President Donald Trump this week conjured up a website called TrumpRx, a government-backed portal claiming to lower prescription drug prices for Americans who, for some reason, still pay cash. While the announcement initially made markets squirm like a teakettle in a hurricane, the financial world eventually delivered a response that could only be described as… shrugs.

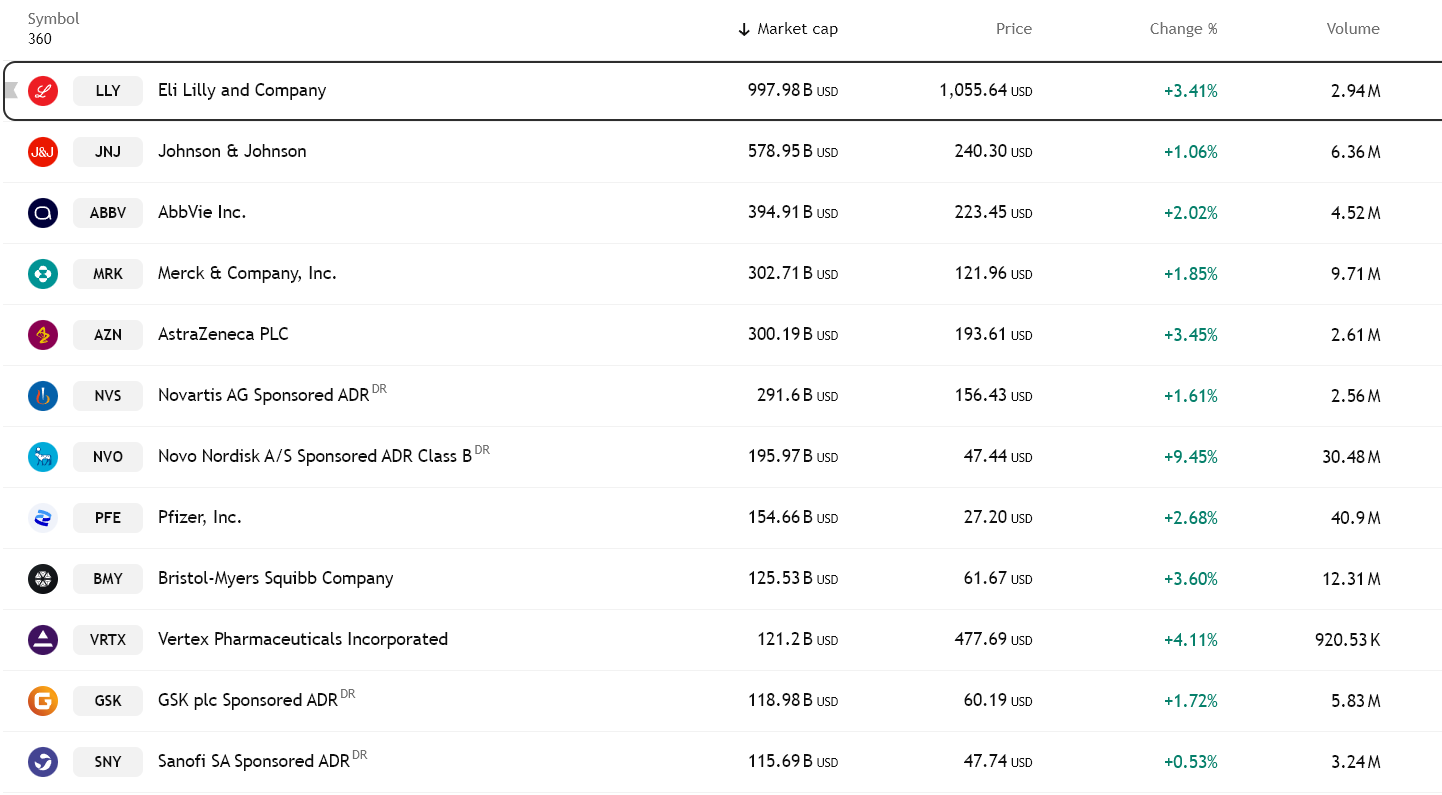

Major pharmaceutical stocks performed a synchronized dance on February 6, signaling that investors see TrumpRx as a gentle breeze, not a hurricane. This reaction matters for everyone from crypto traders to your local goldfish, because it tells the world that risk sentiment is currently set to “meh, why not.”

