Another chapter in the woeful saga of XRP: an 11% plunge in October-not for lack of trying, but for the dreaded paperwork. Spot ETF bottlenecks lead the charge, and long-term holders appeared to take a sudden, albeit lucrative, sea change.

Why, in October, does one see that XRP has, alas, dropped by a further 11 percent, a development which could only be welcomed by the most sympathetic of financial analysts? This unsavory decline can largely be traced back to the noble efforts of long-term holders, who sought to distribute their fortune in the wake of an impending ether tempest.

wp:image {“id”:137092,”sizeSlug”:”full”,”linkDestination”:”none”}

/wp:image

Source – X

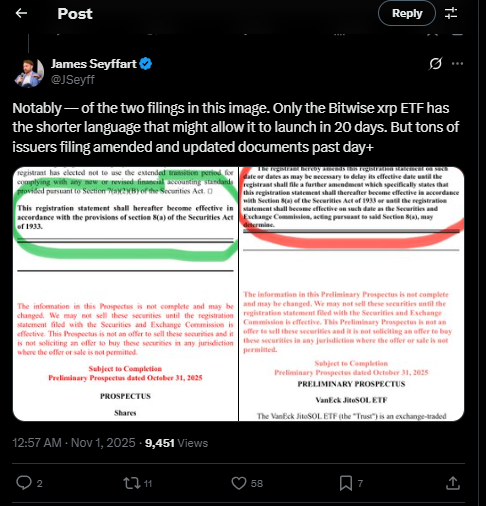

The regulatory nemesis of the spot ETF, with its ineffably slow approval process, has woven a narrative of doubt and despair over the otherwise illustrious short-term prospects of XRP. Our financial Orwellian landscape has been marred by such bureaucratic tedium.

With the swiftness of a tortoise at a financial frontier, the rumblings of ETF approvals continue unabated, much to the chagrin of aficionados and hopeful investors alike. Ripple Labs and its alleged confederates have remained as enigmatic as ever, their silence in the face of declines as lordly as Montgomery’s retreat at Dunkirk.

The tantalizing whisper of imminent regulatory edicts has lit the imagination of those who wager upon these modern-day Stock Exchanges-hasten the SEC, we cry! Let the end of 2025 bring no more delays, lest this saga end not in triumph, but in melancholic resignation.

ETF Delays: A Symphony of Discontent

The SEC, that venerable sentinel of the financial order, continues to dawdle over its ETF decisions, producing in its wake a market as morose as an Evelyn Waugh novel.

In a dramatic turn of events, significant dates for hopeful ETFs have been shuffled as casually as a pack of cards at Bad Ghyll. Investors, those poor souls, hold their breath and wallets tightly bound in an eternal vigil.

Native to such bureaucratic lagoons are ample opportunities for profit-driven departures, as those savvy enough to foresee the aforementioned deluge decamp with substantial gains.

This financial ennui, replete with an irritating dearth of fundamental market news, suggests a coming storm, a period of consolidation and nervous trader contemplation as deliberate as Proust’s prose.

Long-Term Holders: A Deluge of Dispersed Fortunes

Statistics, ever the cold comfort, reveal that long-term holders have engaged in a concerted effort to distance themselves from their former holdings, adding fuel to XRP’s bearish fortunes.

With an average daily withdrawal noted at a distressingly high 260 million dollars- a far cry from its previous more modest levels-October has seen the market color XRP in hues of tawny pessimism.

As these financial adventurers liquidated their positions, technical charts displayed a grim tapestry of declining peaks and troughs, giving the brave a hint of inevitable despondency.

Until some regulatory miracle occurs or ETFs are magically approved, analysts whisper, the trading of XRP might as well be at a standstill, painted vividly by the troubling markets of late.

The indomitable spirit of XRP, battered and bruised by the arbitrary whims of regulation and profit-taking, watches the unfolding narrative with a wariness akin to that of Jeeves in trying times. The crypto community, eyes fixed intently on forthcoming decisions, awaits November’s promise, hopeful yet skeptical.

Read More

- Gold Rate Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Brent Oil Forecast

- Silver Rate Forecast

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

2025-11-02 14:21