In a melodramatic twist of fate, Spark (SPK) has endured a brutal 17% haircut in just one short spinning of the 24-hour clock, yet whispers—perhaps more like shouts—suggest that the bloodletting might be easing, or perhaps just pausing for a breath before another encore.

While the weekly chart still proudly boasts a 200% gain—an impressive, almost absurd feat—certain frantic technical and on-chain divinations allude to a potential second act, should one, just one, resistance level surrender like a knight in shining armor.

Exchange Outflows: The Fading Factions of the Selling Horde

The earliest herald of a possible buyer revival is the recent dip in exchange holdings—down a modest 5.33%, which translates to roughly 21 million tokens, if you care for the exactitude. Fewer tokens on the market? Likely means fewer sell orders, unless everyone suddenly develops a fondness for throwing in the towel.

Meanwhile, the wallet whales—those ogres of crypto, the big bosses—have beefed up their holdings ever so slightly, by 0.3%, now casually hoarding nearly 10 billion SPK in their dark, mysterious vaults. The small surge in buying interest—0.08%—suggests these titans of the token ocean might have finished their profit harvest and are now quietly contemplative, waiting for the next move, or perhaps bored enough to buy more.

This quasi-standoff suggests that unless the price plunges again into despair, the big fish are likely to hold their peace, creating a fragile calm before the next storm of selling—or maybe not, who knows?

Metrics Hint at a Short Squeeze Waiting to Happen—If the Gods Allow

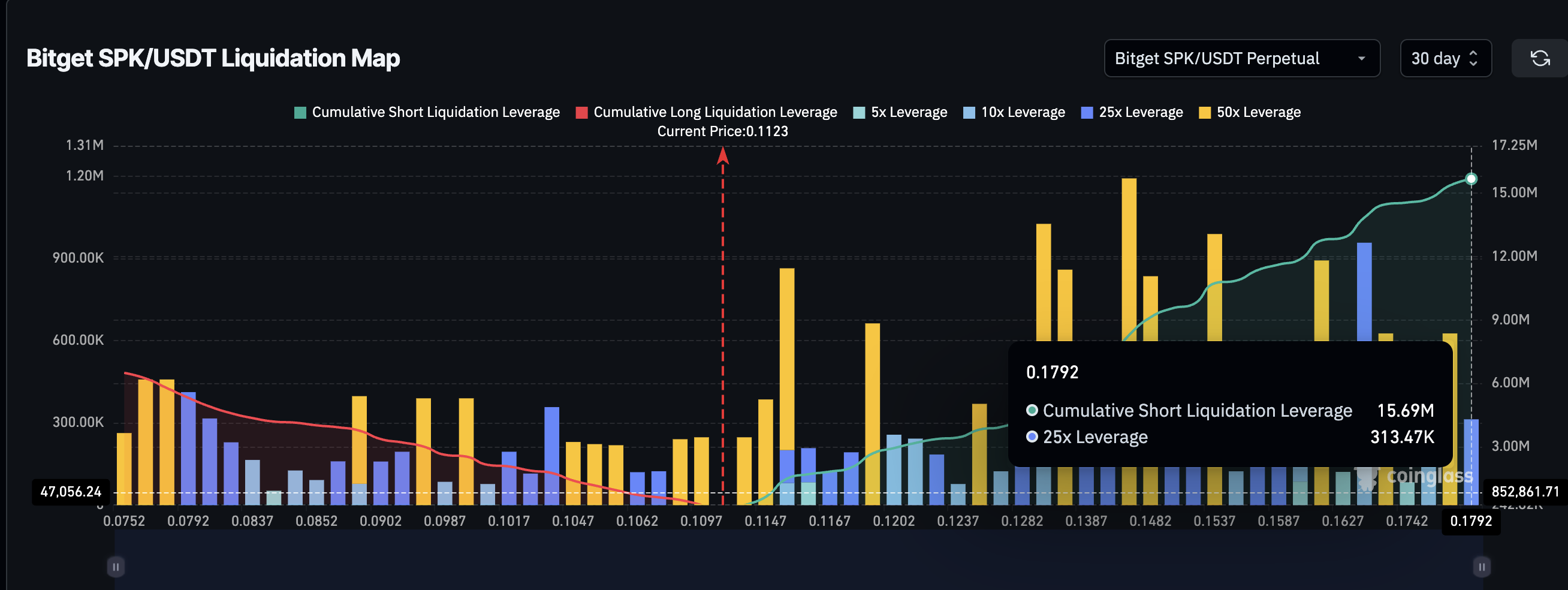

The current price hovers around a humble $0.11, feeling notably cheeky, but if it dares to break above the sacred $0.13 level, a glorious short squeeze could be unleashed—think of traders clawing each other’s eyes out, liquidations flying like confetti at a parade.

The liquidation map reveals thick clusters of doom starting at $0.11, pressed densely between $0.13 and $0.17. These are the battlegrounds where short positions—leveraged to the gills at 25x, 50x—stand on the brink of vaporization. Break into this zone, and the forced buying cascade could make the price skyrocket faster than you can say “margin call.”

Open interest, that fickle sign of trader engagement, has plummeted from a lofty $190 million to a modest $83.6 million—down 60%, yet still clutching onto enough enthusiasm to hint that many are still riding the bearish roller coaster, shorts and all. When these shorts get squeezed, it’ll be less a market correction and more a financial slapstick routine.

