A sweeping new trade agreement between the US and the EU (European Union) could either calm global markets or send them off a cliff like a blindfolded tightrope walker 🤹💥. Either way, Bitcoin (BTC) and its crypto cousins are sweating bullets.

Meanwhile, crypto markets are holding their breath, praying the US-China tariff feud doesn’t erupt into a full-blown barn dance 🕺. Because nothing says “financial stability” like two superpowers arguing over soybeans.

Trump Announces US-EU Trade Deal: All You Need to Know

Now, let me tell you about this grand US-EU deal that’s got folks in Washington buzzing like flies around a honey jar 🐝🍯. The European Union, in a gesture of either generosity or confusion, agreed to buy $750 billion worth of American energy. Then they’ll shovel $600 billion into the U.S. economy and toss in hundreds of billions for military gear. All in exchange for a uniform 15% tariff on traded goods—because nothing says “partnership” like slapping a tax on everything like a mischievous uncle at a family reunion 🎉.

BREAKING: President Trump, ever the showman, just announced a trade deal with the European Union that’s “bigger than a July 4th barbecue” 🍖.

European goods get a 15% tariff, while the EU:

• Puts 0% TARIFFS on US goods (suddenly they’re best friends?)

• Buys hundreds of BILLIONS in military gear

• Makes… unspecified promises written in invisible ink— Nick Sortor (@nicksortor) July 27, 2025

Trump, never one to underplay his own genius, declared this the “biggest deal I’ve made so far” while polishing his ego in front of a mirror 😎. The EU, apparently thrilled to pay full price for tanks, celebrated by importing a truckload of confetti.

“This removes a negative ‘tail risk’ event = good for equities,” said Thomas Lee, who either missed the memo about sarcasm or wrote it himself.

Now, Bitcoin’s in a pickle. Traditionally, when the world chills out, folks stop hoarding “risk-off” assets like crypto. But today’s Bitcoin is treated like a promiscuous gambler—sometimes a hedge, sometimes a risk asset, depending on who’s holding the bag 🎰.

Sounds like a major win for the markets! Positive news always boosts confidence.

— Lady M (@CryptoLady_M) July 27, 2025

Global tariffs are reshuffling like a deck of cards in a hurricane 🌪️. Canada (35%), Mexico (30%), Brazil (50%)—all getting slapped with new rates. Meanwhile, US-China tariffs got a 90-day extension, because nothing says “resolution” like kicking the can down the road.

JUST IN: China and the U.S. agree to extend tariff pause by another 90 days. Investors breathe a sigh of relief before the next panic.

— Whale Insider (@WhaleInsider) July 27, 2025

This chaos could be Bitcoin’s golden ticket. Less geopolitical drama means more dollar-aligned capital flows, and suddenly crypto looks less like a cursed coin and more like a “risk-on” darling 🚀.

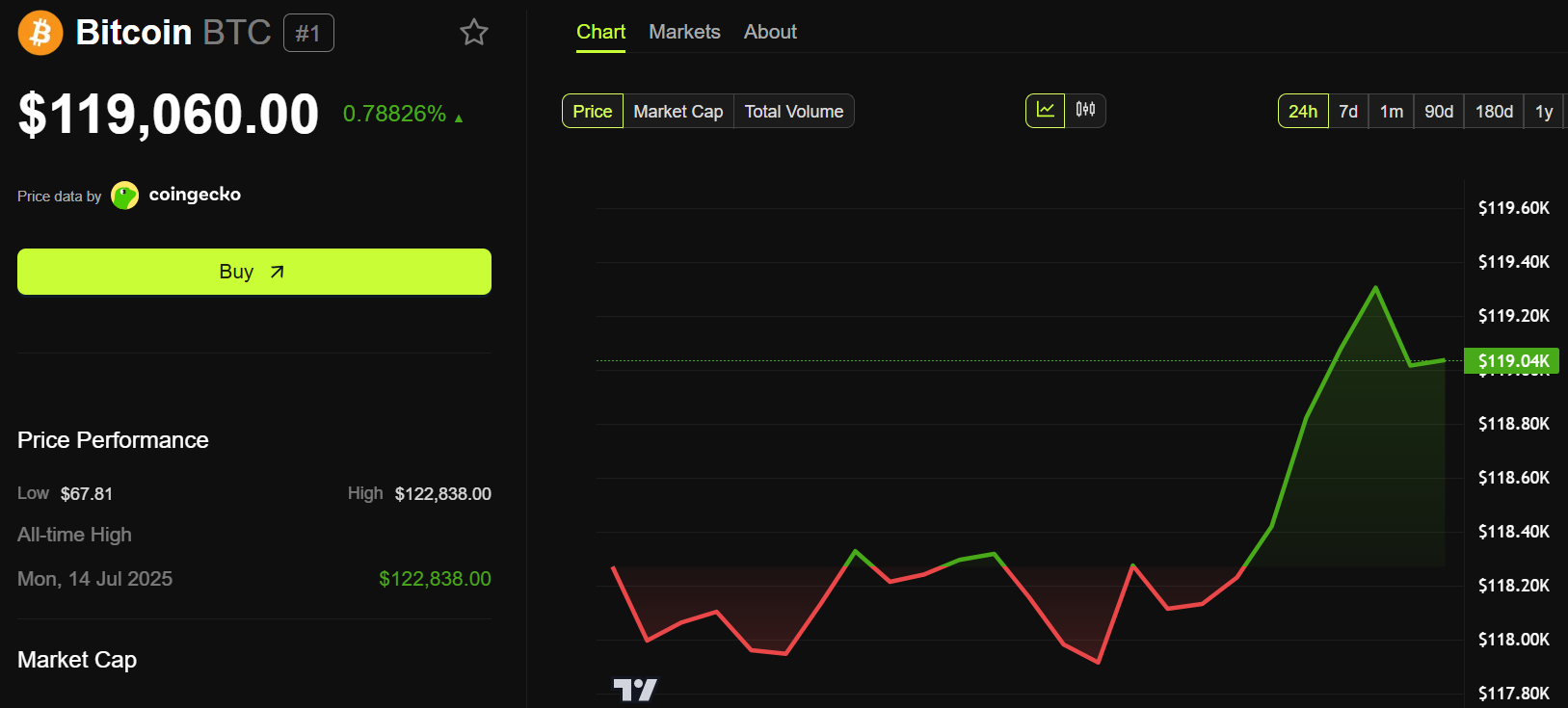

Bitcoin was trading at $119,060, up a modest 0.78%—not enough to throw a party, but enough to raise an eyebrow 🤨. Either way, strap in. This ride’s only getting weirder.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Silver Rate Forecast

- USD GEL PREDICTION

- Bitcoin’s HODLers: The New Titans of the Digital Age 🚀💰

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- USD CNY PREDICTION

2025-07-27 23:12