Instantly, like a curious puppy, Bitcoin rebounds from its post-FOMC slump. Meanwhile, Congress nudges SEC Chair Paul Atkins to let 401(k)s frolic in the crypto fields.

The Federal Reserve’s pronouncement in December flattened the wallet of Bitcoin the way evening shadows obscure the sunshine. Yet, the currency found its footing again. Observers, wizened and wise, note a more erratic behavior than in days long past.

Upon the FOMC’s declaration, Bitcoin, much like a friend at a concert, felt the ground tremble and took a sudden trip downwards, or so says CryptoRover on X. Eventually, Bitcoin stood firm, reminiscent of a dour sunflower resisting a nipping frost. In earlier gatherings, such falters lasted for days.

Source: CryptoRover

You might also like: Bitcoin’s Dip Deepens: Fed Rate Cut Signals More Pain Ahead

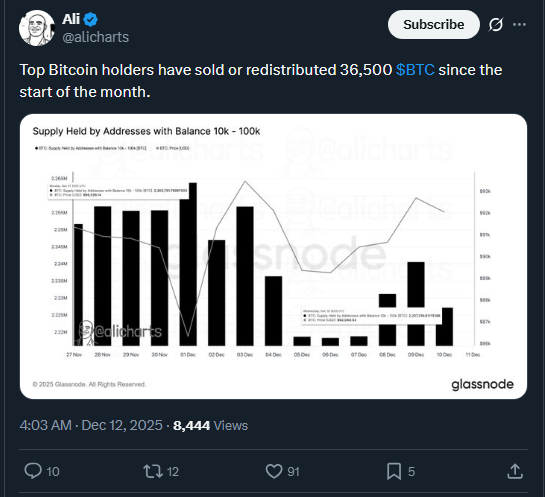

Whales Dump While Price Stabilizes

The heavyweights of Bitcoin, possibly feeling as restless as writer in the heat of Moscow, dispersed their treasures by the month’s start. AliCharts on X reported that the affluent offloaded or shuffled 36,500 BTC in uncertainty’s thick embrace, much as leaves fling from trees in an autumn whisper.

Source: AliCharts

The Federal Reserve, ever the patient gardener, tilled a reduction of twenty-five basis points-a gesture not unfamiliar, for it was their third from the warmth of a year. Bitcoin, experiencing an ominous chill, soon warmed to approximately 92,000, catching many an investor mid-sigh with joy.

You might also like: Bitcoin Treasuries Stall in Q4 as Large Investors Keep Accumulating

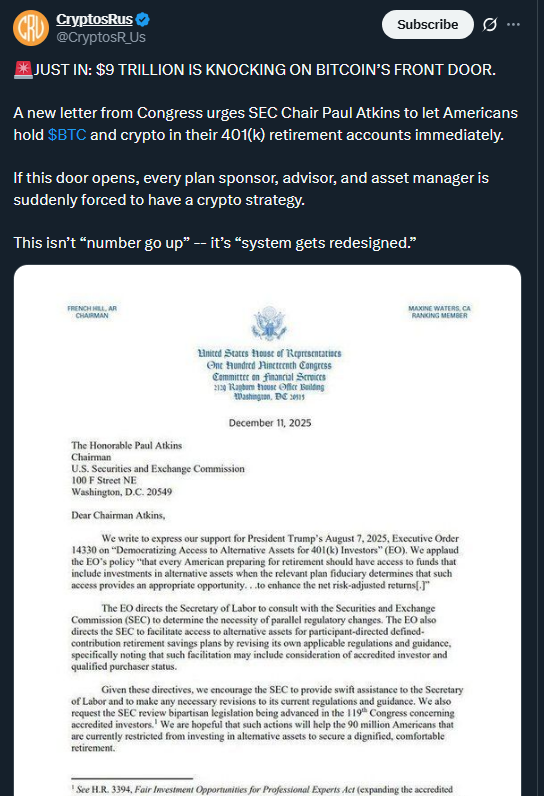

Congress Targets $9 Trillion Retirement Market

A much-readied epistle meets the hands of SEC Chair Paul Atkins, its pages fluttering with pleas from Congress. They wish for the American folk-each with visions of snug retirements-to count Bitcoin and its kin amongst their 401(k) divities, hence unlocking a vault possibly swollen with 9 trillion.

The beckoning is formidable; like the wind rising before a tea spill, so tickles CryptosR_Us on X that all plan sponsors now awaken to a dream for a crypto strategy, as embattled asset managers reassess. This evolution, dear reader, is more than a ride upon the bullish winds.

Source: CryptosR_Us

The scroll, adorned by the House Financial Services Committee on December 11, prods for a revision of the ancient laws of digital assets within the hallowed retirement plans. Such regulations, they say (shivering slightly at the thought), are as quaint as a faceless visage in a darkened parlor, keeping many from prospects anew.

As all things under the unforgiving Russian sky, such policy leans on President Trump’s August decree-an edict eager to widen gates to alternative riches. Whether comprised of cryptocurrencies or the steadfast tangibility of land and enterprise, the cry is for expansion, for opportunity’s breath amongst the elderly saver’s bounty.

You might also like: Bitcoin Builds Foundation: $100K Bounce Eyes $80K Retest

System Redesign on the Horizon

The path now runs through the SEC’s court, where Chair Atkins wields an inquiry known simply as Project Crypto, deciphering the enigmatic tome of digital assets. In recent oratory-reminiscent of an earnest Kir on a lecture stage-most crypto tokens are deemed not unlike securities, thereby inviting their presence in retirement accounts.

Legislators, in their infinite wisdom (and perhaps whimsy), consider broadening the very definition of those deemed accredited investors. A favor previously reserved for the silver-tongued and wealthy, its shadows could soon welcome educators, nurses, even engineers into its embrace.

Following the stellar performance akin to post-FOMC sapling, Bitcoin now stands above the 92,000 mark. Its own weight, a goliath among currencies, represents 1.85 trillion, with a daily trading volume echoing across halls at 52 billion. This budding recovery came post haste after the initial market’s abrupt descent into cold mirth.

Skeptics, with furrowed brows reminiscent of our beloved Gorky in a contemplative moment, caution against giddy inclusion of cryptocurrencies within the fitful embrace of retirement portfolios. For amid crises, Bitcoin can despond like a lover scorned. Yet proponents retort, convinced that youth require alternative assets as flowers need morning dew. Among retirement savers, the chorus for cryptocurrency grows louder.

The SEC, ever the weary gatekeeper, must now parley alongside the Department of Labor-these twin titans of retirement planning. Their dialogue is a dance, stepped upon by the heavy boots of congressional pressure, hinting at reforms not unlike the budding pines in early spring’s embrace.

You might also like: SpaceX Moves $94M in Bitcoin Amid IPO Rumors and Future Plans

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- CNY JPY PREDICTION

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- STX PREDICTION. STX cryptocurrency

- Fear and Greed Index Hits 5-Month Low as BTC Drops to $109K – Warning or Buying Opportunity?

- Bitcoin’s New BFF: $HYPER Raises $13.6M While You’re Still Using Cash 😂

- 🚀 Solana’s November: Bull Run or Bull Plop? 🌽

- BNB’s Big Gamble: $160M Bet or Just Another Rich Kid’s Allowance? 💸🚀

2025-12-13 11:05