In a spectacle that rivals any of Gibbon’s absurdities, Sui’s price has managed to break through the venerable $4 barrier, much like a muppet prising a door open with a butter knife. With DeFi TVL soaring by an improbable 42%, the crypto cognoscenti are nudging their glasses and murmuring about a rally towards the lofty heights of $7 to $9—where the real fun begins, or so they say.

The on-chain data, performing a cha-cha of growing adoption and bustling trading volumes, suggests the fundamentals are less a house of cards and more a carefully arranged tableau—minus the dust and cobwebs. Meanwhile, traders, ever the skeptical spectators at the circus, are fixated on the next act in this rapidly evolving crypto melodrama.

Technical Breakout: The Stage Is Set for a Juicy $7–$9 Plot

SUI recently took a heroic leap above a long-derided descending triangle—a technical pattern which, apparently, now signifies the dawn of something grander. If this was a Regency novel, one might say it’s akin to a rake finally spotting his inheritance—an event of considerable import.

Crypto analyst Ali, whose commentaries resemble a cocktail of scientific jargon and vague reassurance, explained that SUI’s breakout resembles a textbook example of price expansion following what he charmingly calls compression (as if the coin was holding its breath). He hints that at $3.90, a 107% jump is on the cards, targeting Fibonacci extension levels at $5.36, $7.30, and perhaps a dash of $8.58—like a child reaching for the cookie jar.

The Fibonacci levels, like a series of increasingly enticing temptations, will need to be conquered. The critical resistance appears at $4.20, which is as pivotal as a Trafalgar Square flag—crucial, yet easily overlooked by the masses.

SUI Price’s Brief Flirtation with $3.56

The coin’s flirtation with the $3.56 mark was short-lived, reminiscent of a fleeting flirtation at a fancy soirée. Traders, like a pack of wolves with a taste for liquidity, quickly absorbed the dip and pushed SUI back to $3.70 faster than one can say “last call.”

Nastia Vox, a on-chain researcher whose observations are as sharp as a damp match, suggests this dip was merely a liquidity sweep—a poker move to flush out the weak hands before a further ascent. Her analysis confirms that bulls are defending their turf fiercely, with volume spikes resembling a particularly loud cricket concert.

At present, SUI hovers near $3.80–$4.00, balancing precariously—like a cat on a hot tin roof. Break this threshold convincingly, and the next stops are $4.80 and capped with the all-time high of $5.35—if the gods of crypto permit it.

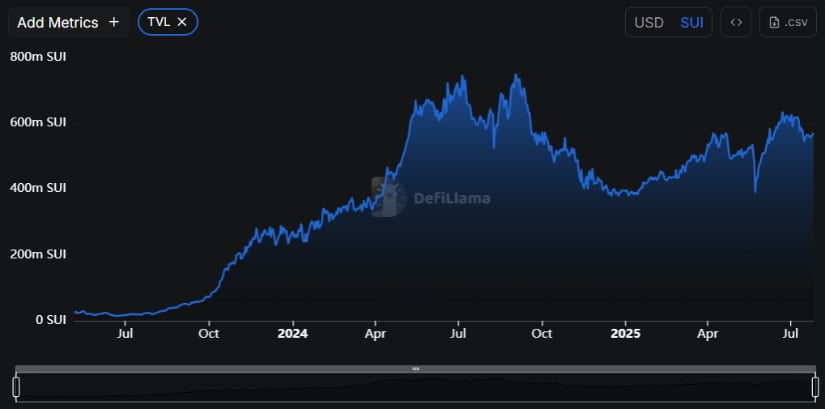

DeFi TVL: The It-Girl of the Moment

Back on the fundamentals front, DeFiLlama reports a dramatic 42% rise in total value locked on Sui, reaching a staggering 564 million tokens in the swirling maelstrom of DeFi protocols—somewhere between impressive and borderline absurd. The trading volume, a blazing $10.3 billion in July 2025, suggests the blockchain’s popularity has gone viral, leaving other projects in its digital dust.

This surging activity isn’t just window dressing; it’s evidence of broader acceptance—like a quaint village slowly turning into a bustling market town. The liquidity deepening may also attract institutions—who, despite their love of chaos, do appreciate a good stable ecosystem. On-chain analyst ToreroRomero notes the increased resilience, like a well-buttered toast in a billionaire’s breakfast.

Predicting $9? The Optimist’s Nostalgia

Crypto strategist Mr. APE, ever the Dreamer, foresees a path that could lead SUI to $7.50–$9.00 by the close of 2025—should bullish fervor persist. He points out that the formerly pesky $3.45, which was resistance at best, has now turned support—like a boorish guest turning into a charming dinner companion overnight.

His logic, which resembles a particularly elaborate game of chess, suggests that this support zone is where the “smart money” (a.k.a. the sharp operators) are moving in. The pattern, he argues, echoes former rallies—where a breakout sparks a multi-week surge, much like a plot twist in a dusty novel.

Technical Indicators: A Smorgasbord of Hope

Indicators paint a picture somewhere between cautious optimism and outright giddiness. RSI’s at 62.42 gives the coin room to grow without screaming “overbought” like an overworked parrot. Meanwhile, MACD stays positive—though with a hint of bearishness, much like a grumpy but loyal butler.

The SMAs sit comfortably at $3.89 and $3.22, providing support like a good tailor. Bollinger Bands show SUI dancing at 0.7106 of the width—confident enough without appearing overheated, a delicate balancing act for a coin flirting with greatness.

Can SUI Keep Its Promising Streak?

If the macro trend continues and the $4.20 resistance is decisively breached, SUI could well be en route to its promised land—$7, then $8, possibly even the elusive $9, if the gods of crypto remain in generous humor. Support zones at $3.45 and $3.90 should be watched like a hawk, lest the whole house of cards come tumbling down in a spectacular, televised fashion.

As the weeks unfold—full of promise, peril, and perhaps a dash of chaos—this spectacle of Sui’s ascent will either be a meteoric launch or a delightful falter. Either way, it’s a show worth the ticket price, or at least a good story to tell over a gin and tonic.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Winklevoss Twins Back $M Bitcoin Listing

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Solana’s Wild Ride: Stock Surges 1,775%! 🚀

2025-07-27 01:28