Ah, the grand entrance! Sei Network’s SEI token, the blockchain equivalent of a toddler in a party hat, finally graced Robinhood’s stage this week. 🎉 Now, 25 million retail users and $13 billion in crypto volume are staring at it like it’s the last slice of pizza at a family reunion. But let’s be real-who needs friends when you’ve got Robinhood?

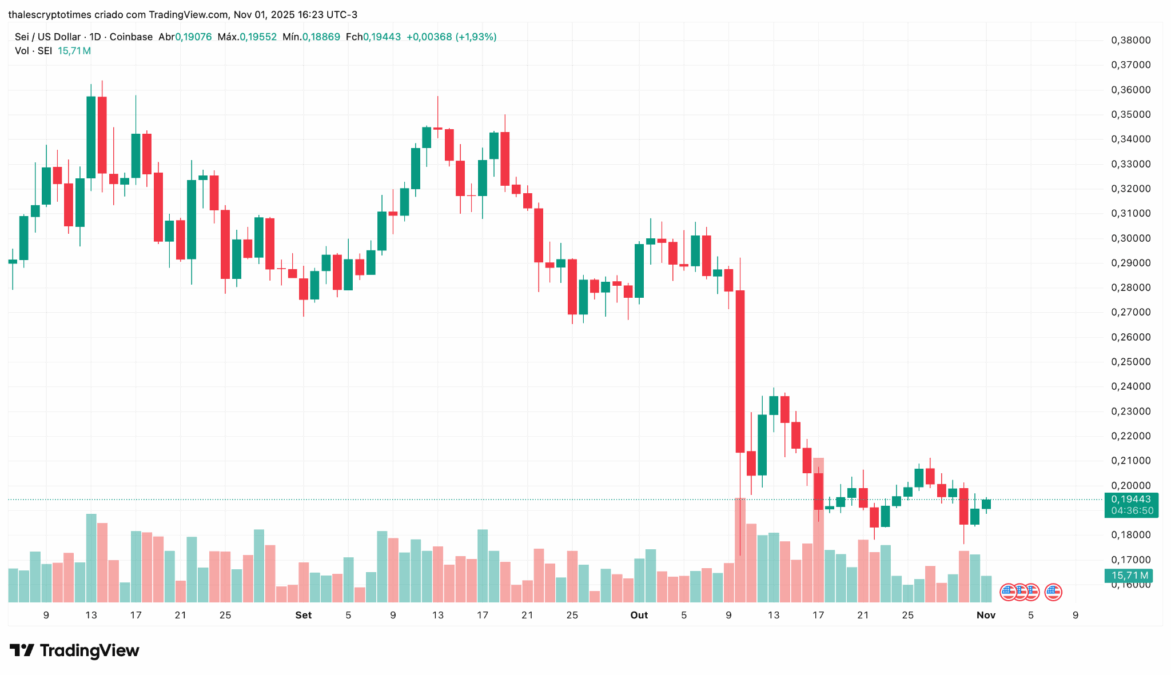

Unfortunately, the debut coincided with the broader crypto market’s midlife crisis. Within 24 hours, SEI plummeted like a poorly timed dad joke, dropping between 4% and 10% to hover around $0.19. 🎢 On-chain data? Active. Investor confidence? Not so much. It’s like showing up to a pool party with a fanny pack in 2025.

Analysts, those self-appointed prophets of the digital age, blamed the Federal Reserve for the chaos. “Delayed interest rate cuts!” they cried, as if the Fed’s communication skills were the root of all evil. Spoiler: They’re not. But hey, it’s a nice excuse to wipe $200 billion from crypto’s balance sheet. 💸

The Robinhood listing, announced on October 30, initially looked like SEI’s golden ticket. For a week, it rode a 15% rally, like it was trying to outdo a TikTok dance trend. But then Bitcoin dropped below $110,000, Ethereum crumpled under $3,900, and suddenly, SEI was the crypto version of that one friend who always crashes the party. 🤡

@Ali_Charts, the Twitter oracle of all things crypto, offered a silver lining: “The TD just flashed a buy signal for $SEI! Hold $0.19 as support; the next move could be a rebound to $0.31.” Translation: Hope for the best, panic for the rest. 🙃

The TD just flashed a buy signal for $SEI!

Hold $0.19 as support; the next move could be a rebound to $0.31.

– Ali (@ali_charts) October 30, 2025

While short-term traders are currently crying into their NFTs, the listing still earned SEI a VIP pass to regulated U.S. exchanges. Not bad for a blockchain that’s basically a tech startup with a better PR team. 🚀

Sei, for those who haven’t met the Layer 1 blockchain equivalent of a Swiss Army knife, promises Web2-level throughput without sacrificing decentralization. Sounds fancy, but let’s see if it can survive the next market tantrum. 🤞

Just weeks before the Robinhood debut, BlackRock and Brevan Howard decided to play matchmaker, bringing tokenized funds onto Sei via KAIO. Suddenly, investors could trade onchain versions of real-world assets like the BlackRock ICS US Dollar Liquidity Fund. It’s like turning a savings account into a crypto flex. 💼

Meanwhile, behind the scenes, Sei is busy playing matchmaker between institutional finance and retail investors. Think of it as the crypto equivalent of a dating app for Wall Street and your average Joe. 🤝

SEI’s rollercoaster price swings contrast sharply with its growing institutional fan club. It’s the crypto version of a reality TV star-loved by some, mocked by many, but always in the spotlight. 🌟

As 2026 looms, Sei’s fate hinges on whether the market regains its footing. Or, you know, whether someone finally explains why blockchain is different from a ledger. But hey, that’s a problem for tomorrow. For now, let’s just enjoy the chaos. 🎢

Read More

- Brent Oil Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- USD CNY PREDICTION

- ETH CAD PREDICTION. ETH cryptocurrency

2025-11-02 00:32