In the grand theater of modern finance, where the absurdity of human ambition rivals the chaos of a thousand circuses, Ethena’s USDe strides forth-a synthetic dollar draped in the robes of progress, yet weighed down by the invisible chains of speculation. 🚀

The Unyielding Ascent of USDe: A Colossus Strides Across the Cryptoverse

Behold, dear reader, this curious invention: a “stablecoin” that mocks the very notion of stability! USDe, neither coin nor banknote, but a specter haunting the Ethereum blockchain-a ghostly abstraction forged in the fires of delta-neutral hedging. Imagine, if you will, a troupe of crypto acrobats balancing collateral and perpetual shorts on a tightrope, all to maintain the illusion of a $1 peg. 🤹♂️

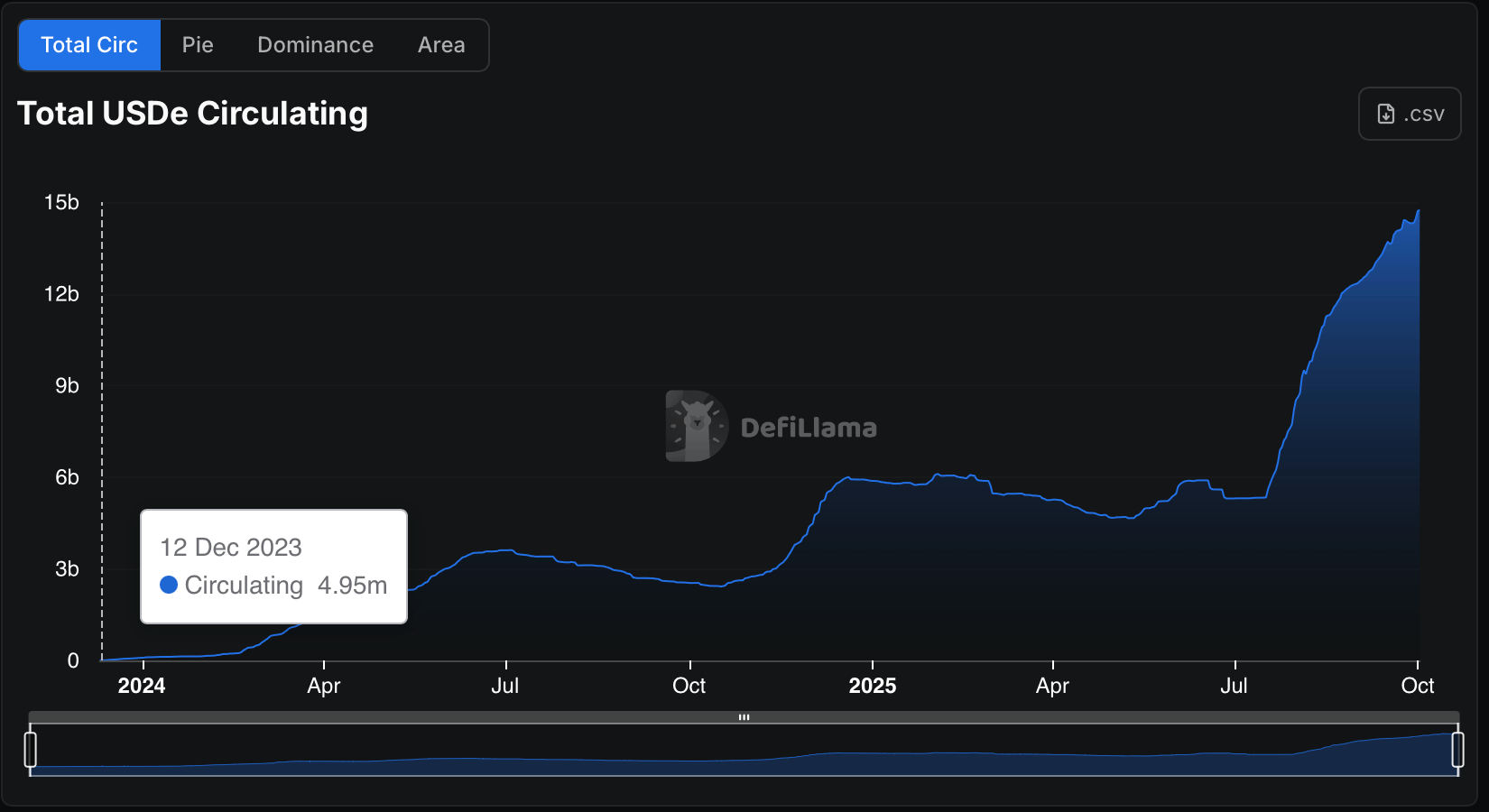

Peruse the sacred scrolls of defillama.com, and you shall witness the miracle: $14.755 billion in mortal hands, clawing toward $15 billion like avaricious moths to a flame. On December 12, 2023, this empire was but a grain of sand-$5 million!-yet today it stands as the third-largest fiat-pegged token in a sector worth $299.447 billion. A parable of growth, or a warning etched in blockchain? The answer lies beyond the veil of speculation. 🧙♂️

Trading volumes, you ask? A mere $31.55 billion in cumulative trades across venues-a number so vast it could fund a thousand NFT art galleries! And yet, the true drama unfolds in the DeFi pits: USDC-USDe, FRAX-USDe, crvUSD-USDe. These pairings are the modern salons where traders sip risk like vintage wine, while liquidity pools swell to $194.4 million. A liquidity renaissance, or a carnival of fools? 🍷

Ethereum, the empire’s throne, still reigns supreme, though vassal chains like Arbitrum and Solana nibble at its heels. A pragmatic multichain strategy, they say-though one wonders if this is diplomacy or desperation. 🕊️

But let us not forget the grand illusion: USDe’s “stability” is but a magician’s sleight of hand, converting crypto’s madness into a facade of order. Staking rewards and funding rates are its holy grail, yet the specter of regulation looms-a beast still sharpening its claws. 🐉

Will USDe breach $15 billion? It is inevitable, as the tides to the moon. But the deeper question remains: In this theater of the absurd, who will laugh last-the traders, the protocols, or the market itself? 🎭

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- Powell’s Dilemma: The Fed’s Crumbling Confidence and Bitcoin’s Wild Ride 🚨

- Steinbeck’s Take on Dogecoin’s Wild Ride 🐶🚀

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

2025-10-02 18:03