Ah, Tesla. The electric chariot of the future, or so we were told. But now, its stock price has taken a nosedive that would make a Discworld raven blush, plummeting 17% from its lofty perch. That’s $130 billion in value gone, faster than a wizard’s hat at a tax audit. And who’s to blame? Well, the usual suspects: competition, slowing growth, and a CEO whose tweets are about as helpful as a chocolate teapot.

- Tesla’s stock has dropped 17%, which is roughly the same percentage of people who still believe in the great “electric car revolution.”

- Growth has stalled harder than a treacle mine cart on a rainy day.

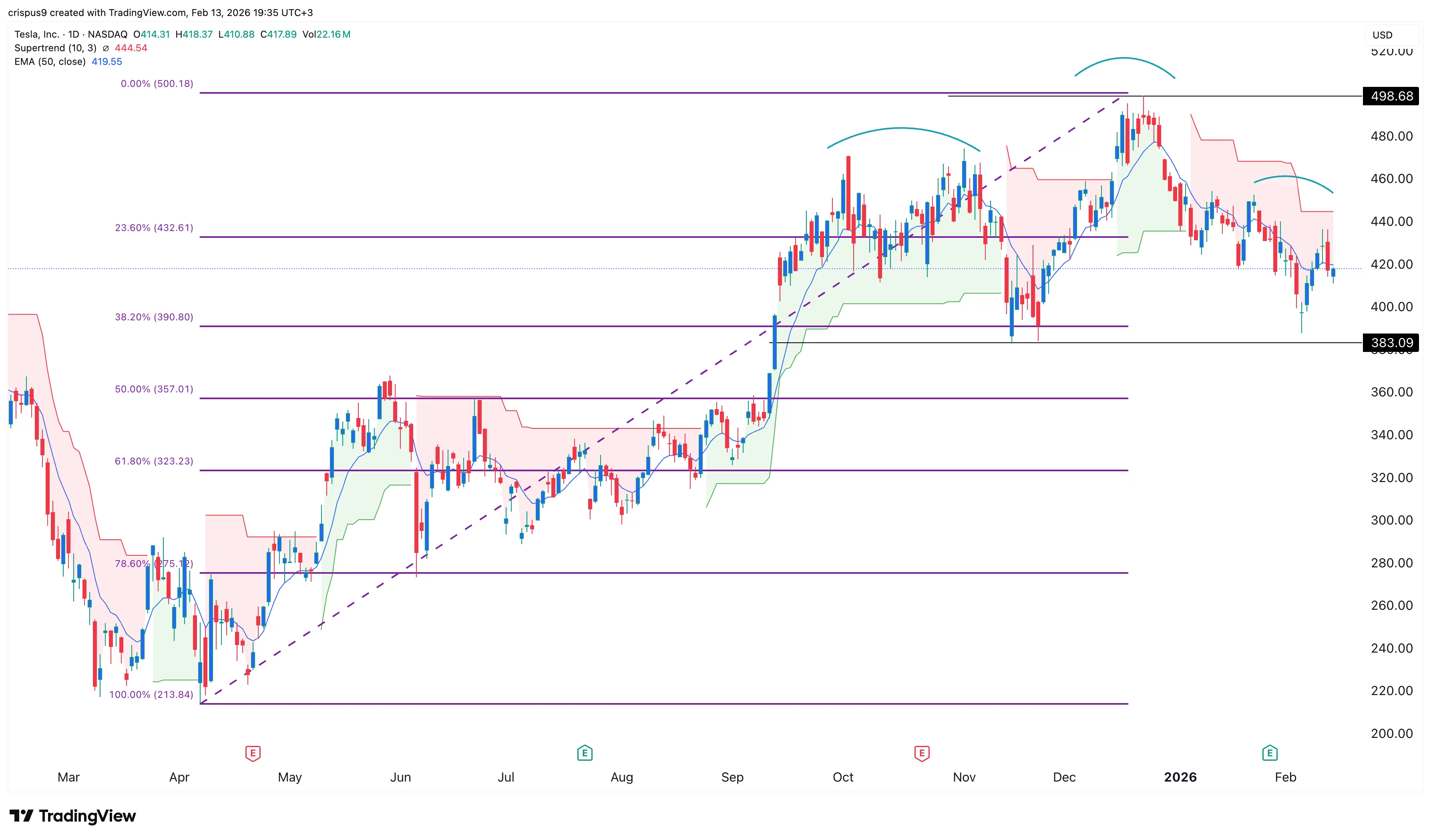

- The stock chart has formed a head-and-shoulders pattern, which, in the language of the Ankh-Morpork Stock Exchange, means “sell, sell, sell!”

Tesla’s shares are retreating faster than a troll from a garlic festival, thanks to headwinds that would make a dwarf miner sigh. Rising competition in the electric vehicle market? Check. Slowing revenue growth? Double check. It’s like watching a wizard try to cast a spell with a wet matchstick.

Their latest results? Total revenues dropped 3% to $24 billion. Automotive revenue fell 11% to $17.6 billion, while energy generation and storage revenue rose 25% to $3.8 billion. So, basically, they’re making more money from batteries than cars. Who knew the future was in storing power, not using it?

And the competition? Oh, it’s fierce. Rivian is surging like a dragon with a caffeine addiction, surpassing expectations and projecting a 47%-59% increase in vehicle deliveries. Meanwhile, in China, local brands like Nio, XPeng, Xiaomi, and BYD are flourishing. Xiaomi’s YU7 even outsold Tesla’s Model Y, which is like a rat winning a cheese-eating contest against a mouse.

In the U.S., the upcoming R2 is poised to steal Tesla’s thunder, and in Europe, tariffs on Chinese companies are being slashed faster than a thief in a pie shop. Tesla’s overvalued status? Oh, it’s got a forward PE ratio of 202, which is about as realistic as a vampire’s tan.

Then there’s Musk, whose social media presence is about as welcome as a swamp dragon at a garden party. His recent posts have critics clutching their pearls, accusing him of echoing white supremacist conspiracy theories. Analysts warn this could alienate customers faster than a bad batch of dwarf bread. Lovely.

Tesla Stock Price: A Technical Farce

The daily chart shows TSLA’s stock peaked at $500 in December and has since retreated to $417. The Supertrend indicator has flipped from green to red, and it’s now below the 50-day Exponential Moving Average. But the real kicker? That head-and-shoulders pattern, with a neckline at $383. If it drops below that, it’s headed for the 50% Fibonacci Retracement level at $357. Or, as we say in Ankh-Morpork, “down the Clacks without a message.”

The Musk Factor: A Tweet Too Far

Elon Musk, the man who once sold flamethrowers for fun, is now amplifying anti-immigrant and far-right content. Critics say he’s gone full “great replacement” conspiracy theorist, which is about as helpful as a librarian with a hangover. With 200 million followers, his tweets are shaping perceptions of Tesla faster than a gossip in a small village. Will it hurt sales? Probably. Will he care? Doubtful.

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Bitcoin Miners Strike Gold Again, But Is It All Shiny? 🤔💰

- Gold Rate Forecast

- Bank of Russia Puts Foot Down: No Crypto Allowed for Domestic Payments! Get Ready for Digital Ruble!

- Brent Oil Forecast

- Trump Coin ETF: Canaries Singing on Wall Street? 🏦💸

- Michael Saylor Thinks Bitcoin’s 30% Drop is ‘Healthy’? 😂

- 🐕 Diamond Paws Cling to SHIB: Will $0.00009 Be Their Fairy Tale? 🌟

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

2026-02-13 22:14