Dear Reader, it appears that Solana, once the darling of the digital sphere, has found itself in a most precarious predicament. Its price, like a recalcitrant suitor, has slipped into a most unbecoming position, and the market, ever so fickle, reflects this downturn with a sigh of discontent. What renders this moment particularly noteworthy is not merely the decline in value, but the alacrity with which sentiment has shifted from confidence to caution-a transformation as swift as a gossip spreading through the drawing rooms of Bath. 🌪️💔

Solana Under the Cosh as Market Reaches New Depths

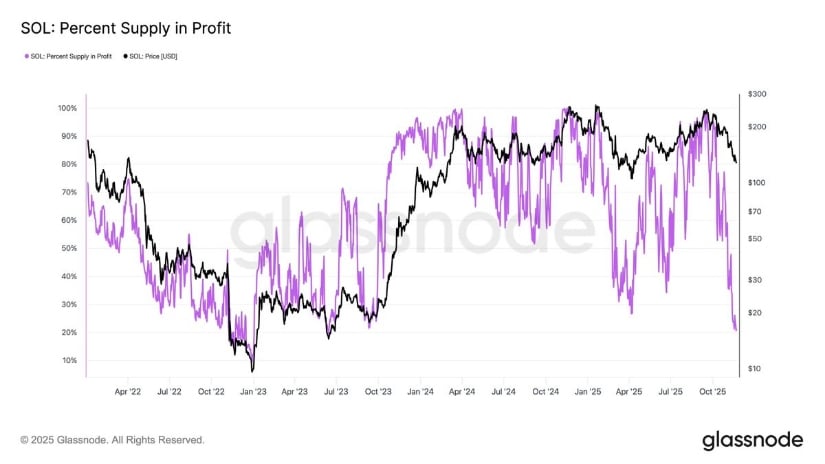

Solana, alas, has plummeted to a three-month low, a circumstance that has begun to fray the nerves of its holders. Recent on-chain data, as shared by the ever-observant Ted, reveals that nearly 79.6% of the circulating supply is currently at a loss-a state of affairs that typically accompanies deeper corrective phases. The chart, with its sharp lines and somber hues, underscores the rapidity with which profit has turned to peril, a testament to the persistent sell-side pressure. 📉😱

Yet, in this gloom, there is a glimmer of hope. History, that most reliable of narrators, suggests that such extremes often herald a slowing of downward momentum. When a substantial portion of the supply is submerged, forced selling tends to abate, allowing for tentative stabilization attempts. A silver lining, perhaps, for those with the fortitude to endure. 🌟🤞

Liquidity Signals Hint at Potential Uplift

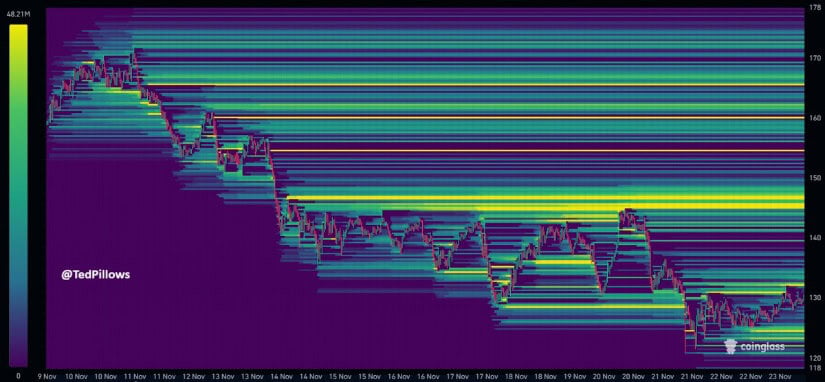

A separate liquidity map, also courtesy of Ted, presents a somewhat more optimistic perspective. According to this chart, the majority of Solana’s downside liquidity has already been exhausted, leaving two notable upside zones: a robust cluster awaiting at $145 to $150 and another around $120. With the lower range already cleared, the path forward appears more straightforward should volatility tilt upward. 🚀📈

Should Bitcoin deign to rebound, Solana might swiftly ascend into these untapped liquidity pockets. Markets, after all, have a penchant for gravitating toward the unclaimed, and the current setup suggests a clearer upward trajectory than downward. A comforting thought, no doubt, for the beleaguered investor. 🤑😌

Momentum Indicators Show Fledgling Resilience

Momentum-focused traders, such as the astute Hardy, are discerning the first signs of relief on Solana’s higher timeframes. The asset presently rests upon a multi-tested support zone, while both the RSI and oscillators exhibit early bullish divergences. These indicators, like the first blossoms of spring, often appear when sellers begin to lose their vigor, even before the price reflects this shift. 🌱📊

The SOL chart further reveals oversold conditions accumulating at this support. Should this level hold, the divergence could catalyze a short-term bounce, particularly once volume begins to swell. A modest reprieve, perhaps, but one that may yet prove significant. 🤞📈

Solana Price Prediction: The Channel Remains a Guiding Light

A pristine descending channel, as highlighted by the discerning 0xBossman, continues to shape Solana’s short-term prospects. The price is currently reacting from the lower boundary around $130, a level that has proven its mettle on multiple occasions. So long as this foundation remains intact, the next logical step would be a retest of the channel’s midpoint, near $160 to $165. 🛤️🔮

The upper boundary of the channel resides closer to $200, a figure that 0xBossman believes Solana could revisit in due course. A push above the mid-range would serve as the first tangible indication that momentum is tilting back in favor of the bulls. A prospect, one might hope, worth anticipating. 🐂🚀

Final Musings

Solana, it is clear, is under considerable duress, yet such moments often precede a settling of the market. With a preponderance of holders now at a loss, selling is likely to diminish, affording the price an opportunity to stabilize. Should the current support hold, even a modest bounce could propel SOL back toward the mid-channel levels. 🌊🤞

Caution, however, remains the watchword. Much hinges on Bitcoin’s next move, and volatility, ever the wild card, can escalate swiftly. For now, Solana stands at a juncture where both risk and opportunity are present, and the coming days will determine whether this stress metamorphoses into a steady recovery or another downward spiral. Only time, that most impartial of judges, will tell. ⏳🤔

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- OKB PREDICTION. OKB cryptocurrency

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

2025-11-25 00:21