The latest correction appears to have completed a five-step waltz that no one asked for, and our slightly obsessive analyst, Rami Scalps, declares the ideal long entry at $0.6297, neatly protected by a stop loss at $0.5814 and targeting $0.7248. If the universe decides to stop by for tea and mutter something about probabilities, you might just get a tidy little rebound. Don’t panic, but maybe tighten your seatbelts, or your teacups, or both. 🚀

Whale Accumulation Signals Market Confidence

Optimism has strutted back into the room after a sharp corrective move within a descending channel, as if the channel itself were the universe’s way of saying, “/File under: potential.” Analyst Rami Scalps has sketched out a bullish scenario, calling for a long entry at $0.6297, with a stop loss at $0.5814 and a target of $0.7248. The kind of precise forecast that makes fortune cookies look sloppy. 🐳

The fifth wave of the corrective structure is unfolding, and traders are watching the channel support and order block zone as if they’re staking their very livelihoods on the loyalty of a particularly dubious vending machine. A reversal? Maybe. A dramatic montage? Almost certainly. 📈

Adding to the bullish case, whale wallets have reportedly been accumulating the crypto throughout the dip, suggesting growing confidence that the current price zone represents value. It’s like a herd of oceanic bankers deciding the water is a good deal. 🐋

This smart-money behavior has historically preceded rallies, reinforcing the potential for the token to bounce toward the upper channel and retest resistance around $0.72-$0.74 in the near term, which is basically a VIP lounge for momentum. 🍸

On-Chain Strength Despite Recent Pullback

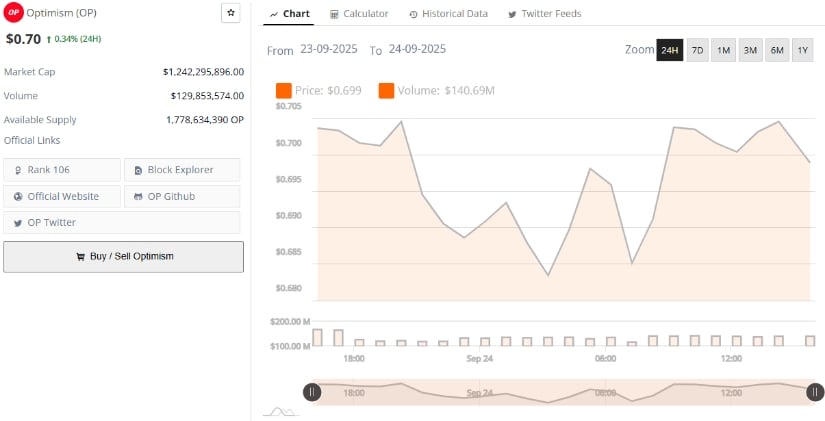

On one hand, from a market data perspective, OP is trading at $0.707, up 3.6% in the last 24 hours. The token maintains a healthy $1.24 billion market cap and sees strong daily turnover with $129 million in volume, signaling that liquidity remains robust despite recent selling pressure. In other words, the cash is still laughing at the rain. 💧💸

Buyers stepping in at the $0.62-$0.64 support zone are helping stabilize the price action, making this area a critical line in the sand for bulls. It’s the kind of line you’d consider drawing with a very steady hand and a slightly caffeinated pen. ✒️

The token’s long-term resilience can be seen in how volume surges align with dips, highlighting consistent demand at lower price points. This ongoing accumulation aligns with the broader narrative of whales quietly stacking, further strengthening the likelihood of a bullish reversal forming in the short to mid-term. It’s basically a cosmic ‘buy low, sell high’ brochure that never expires. 🧭🪙

Technical Indicators Hint at a Turning Point

On the other hand, the daily chart reflects a tug of war between bulls and bears. The MACD shows bearish momentum fading, with the histogram approaching neutral levels – a sign that sellers may be losing steam, or perhaps they’ve just taken a coffee break. ☕️🤖

Meanwhile, the Relative Vigor Index (RVI) hovers around 51.49, nearly in line with its moving average of 63.15, suggesting indecision but also laying the groundwork for a potential bullish crossover if buying momentum intensifies. It’s like waiting for a galactic traffic light to change from “maybe” to “go.” 🚦

Holding above the $0.62 support zone remains key. If buyers defend this base and volume continues to rise, OP could push toward its target of $0.7248, representing a 15% upside. Conversely, losing this support would flip the script, exposing the token to a deeper pullback toward $0.58, the last strong demand area-where the universe might remind you that gravity still exists. 🪐

For now, the balance of signals leans cautiously bullish, with whale accumulation acting as a quiet tailwind for the recovery narrative. If the stars align and a spare whale coughs up a miracle, we could be raising our eyebrows at a 15% pop before lunch. 🚀😂

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

2025-09-25 00:03