It is a truth universally acknowledged, that a market in possession of a good deal of volatility, must be in want of a stable price. Thus, the Solana-based memecoin Popcat, whose value stands at a modest $0.13, has seen a most extraordinary increase in trading activity, with a 500% surge in volume on Nov. 12, driven by panic and speculation. Alas, the whispers of market manipulation on Hyperliquid DEX have sent traders into a tizzy, much to the delight of the more mischievous among us. 🧙♂️

🚨JUST IN: @Solana memecoin $POPCAT is experiencing heavy volatility following concerns of possible market manipulation on @HyperliquidX. In the past four hours, $63 million worth of long positions have been liquidated, including a single liquidation worth $21 million, the…

– SolanaFloor (@SolanaFloor) November 12, 2025

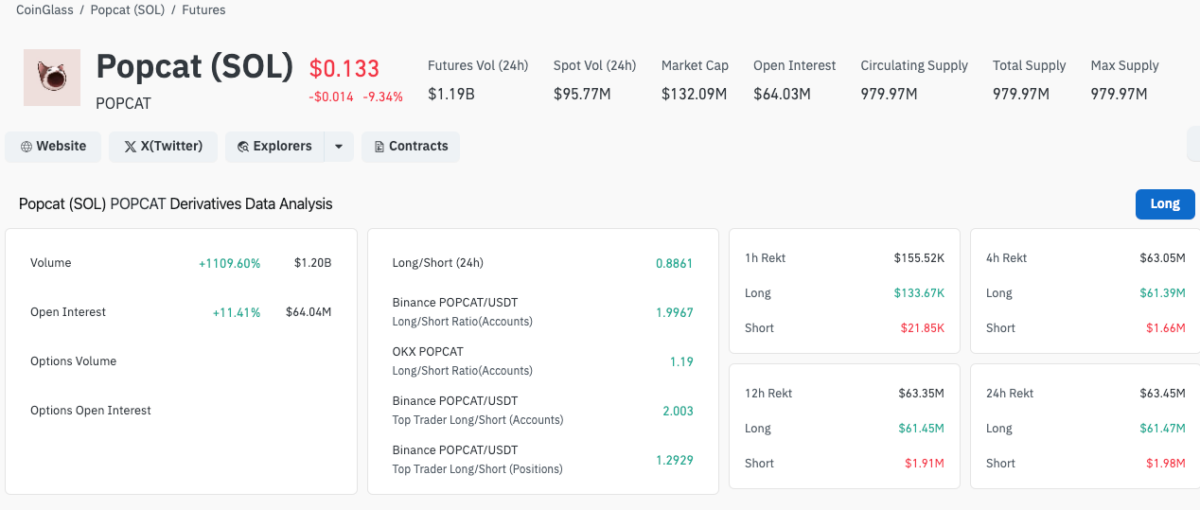

Behold, the data from Coinglass reveals that over $63 million in long positions were liquidated within four hours, as traders, in their haste to close out overleveraged positions, have left a trail of chaos. Of this, $62 million were long-side liquidations, compared to a mere $1.6 million in shorts, a testament to the bullish traders’ penchant for booking losses. 📉

Popcat derivatives market analysis | Source: Coinglass

The market turbulence saw a whale position worth $21 million wiped out, the largest single liquidation outside of Bitcoin and Ethereum markets during the same period. A most unfortunate whale, whose fortune was reduced by a staggering $21 million, was the largest single loss outside of Bitcoin and Ethereum’s markets. 💸

Derivatives trading metrics showed a 1109.6% spike in Popcat futures volume to $1.2 billion on Nov. 12, while open interest climbed 11.41% to $64.04 million. However, the long-to-short ratio dropped to 0.89, signaling a dominance of short sellers exploiting market chaos for quick profits. 🕵️♀️

Amid this turbulence, Popcat price declined 10% intraday to $0.21. Popcat has slipped from the top ten ranked Solana memecoins, according to Coingecko data, leapfrogged by Catinadogsworld (MEW) which saw a modest 5% dip on the day, and Trump-linked Melania token, which rose 17%. A most curious turn of events, indeed. 🤔

Popcat Price Forecast: Can Bulls Defend the $0.13 Support After 20% Intraday Crash?

Popcat’s 12-hour chart shows a sharp rejection at $0.2127, followed by a steep 20% decline to $0.1324, forming a long upper wick that signals distribution pressure. The Donchian Channel (DC) upper band near $0.2127 acted as key resistance, while the median line at $0.1578 flipped into short-term resistance after the selloff. 📈

Momentum indicators point to cooling bullish momentum. The MACD histogram is narrowing, suggesting fading upward strength, while the Relative Volatility Index (RVI) near 56.9 signals indecision after excessive volatility. 🌀

Popcat price analysis, Nov. 11, 2025 | Source: TradingView

For bulls, maintaining support above $0.1029 is crucial to avoid a deeper correction toward $0.0850, which aligns with early November consolidation levels. A rebound above $0.1578 could restore short-term bullish bias and reopen targets toward $0.2127 and $0.24, where the next liquidity cluster lies. 🧭

However, if manipulation fears persist, Popcat risks extending its decline, potentially revisiting sub-$0.10 levels before stabilizing. A most precarious situation, one might say. 🌪️

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- Wall Street Embraces Crypto: SEC and CFTC Unite in a Dramatic Twist!

- CORPORATE BITCOIN MADNESS: 1 MILLION BTC AND COUNTING! 🚀💰

- tag, and it shouldn’t be repeated in the body. All images should stay in place, but there are no images here. I need to add humor and emojis while keeping the original information. First, I’ll tackle the title. The original title is “Cardano May Finally Get Chance to Flip Tron, Here’s Reason”. To make it clickbaity and Mel Brooks-style, maybe something like “Cardano vs. Tron: The Flippening Frenzy 🚀 (Spoiler: Whales Are Involved)”. It’s under 100 characters and has emojis. Next, the body. The original paragraphs discuss ADA and TRX’s market positions, price movements, and trading volumes. Mel Brooks’ style is comedic and sarcastic, so I can exaggerate the scenarios. For example, referring to ADA’s price surge as a “heroic breakout” or “whales in the ocean” with emojis like 🐋. Use phrases like “plot twist” or “suspenseful drama” to mimic Brooks’ flair for over-the-top storytelling. I need to replace technical terms with humorous analogies. Instead of “bullish reset,” maybe “bullish adrenaline rush.” Mentioning the RSI as a “nervous ticker” could add a funny touch. Also, use emojis like 💸, 📈, and 🤑 to keep it light and engaging. Check for any parts that can be sarcastic. For instance, when talking about Tron’s slight decline, say “Tron, the underdog, is currently sipping from the ‘0.08% Decline’ chalice of despair.” That adds a humorous twist. Ensure all key data points are retained but presented in a more entertaining way. Avoid markdown and stick to HTML tags like and . Make sure not to use any tags or colors. Also, confirm that the title is only in the tag and not repeated elsewhere. Finally, review for emojis and humor without overshadowing the original content. Ensure the HTML structure is correct and all necessary elements are included. Let me put it all together now.End of Thought (15.22s) Cardano vs. Tron: The Flippening Frenzy 🚀 (Spoiler: Whales Are Involved)

2025-11-13 02:17