Somewhere, possibly on a blockchain far, far away (but definitely not at the back of a dusty Discworld bookshop), Solana’s price is quietly plotting. If you listen closely, you may hear the rustle of bullish intent—an echo of Bitcoin’s own wild 2024 adventure, only with fewer dragons and slightly more anxiety. After what analysts call a “liquidity grab” (which sounds suspiciously like the sort of thing urchins do when presented with unattended pies), SOL has bounced, retested important support, and is winking at traders with the promise of more adventure. If all the technical villagers and data wizards are to be believed, SOL could be sharpening its sword for a proper run. 🧙♂️✨

Solana Price Mirroring Bitcoin’s 2024 Shenanigans

Imagine a fractal—no, not the sort of thing that drives wizards mad when they stare too long, but a price fractal that, when held up to Bitcoin’s colorful 2024 epic, looks almost identical. There’s a dramatic “liquidity grab” (cue the audience gasp!), a double top that practically yells “you shall not pass!” and then—miracle of miracles—a triumphant recovery.

That recent sweep under $120? Less collapse, more theatrical trapdoor opening—one meant to shake out the weak hands and reward anyone too stubborn (or too busy napping) to sell. If you blinked, you missed it. Market traps: fooling traders since the dawn of speculation.

Mister Crypto (possibly wearing a mysterious cloak and monocle) reckons if this magical fractal persists, Solana may soon find itself galloping towards the $200–$280 region, with as much subtlety as an elephant dancing on a tightrope. The resemblances to Bitcoin’s former life are uncanny. The price is stubbornly inching up, and it seems the bulls have found where they left their keys.

Technical Outlook: Solana Winks at $190

Now Solana is revisiting the top of its rather dramatic recently-broken channel—where resistance once lived and, after much negotiation, became support. (Architectural terms are transferable to both bridges and price charts, apparently.) Visual aids from Satoshi Flipper—a renowned digital cartographer of imaginary value—show SOL sniffing around above $145, where support is quietly stacking up.

This pullback isn’t dramatic. There’s no panic, no running for the exit, just a polite knock on the mid-range consolidation band and a vague sense of déjà vu. Should SOL decide to hold steady above $142–$145 (no pressure), the route to $190 could open up like the express lane at Ankh-Morpork’s toll bridge on Garlick Festival weekend. History reminds us: last time Bitcoin flirted with this pattern, it broke out fast enough to make even the Luggage look slow. 🧳

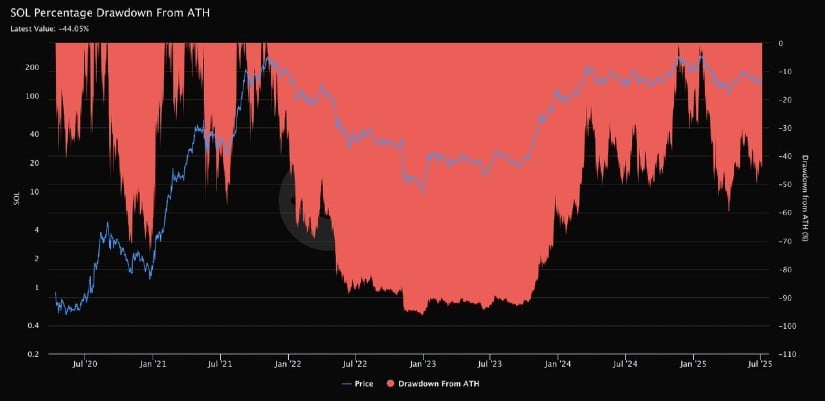

SOL Solana Price Drawdown: From Nosebleed to Comfortably Down

Once upon a time (specifically 2022–2023), SOL’s price had suffered a drop that even lemmings would find dramatic. But these days, thanks to an ongoing comeback, that catastrophic -95% drawdown is now a genteel -44%. (Still nothing to write to your financial advisor about, but a vast improvement in the “not needing a stiff drink” department.)

