Ah, the classic token unlock saga! Today, SUI‘s price is feeling the weight of an $82.81 million unlock, set to flood the market on December 1. While this may seem like a mere drop in the ocean of total supply, trust me, it’s enough to stir the pot in the short-term. Especially when we’re already in the midst of some stellar buying activity (spoiler: there isn’t much).

SUI Price Today

| Price | |

| 24h Change | |

| Market Cap | |

| Circulating Supply | 3.68B SUI |

At this very moment, SUI hovers somewhere around $1.50-it’s been stuck in this range like a cat who refuses to leave the warm spot on the couch. Despite multiple attempts to break through the resistance zone at $1.58-$1.60, the bulls have failed. It’s like trying to open a jar that’s just a little too tight. But don’t despair! Buyers are valiantly defending $1.48. The structure remains intact… for now. 🙄

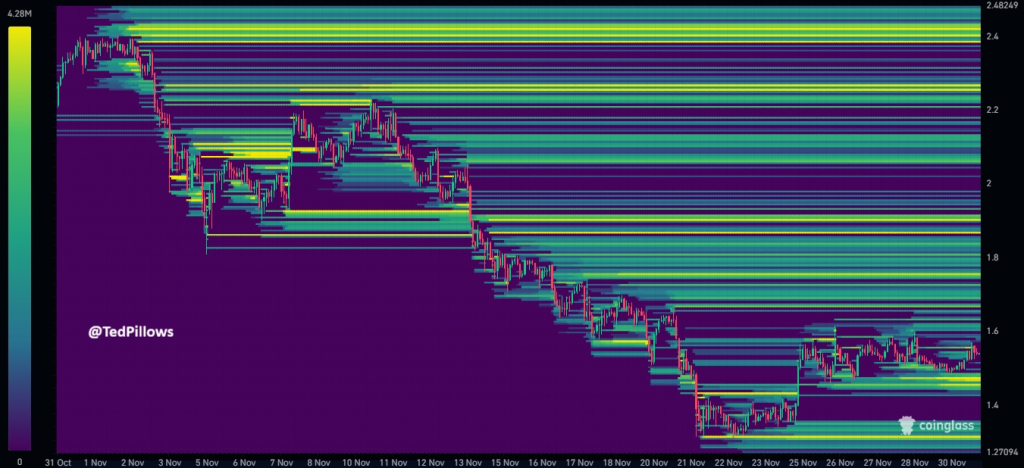

In the wise words of analyst Ted Pillows (yes, that’s his real name), SUI has decent liquidity above, but if selling picks up, we could be looking at liquidations around the $1.40-$1.50 range. Historically, December is usually bullish, and hey, we all know what happens after Thanksgiving-Bitcoin likes to go on a little rally. If that happens, SUI might just join the party.

Until the bulls manage to break through resistance, SUI will likely continue its endless shuffle between these levels, building tension like a soap opera waiting for the big reveal. Tune in next week for… the next price move. 😅

Let’s not forget that SUI is still recovering from its epic fall from grace-$5.35 is a distant memory. But who knows? If momentum swings back in its favor, it might just climb back up. Stranger things have happened.

SUI Price Technical View

Looking at the charts, SUI is currently stuck inside a descending channel-like a hamster running endlessly in its wheel, but with more technical jargon. Recently, it touched the lower boundary of this channel and tried to move upwards. The key support level is at $1.33, a zone where it has bounced off a few times, so that’s where the buyers are taking their stand. 🦸♂️

And for those of you who are into technical indicators, the RSI is also hovering near its lower range, which means-surprise, surprise-a short-term rebound could be on the horizon. Meanwhile, SUI is consolidating near the 100-period moving average, which might suggest it’s gearing up for an upward move if the stars align.

A clean break above the descending channel could send the token straight back to the $1.58 resistance zone, making everyone feel like they just won the lottery (except it’s not really a lottery). 🎰

However, it’s not all sunshine and rainbows. The broader market is still on edge. Bitcoin dominance has risen to 58.73%, causing altcoins like SUI to be pushed around like the kid who always gets picked last in gym class. Bitcoin miners are also offloading $172 million worth of BTC, adding more pressure on altcoins. Talk about a tough crowd.

The Fear & Greed Index is sitting pretty at 20, which means, yep, market sentiment is definitely leaning toward the “fear” side. For SUI to have any shot at a bounce, it needs to stay above $1.37. If Bitcoin slips below $81,600, well… we might see SUI testing the waters at $1.20.

Fundamental Updates

The upcoming Coinbase SUI futures launch on December 5 could bring some short-term excitement and liquidity. And in case you missed it, the gaming ecosystem and Sui Kiosk adoption are still growing, so long-term prospects aren’t completely hopeless. Investors might want to start thinking about accumulating near support zones while keeping an eye on BTC’s every move. 🧐

However, capital inflow into SUI is still wobbly at best. Without stronger buying pressure, SUI might just continue to move sideways-or worse, tumble back to key support levels. Classic crypto drama, really.

SUI remains under pressure from fresh supply hitting the market and tepid capital inflows, but with solid fundamentals and ecosystem growth, it’s far from forgotten. Watch for price action around the $1.33 support and $1.58 resistance to see where the market decides to take it next.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- 🤑 GAIN Token: Bull Trap or Divine Rebound? 🤑

- XRP: A Most Disappointing Turn of Events! 📉

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- XRP’s Wild Ride: SBI, ETFs, and the Great $3.00 Chase 🎢💸

- BBVA’s Crypto Chaos: Will Your Money Fly?

2025-12-01 17:00