Oh dear, Solana’s price seems to be cracking under pressure! Despite a rather cheery 12% gain in July, the token has now corrected by more than 7.5% in the past 24 hours, effectively wiping out most of those lovely gains. How tragic! 😬

The sudden plummet has dragged Solana below a crucial support level, breaking away from a bearish pattern that had been lurking ominously on the daily chart. Traders are now left in a state of great confusion: Was this merely a temporary shakeout, or are the bears tightening their grip, preparing for a long, unrelenting squeeze? 🤔

Active Addresses Collapse As Demand Fades

On July 21, Solana’s daily active addresses peaked at 4.1 million, just as the SOL price skyrocketed past the $200 mark. This seemed to suggest that a robust network activity was powering the rally. A promising sign indeed!

But alas, the momentum quickly dissipated. Within a mere two sessions, active addresses took a dive, dropping by a hefty 23.7%, and Solana’s price followed suit, tumbling down to $176. Currently, the address count sits around 3.2 million, a steady decline that sends shivers down one’s spine. 📉

This is noteworthy because active addresses are a clear indicator of real network demand. Without rising participation, rallies simply cannot hold their ground. The latest breakdown, below the ascending wedge (a pattern we’ll reveal later, because suspense is always fun), came just as activity was falling off a cliff. Clearly, Solana’s bullish push lacked the necessary support to defend those all-important key levels.

Shorts Dominate Liquidation Map, Confirming Bearish Bias

The derivatives market is throwing its lot in with the bears. This is unsurprising, given the dip in network activity, and leaves the entire price structure in a rather weak state.

Open short positions now stand at a rather intimidating $1.69 billion, while longs trail dismally at just $244 million. Typically, a high short ratio could signal a game of funding rate cat and mouse or set up for a squeeze. However, with longs this low, this is no game—it’s a proper bear bias in full swing.

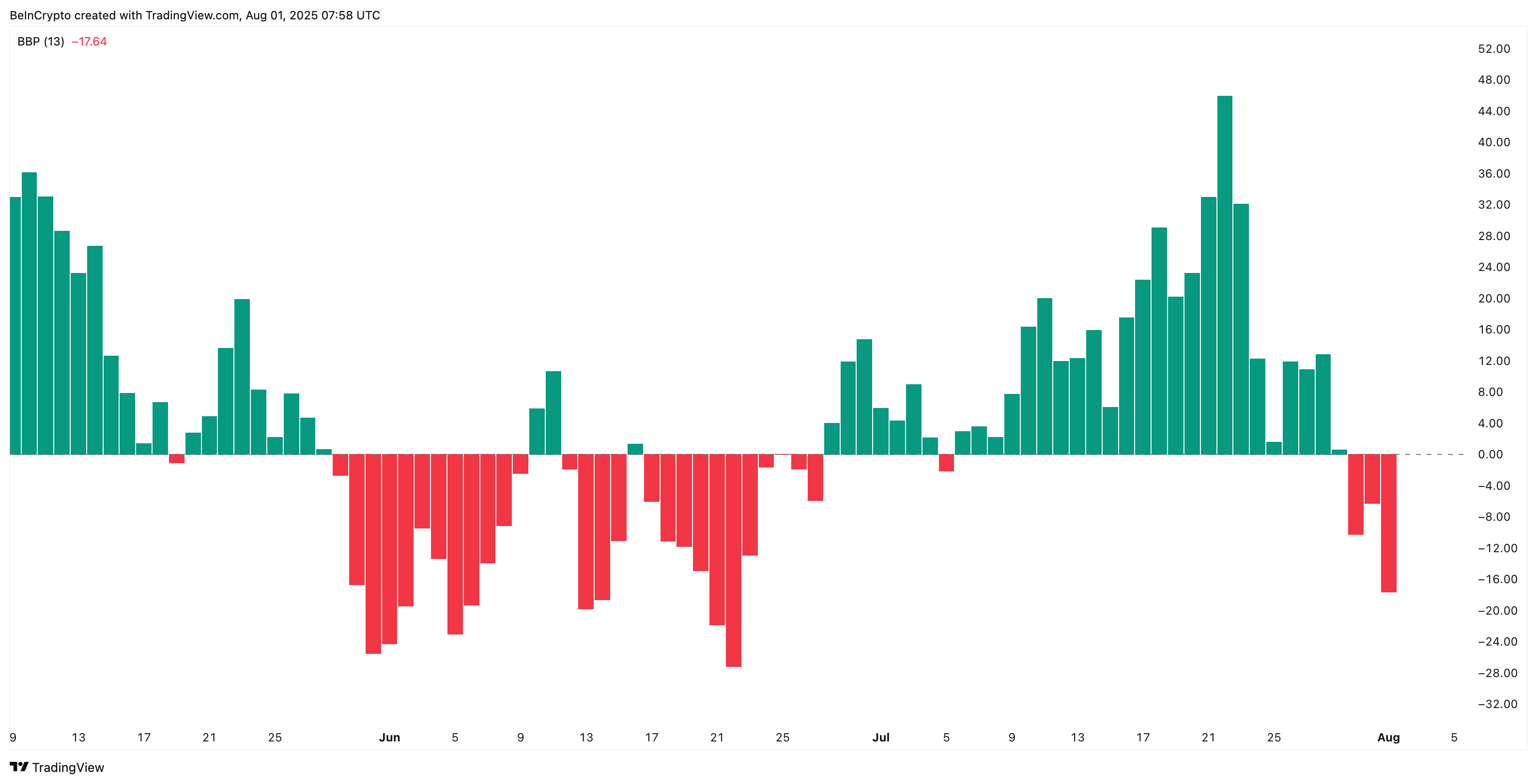

Meanwhile, the Bull-Bear Power index has been in the red for three consecutive sessions, its longest streak of doom since June. Sellers, it seems, are firmly in control, driving prices lower despite the occasional, almost pitiful attempts at recovery.

However, if Solana manages to rebound sharply and regain momentum above the $175–$180 mark (which we’ll discuss in a moment), these heavy shorts might just become fuel for a short squeeze, creating a rather amusing “bear trap.” But, at this point, it’s hard to see how that could happen. For now, the pressure seems unmistakably tilted to the downside, with a bear trap looking more like an impossible fantasy. 🙄

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana Price Action Puts $166 In Focus

Technically speaking, Solana’s price has broken down from its ascending wedge on the daily chart, snapping a pattern that had been supporting the July rally. The immediate support level to keep an eye on is $166, which coincides with the 0.5 Fibonacci retracement zone from the $206 high. Lose this area, and we could see a descent toward $156 or even a truly grim $143.

To invalidate this rather bleak scenario, Solana will need to pull off three impressive feats in rapid succession:

- User activity must rebound, signaling a resurgence in demand.

- Price must reclaim $175–$180, forcing shorts to unravel in panic.

- A daily close back inside the broken wedge, restoring the bullish pattern to its former glory.

Only if all these conditions align could this setup transform into a classic bear trap, flipping sentiment back in favor of the bulls. Until then, the Solana price remains under heavy pressure, with the specter of further losses looming ominously on the horizon.

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- XRP: A Most Disappointing Turn of Events! 📉

- Feeder Funds Go Full Fashionista with RLUSD 💸✨

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- XRP’s Wild Ride: To the Moon or Just a Bit Bouncy? 🚀

- India’s Crypto Users Are Finally Diversifying (And It’s Hilarious)

- Crypto Leverage: Uh Oh ⚠️

2025-08-01 19:06