All these signals—liquidation zones above $0.13, spooked open interest—combine into a tantalizing possibility: a breakout that might trap every last bear in a digital corner. If $0.13 capitulates, Spark (SPK) could rocket through the stratosphere, propelled by a mixture of fresh demand and shorts desperately buying back their borrowed, overpriced honey.

Craving more crypto mysteries and market mumbo jumbo? Don’t forget to sign up for Harsh Notariya’s Daily Crypto Newsletter—your ticket to the chaos.

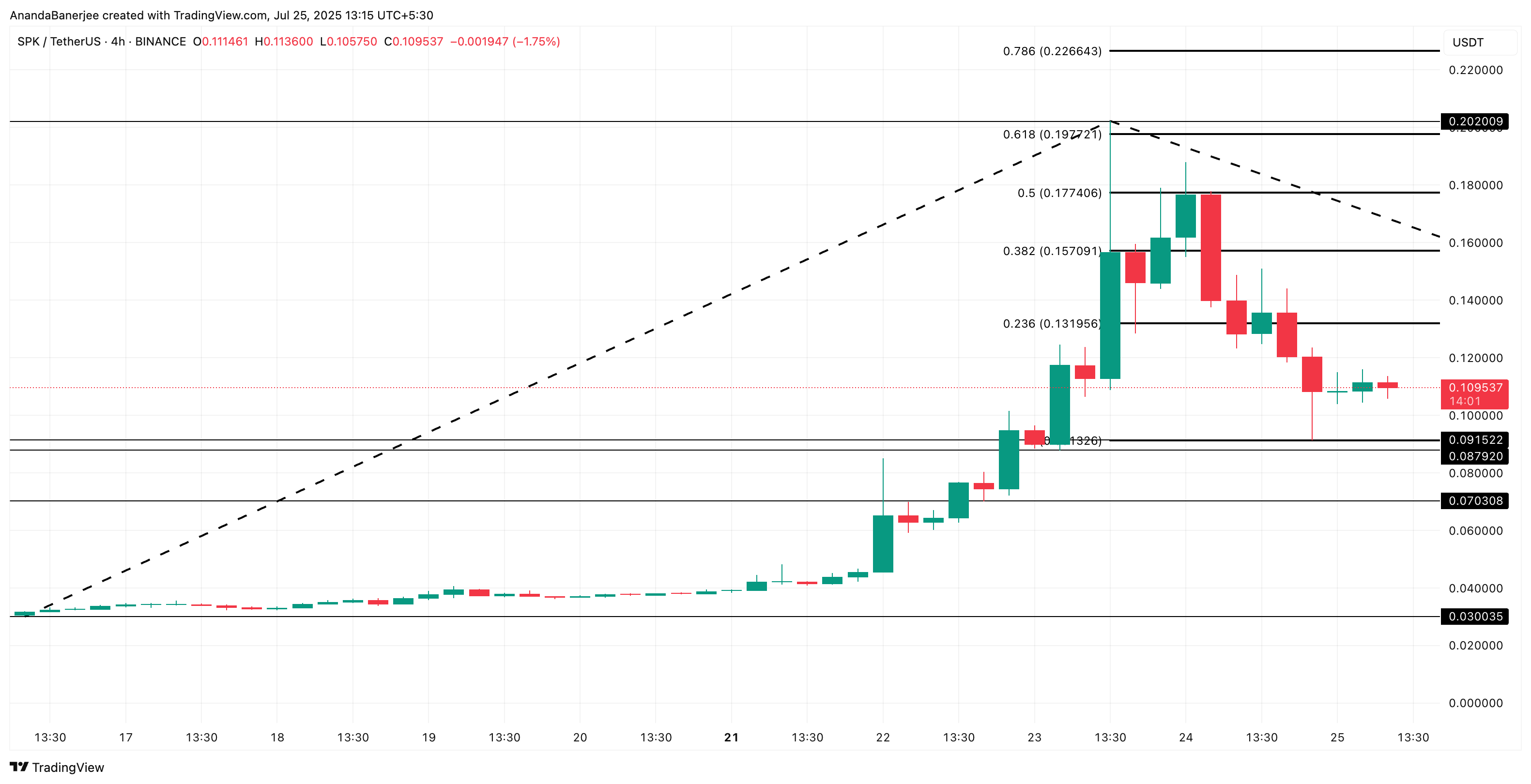

SPARK (SPK) Eyes the Legendary Breakout Zone—A Tale in Fibonacci’s Clothes

On the 4-hour altar of technical wizardry, the Fibonacci extension points at about $0.13—where the gods of liquidation whisper their warnings. Cross that line, and resistance lurks at $0.15 and $0.17; scale higher, like a caffeinated mountain goat, and a chariot to $0.202 might await.

The $0.15 resistance? Mere child’s play last rally. But $0.17 is the real villain—ITS phenomenon of resistance. If the price charges past $0.13 with the ferocity of a Reddit meme, a 70% surge could be in the cards—outpacing even the most optimistic moonboys.

However, should it dip below $0.09—an ancient sacred support line—the bullish narrative might just be an elaborate hallucination spun by over-caffeinated analysts rather than reality. And nobody wants their dreams of altcoin glory crushed—except maybe the bears.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- SEI PREDICTION. SEI cryptocurrency

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

2025-07-25 16:53