The latest “Drawdown Chart” looks like a blood pressure reading before and after discovering decaf. As prices push higher and technical setups twinkle, Solana’s narrative is less tragic epic, more determined underdog. Structural retests, reclaimed levels, and much less of the old “bleeding like a stuck pig” vibe. The drawdown’s slimming down—Weight Watchers for crypto charts! 📉

Solana’s On-Chain Mojo: Data Wizards Approve

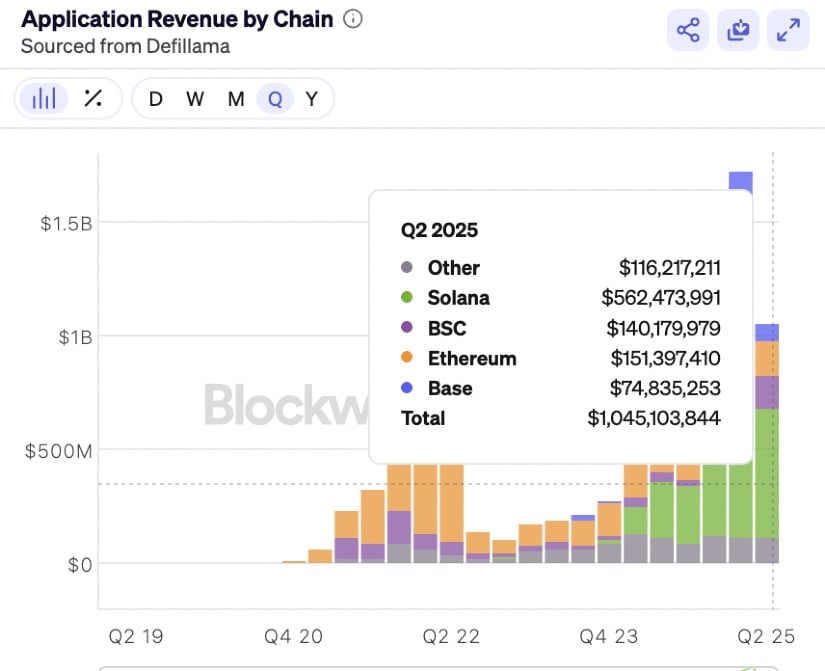

Here’s where things get spicy. Solana’s not just leading the price parade; it’s blitzing the on-chain stats like a wizard at a spell-casting competition where the prize is more magic. New data claims Solana’s left every other chain picking through their pockets for spare “tokenized asset” volume. That green bar on the chart? It’s not so much ‘up’ as it is ‘through-the-ceiling-and-out-the-back-window’.

More impressive: Solana DApps pulled in $562 million in Q2 2025—more than Ethereum, BNBs, and Base combined. That’s five quarters of “mine’s bigger” energy. Key magical plot points:

- Tokenized asset volume: Solana’s taking a victory lap while rivals catch their breath.

- DApp revenues: Sky-high, and Solana clutching more than half the market’s spoils.

- The DePIN and RWA initiatives: No one knows what RWA stands for, but it’s making numbers go up.

- Fees are low, throughput is high, and developers are migrating faster than Rincewind when trouble arrives.

Green lights everywhere, and the fundamentals are so strong even a troll accountant would be impressed. If the broader market doesn’t spontaneously combust, these on-chain tailwinds could end up strapping a rocket to SOL’s price, Wile E. Coyote style. 🚀

The Obligatory Dramatic Conclusion

Solana’s setup looks mighty tempting—technicals, fundamentals, and on-chain hijinks all lining up like wizards at the Unseen University’s lunch line. The price structure is howlingly similar to Bitcoin’s own fairy-tale revival. The odds favor a bullish charge through resistance, perhaps even to that magical $280 mark (give or take a few plot twists).

There are, of course, lurking risks—the sort with sharp teeth and “correction” written on their collars. Should key support levels give way, there could still be awkward sideways shuffling before the next spectacular leap. But for now, all indicators suggest that Solana, having survived its lengthy bear-market slapstick, is ready for a fresh chapter. Watch this space, and remember to bring popcorn. 🍿

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- 🚀 BNB Soars to the Moon While Crypto Market Faceplants! 🌕💸

- XRP Staking: A Tale of Tension and Tokens 🚀

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-07-06 02:46