In a world where dreams are made and broken on the ticker tape, Tom Lee, the eternal optimist of Fundstrat, has once again thrown his hat into the ring, predicting a Bitcoin price that would make the streets of San Francisco glisten with digital gold. A cool $200,000, he says, is just around the corner. But not everyone is buying it, especially not Peter Schiff, the modern-day gold prospector who sees the writing on the wall.

Lee, ever the believer, suggests that the recent lull in Bitcoin’s price is merely a hiccup, a result of the Federal Reserve’s stubbornness in cutting interest rates. Meanwhile, Schiff, pointing to the robust rally of gold, which has climbed a staggering 10% over the last two months, warns that Bitcoin’s failure to follow suit is a red flag. “Markets are forward-looking,” Schiff muses, suggesting that the precious metal’s ascent is a harbinger of easier monetary policy to come. But Bitcoin, it seems, is not getting the memo.

Schiff’s Golden Warning

On X, Schiff couldn’t help but highlight the irony: while Bitcoin stagnates, gold hits a record high of $3,620. “That’s why gold is up 10% in advance of coming rate cuts,” he declares, adding a touch of sarcasm, “Bitcoin, apparently, prefers to go its own way.” The gap between the two assets, he argues, is a cause for concern, a sign that the crypto king might not be as invincible as some believe.

Permabull @fundstrat forecast Bitcoin will hit $200K by year-end, as Bitcoin is sensitive to Fed rate cuts. He said the Fed’s two-month pause is why Bitcoin hasn’t rallied over that time period. But gold rallied 10% during those two months, hitting a record $3,620 as he spoke.

– Peter Schiff (@PeterSchiff) September 8, 2025

Lee’s Bullish Bet

Undeterred, Tom Lee remains a beacon of hope in the crypto community. He argues that the influx of institutional investors is giving Bitcoin a new lease on life, imbuing it with “counter-cyclical characteristics” that could propel it to unprecedented heights. Despite the recent underperformance, which he attributes to the Fed’s indecision, Lee clings to his $200,000 prediction, a figure that has become his calling card on Wall Street.

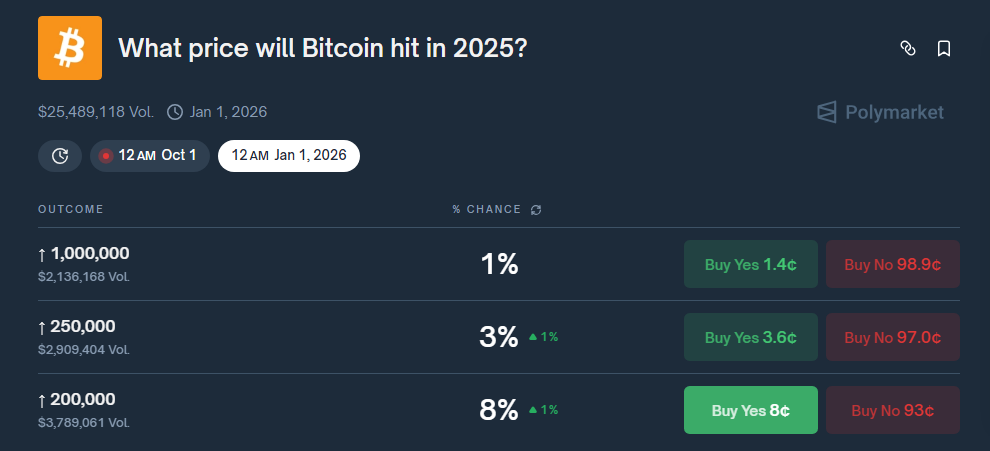

But the market, as always, has its own mind. Polymarket users, a group known for their keen sense of irony, give Lee’s prediction an 8% chance of coming true. The same odds, coincidentally, are placed on Bitcoin dropping below $70,000 by year’s end. It seems that in the world of finance, optimism and skepticism are two sides of the same coin.

Schiff, ever the contrarian, looks at the bigger picture. Over the past four years, Bitcoin has lost 16% against gold, despite its impressive gains against the US dollar. He warns that the crypto bubble might have more air to lose, and the traditional four-year cycle tied to halvings might be a thing of the past. This, he suggests, is not just a short-term blip but a structural issue that could define Bitcoin’s future.

Schiff, in his characteristic style, predicts that Bitcoin is more likely to dip below $100,000 than to soar to $200,000. His cautionary tale is clear: gold’s rally is a forward signal, and Bitcoin’s lag is a sign of deeper troubles. Lee, on the other hand, holds firm to the belief that institutional flows could reshape the landscape, making Bitcoin’s journey a long and winding road, but one worth traveling.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- Circle’s USDC Surpasses $75B: A Triumph of Modern Finance?

- South Korea’s Crypto Clampdown: Leverage Gets the Boot 🚪💸

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

2025-09-09 02:13