. What does this mean? Well, it seems these crypto kings are less interested in stashing their treasure in cold storage and more interested in leaving it on-platform, ready to trade like a game day jersey on eBay.

Rising Deposits and the Flatline of Hope

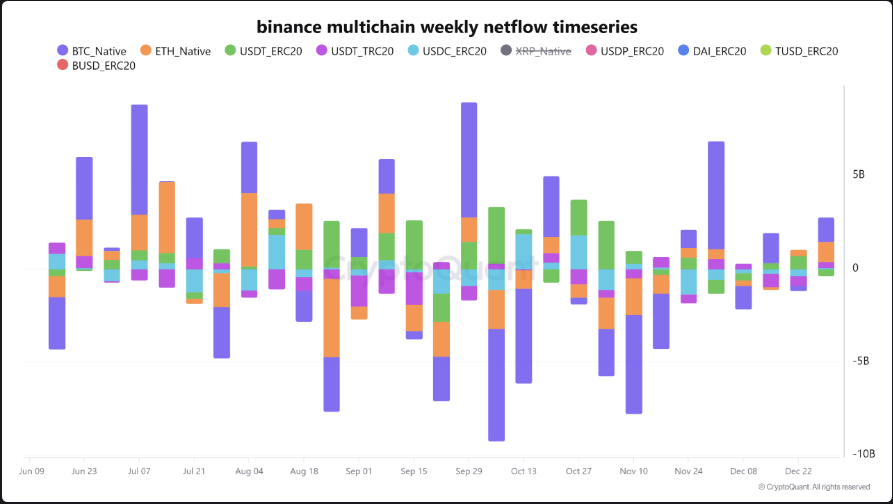

But here’s the kicker: all this whale activity didn’t come with fresh buying power. Stablecoin net flows were flatter than a pancake at a lumberjack convention, with a mere $42 million inflow. Analysts suggest this was mostly token transfers between Ethereum and Tron, not actual new money. So, no, your crypto dreams aren’t coming true just yet.

CryptoOnchain theorized that these massive transfers could mean whales are gearing up to sell or use their assets as collateral in derivatives markets. Translation: more supply is lurking like a shark, while demand is about as visible as Bigfoot at a vegan potluck.

Geopolitics: The Ultimate Buzzkill

Bitcoin wobbled around $92,620 after briefly hitting $93,180, because apparently geopolitical drama is the new spice of life. This spike came as tensions flared following U.S. military action in Venezuela that ended with the capture of President Nicolas Maduro. Meanwhile, gold climbed to $4,400 an ounce, and silver jumped 4.8%, because when in doubt, invest in shiny rocks, right?

Selling Pressure vs. Demand: A Love Story

Analysts are watching this mismatched tango. Large deposits and shrinking withdrawals suggest big holders are less interested in locking up Bitcoin and more interested in trading it like Pokémon cards. Reports say accumulation has stalled since October, which means price rallies are more likely to be met with selling than with cheers.

So, while the risk of downward pressure has risen, it’s not quite time to panic-sell your Bitcoin and invest in Beanie Babies. Price strength seems tied to headlines and cross-market moves as much as to actual crypto demand. Traders will be watching to see if stablecoin inflows pick up or if whales finally hit the “sell” button. And let’s not forget, even Donald Trump’s pro-crypto stance couldn’t reverse the accumulation lull by year-end. Until buyers return like a prodigal son, gains will likely be as short-lived as a New Year’s resolution.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- Brent Oil Forecast

- ATOM PREDICTION. ATOM cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- USD TRY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- Trump’s Crypto 401(k) Plan: Retirement or Racket? 🤔💰

2026-01-06 04:18