Oh, what a sight it was! As Bitcoin soared to dizzying heights near $123,000, the whales and miners decided it was time to partake in a grand exodus to the exchanges, according to the latest data from the illustrious Cryptoquant. 🏦🚀

Onchain Data Tracks the Great Exodus of Miners and Bitcoin Whales

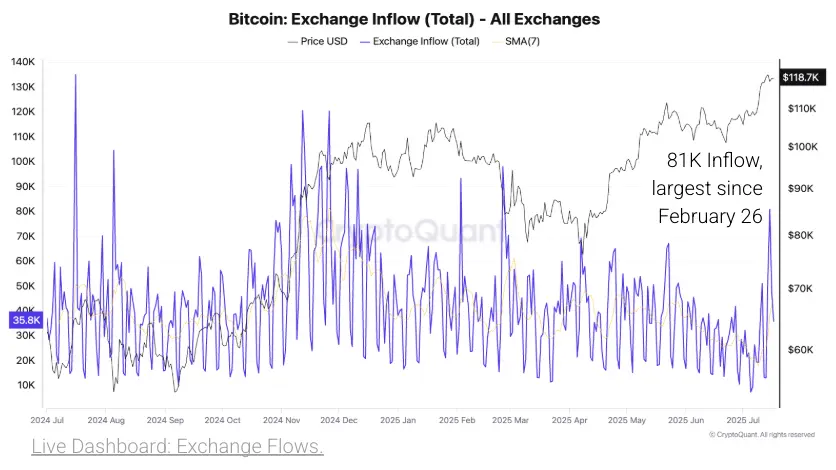

The Cryptoquant Weekly Crypto Report, a document as thick as a Tolstoy novel, reveals a dramatic surge in daily Bitcoin exchange inflows. From a mere 19,000 Bitcoin a week earlier, the number swelled to a staggering 81,000 BTC on July 15, marking the largest single-day deposit since the distant past of February 26. The scholars at Cryptoquant, with their keen eyes and sharper minds, attribute this monumental spike primarily to the whims of “whales” — those mysterious beings who hold vast fortunes in Bitcoin. 🐳🌊

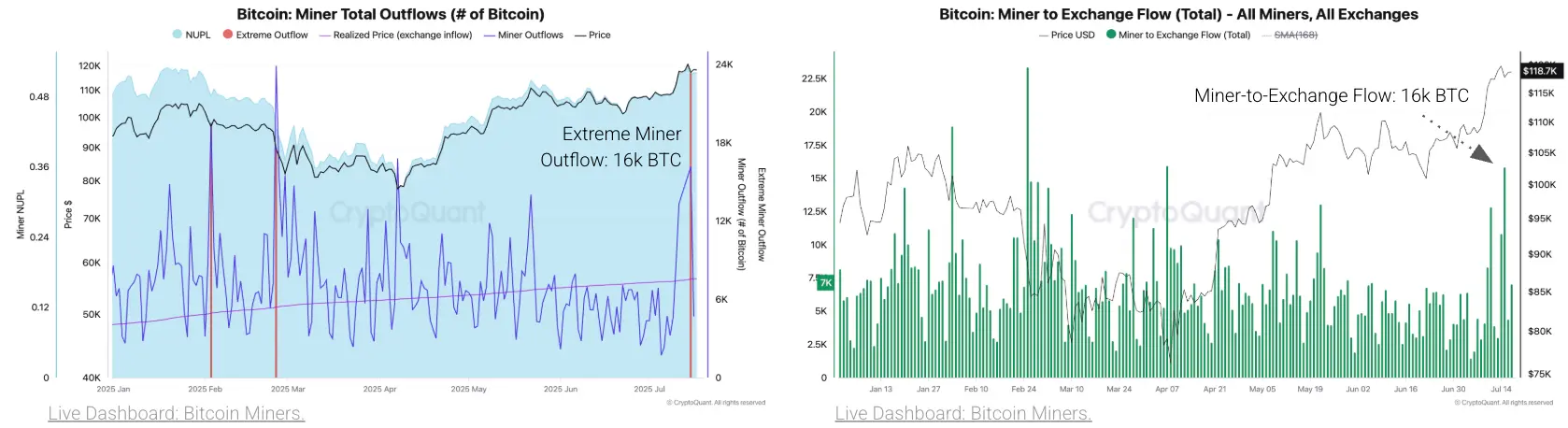

The transfers from these grand holders to exchanges leaped from 13,000 BTC to 58,000 BTC in the blink of an eye, a clear sign that they were cashing in on their gains. But wait, there’s more! Bitcoin miners, those industrious souls who toil day and night, also joined the feast. According to Cryptoquant data, miner outflows spiked to 16,000 BTC on July 15, an “extreme outflow” not seen since the days of yore, April 7. 🛠️💰

And if you thought the drama ended there, think again! Virtually all of this Bitcoin found its way directly into the maws of exchanges, a fact that Cryptoquant noted with great interest. Meanwhile, the noble Ethereum (ETH) was not to be left behind. Cryptoquant reported that daily ETH inflows nearly reached 2 million ETH on July 16, doubling from the previous week and hitting the highest level since February 26. 🦄,

This surge followed a 131% rally in ETH since early April, a detail not lost on the astute analysts at Cryptoquant. However, in a twist of fate, the selling pressure for altcoins remained curiously low. Daily transactions sending altcoins to exchanges totaled just 31,000, a mere fraction of the 120,000 seen during previous market peaks in March and December 2024. 🕵️♂️,

Cryptoquant researchers, ever the prophets of the digital realm, highlighted that this muted activity suggests that altcoin investors are not rushing to sell, despite the broader market rally. Their analysis indicates that increased exchange inflows, especially from large entities and miners, often herald heightened price volatility. Thus, the significant divergence between the heavy Bitcoin and Ether selling and the subdued altcoin activity paints a complex and intriguing market picture, as per the firm’s latest report. 📊,

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- XRP Staking: A Tale of Tension and Tokens 🚀

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Bitcoin’s Dramatic Fall Puts Strategy’s Holdings in Crisis Mode! What Happens Next?

2025-07-19 20:58