So, you know how everyone’s been waiting for Ripple‘s IPO? Well, it’s finally maybe, possibly, hopefully happening by 2026 🤞. And, spoiler alert, DBS Bank thinks it’s going to be worth a cool $11.3 billion 💸. Meanwhile, XRP is just chillin’ in a consolidation zone, waiting for its moment to shine (or crash, who knows? 🤷♀️).

Ripple’s Got Momentum (and a Few Billion Dollars)

DBS Bank’s valuation is like a big ol’ stamp of approval for Ripple. It’s like, “Hey, we believe in you, Ripple! You’re doing great things in the world of blockchain-based cross-border payments!” 🌟. And, let’s be real, Ripple’s been crushing it in Asia, especially with its new BFF Tenity in Singapore 🤝.

Ripple CEO Brad Garlinghouse is all, “Yeah, we’re thinking about going public, but no big deal 🤷♂️.” Meanwhile, the company’s just scaling organically and making bank without even needing an IPO 💸.

Despite some drama with the SEC, Ripple’s still the leader of the blockchain finance pack 🐕. Garlinghouse is all, “We’re gonna thrive in the US, the world’s largest economy!” 🎉. And, now that the SEC drama is almost over, it’s time for institutional adoption to take off 🚀.

XRP Price: The Calm Before the Storm?

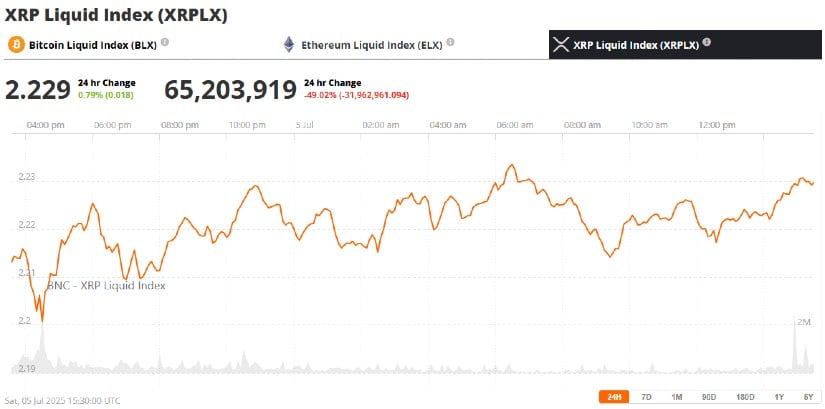

XRP’s just chillin’ at $2.22, waiting for its next big move 🤔. Technical analysis says it’s in a compression area, which is just a fancy way of saying it’s about to get real 🚨. Traders are watching closely for a breakout, and if it happens, it could be a wild ride 🎢.

The 4-hour chart is looking a little sketchy, with a rounded top pattern and decreasing trading volume 📉. But, hey, XRP’s still got some momentum left, and volatility is expected to pick up soon 🚀.

Ripple’s Taking Over the World (of Finance)

Ripple’s tech is becoming the go-to replacement for old systems like SWIFT 💻. And, with blockchain adoption on the rise in Southeast Asia, Ripple’s value proposition is looking stronger than ever 💪. It’s like, “Hey, we can save you up to 30% on transactions!” 🤑.

DBS is all in on Ripple, and other major banks are following suit 🤝. Ripple’s expansion plans are looking bright, with the XRP Ledger Accelerator Program bringing in new devs and projects 🚀.

The SEC Saga is Finally Over (Almost)

The multi-year drama between Ripple and the SEC is finally coming to an end 🙌. Garlinghouse is all, “We’re closing this chapter once and for all!” 📚. Now, it’s time to focus on product development and scaling operations 🚀.

But, hey, there’s still some drama with Linqto 🤔. Ripple’s all, “We stopped approving Linqto purchases in 2024, and they’re just a shareholder with 4.7 million shares 🤷♂️.”

What’s Next for Ripple and XRP?

It’s all coming together for Ripple: institutional interest, regulatory clarity, and technical development 🤩. The IPO is looking more likely than ever, and XRP’s poised for a breakout 🚀. The next few months are going to be critical for XRP price prediction models, but the long-term forecast is looking bullish 🐂.

For now, XRP’s just chillin’ at $2.22, waiting for its next big move 🤔. But, hey, with Ripple’s IPO plans advancing and the SEC saga almost over, the future is looking bright 🌟.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- XRP Price Tale: The River That Rises

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- BNB: To $1,000 or Total Chaos? 🤯

2025-07-06 01:23