Tokenized gold, the latest darling of the digital age, has managed to amass a trading volume of over $19 billion this year, leaving many a traditional gold ETF in the dust. One can almost hear the sighs of relief from the crypto enthusiasts who have been waiting for this moment, as if the world of finance needed yet another shiny object to chase after.

//crypto.news/app/uploads/2025/07/image-18.png”/>

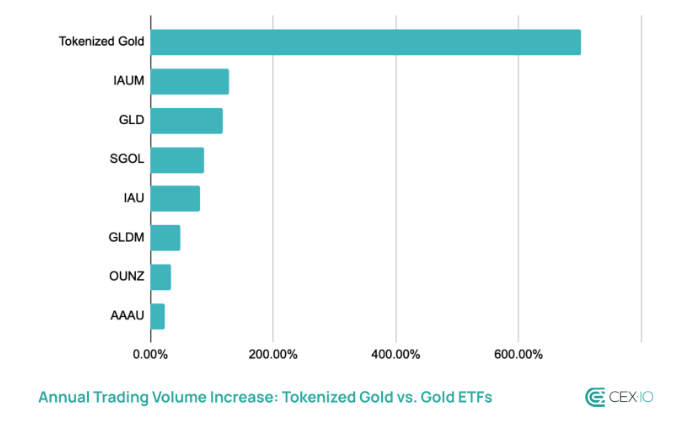

While tokenized gold still lags behind major ETFs like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), it has managed to surpass many smaller counterparts. The asset class now sees higher trading volume than SGOL, AAAU, IAUM, and OUNZ. It’s a small victory, but a victory nonetheless, and one that has the crypto community abuzz with excitement.

Moreover, the growth in tokenized gold trading volume has significantly outpaced all gold ETFs so far this year. In the second quarter of 2025, volume in the asset class rose from $2.4 billion to $19.2 billion—an eightfold increase. One can almost hear the collective gasp of the traditionalists, as if the world of finance is being turned on its head. 🤯

This marks part of a broader trend, as tokenized gold has outperformed gold ETFs in trading volume growth for four consecutive quarters. According to CEX.io, this outperformance suggests that capital is shifting from gold ETFs to tokenized gold assets. It’s a bold move, and one that has the financial world watching with a mix of curiosity and skepticism.

Retail Investors Fuel Shift to Tokenized Gold

According to the CEX.io report, most of the new trading volume in tokenized gold is being driven by retail and crypto-native investors. Meanwhile, institutional investors continue to dominate traditional gold ETFs. Notably, the number of PAXG holders grew by 25%, while XAUT holders increased by 151%, highlighting a significant influx of new traders into the market. It’s a testament to the allure of the digital, and a sign that the future of finance may be more virtual than we ever imagined.

Still, tokenized gold continues to trail ETFs in terms of market capitalization. For instance, GLD’s total market cap rose 36%, while tokenized gold’s grew just 29%. This indicates that tokenized gold is not yet widely perceived as a long-term store of value; rather, most traders still use it as a utility asset within the DeFi ecosystem. One can’t help but wonder if this is just the beginning of a new era, or if it’s all just a digital mirage. 🤔

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- ETH PREDICTION. ETH cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

2025-07-08 19:48