LIFE-CHANGING HEALTHCARE INITIATIVE 🇺🇸 No more choosing between bills & health. TrumpRx dramatically cuts costs on fertility treatments & essential medications.

“Real and immediate impact.” ⬇️

– The White House (@WhiteHouse) February 6, 2026

The True Nature of TrumpRx (Or, How to Discount Without Breaking a Sweat)

TrumpRx is a pricing and discount portal, which is just a fancy way of saying it’s a website that points you to other websites. It lists dozens of drugs and directs users to discounted cash prices, which drugmakers and pharmacies have “voluntarily” agreed to offer. Voluntarily, in this context, meaning they had a choice between this and a trade war involving metaphorical anvils.

Crucially, it targets cash-paying and uninsured consumers, a demographic so niche it could fit in a teacup. It does not touch insurance-negotiated prices, Medicare reimbursement formulas, or long-term supply contracts, which make up most of the pharmaceutical industry’s revenue. Think of it as a fly swat in a room full of elephants.

But Investors Aren’t Panicking About Drug Profits

Markets are sending the message that TrumpRx is the equivalent of a polite cough at a party. Most pharmaceutical revenue comes from insured and institutional channels, which remain untouched by the program. For companies selling weight-loss drugs or specialty meds, pricing power is still as strong as a dragon’s will to hoard gold.

In some cases, lower cash prices might even boost sales volumes, assuming people are suddenly inspired to buy medication at cost. It’s the economic equivalent of a buffet with no dessert.

Voluntary Discounts, Not Forced Controls

Another key factor is structure. Participation in TrumpRx is voluntary, which is corporate-speak for “we’ll do this if we get something in return.” This includes tariff relief and a general sense of goodwill, which global drugmakers seem to value more than the ability to charge $10,000 for a pill.

Reduced trade risk is apparently enough to make companies overlook the fact that their cash prices are now slightly lower. It’s like trading your sword for a parrot that says “hi” occasionally.

What This Means For Broader Markets

The pharma rally sends a signal that could be interpreted as “relax, nothing bad is happening.” Investors are treating TrumpRx as a well-rehearsed ballet, not a circus of chaos. When policy actions are contained and predictable, markets behave like a well-oiled clockwork beast-predictable, slightly boring, and occasionally covered in glitter.

Crypto: The Sensitive Flower That Hates Surprises

TrumpRx has no direct link to digital assets, but crypto is still watching like a hawk with a magnifying glass. Why? Because it hates surprises more than a vampire hates garlic. By failing to trigger a regulatory shock or inflation spike, TrumpRx reduces the chance of the Federal Reserve doing something drastic, like raising interest rates or inventing a new form of fiscal alchemy.

Markets are treating TrumpRx as a political signal, not a systemic shock. The positive reaction in pharma stocks suggests investors see this as a narrow, voluntary, and economically contained policy-like a small fire in a forest of potential disasters.

For crypto and other risk assets, the takeaway is simple: TrumpRx isn’t tightening financial conditions or raising regulatory risk. Instead, it’s creating a backdrop of policy stability where markets can focus on liquidity, rates, and fundamentals without screaming into the void.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Bankman-Fried\’s Wild Excuse

- DeFi’s Wild Ride: From Yield Fever to Utility Sanity 🤠💰

- XRP: A Most Disappointing Turn of Events! 📉

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- XRP’s Wild Ride: To the Moon or Just a Bit Bouncy? 🚀

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

2026-02-07 03:02