Well, folks, gather ’round! It seems our beloved Bitcoin investors are still on the “bear train,” chugging along like it’s a 3-hour ride through the middle of nowhere. 🚂 Who knew cryptocurrency could be this melancholy?

All Aboard the Short Position Express!

In a new and thrilling twist on the social media sensation X, our pals at Glassnode decided to crank out some data on Bitcoin market sentiment-because nothing screams fun like numbers! 📊 They introduced us to “Long/Short Bias,” which sounds like a fancy cocktail that no one wants to try, but here we are.

The magic happens when this indicator is positive; it means the bullish traders are throwing a party! 🎉 But, when it’s below zero, well, it’s like a sad, half-eaten cake left in the corner. Right now, it seems folks are bringing the negativity, with shorts pouring in like they just won the lottery.

And here’s the dramatic visual of it all-yes, it’s a chart! Because who doesn’t want to gaze at a graph on a Tuesday?

The chart makes it look like shorts are the star of the show, while longs are the extras nobody remembers. And despite Bitcoin’s recent post-holiday glow-up, the shorts are still raking in the wins-by 485 BTC. That’s right, folks, that’s about $56.2 million, which is roughly enough to buy an island and live out your pirate dreams! 🏴☠️

History lesson: cryptocurrencies tend to move in the opposite direction of what everyone thinks. So, maybe this bearish parade isn’t the end of the world! 🌍

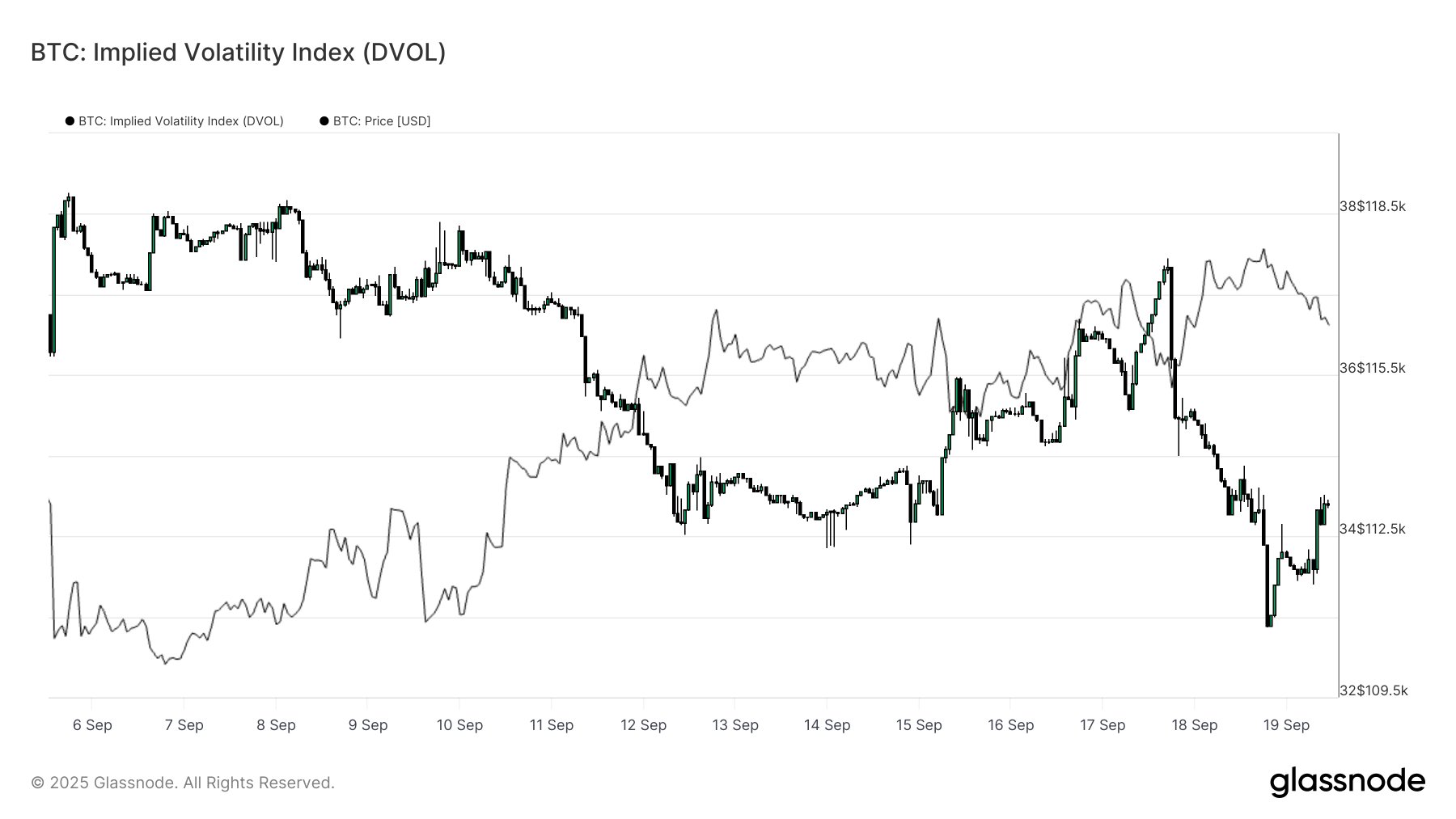

Moving into the glitz and glam of Bitcoin Options, Glassnode drops another pearl of wisdom: Implied Volatility (IV)! This darling measures how dramatic Options traders expect things to get-think of it as the soap opera of the finance world. 📺 Our favorite part? The “At-The-Money” (ATM) version, which only applies to traders who forgot to read the fine print on their purchases.

Check out this charming chart that reveals the latest gossip on IV trends-it’s like looking into the crystal ball of Bitcoin!

As the graph shows, one week before the Federal Open Market Committee (FOMC) meeting, everyone was in a tizzy, but then, boom-it fell like your hopes after a bad haircut. 💇

Also, let’s not ignore DVOL, which aggregates IV across strike prices, because clearly, we need more metrics to ponder while sipping our overpriced lattes.

Glassnode quips, “Post-FOMC, DVOL dropped back,” confirming that the market is playing it safe and not expecting a wild rollercoaster ride anytime soon. 🎢

BTC Price Rundown

In the latest episode of “As the Bitcoin Turns,” our star crypto peaked at $117,900, only to do a sad backflip and land at $116,000. Talk about commitment issues!

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- USD TRY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- DOGE PREDICTION. DOGE cryptocurrency

- USD DKK PREDICTION

2025-09-20 14:14