Bitcoin’s Boring Dance: Will It Break Free or Nap Till 2024? 😴💤

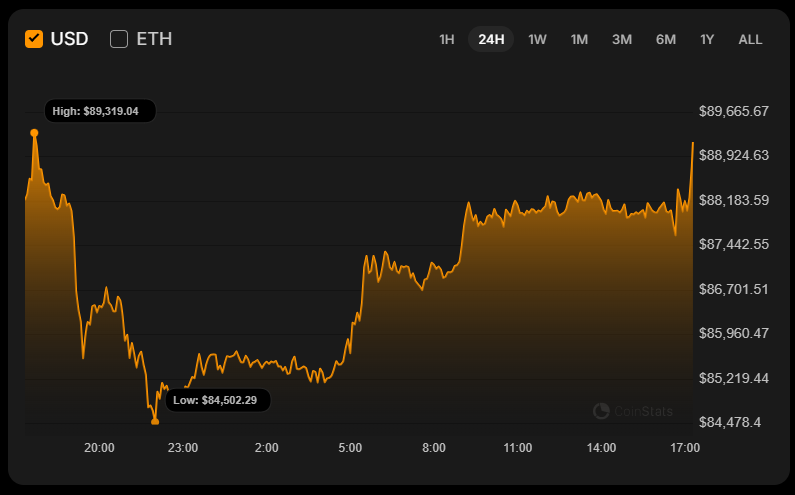

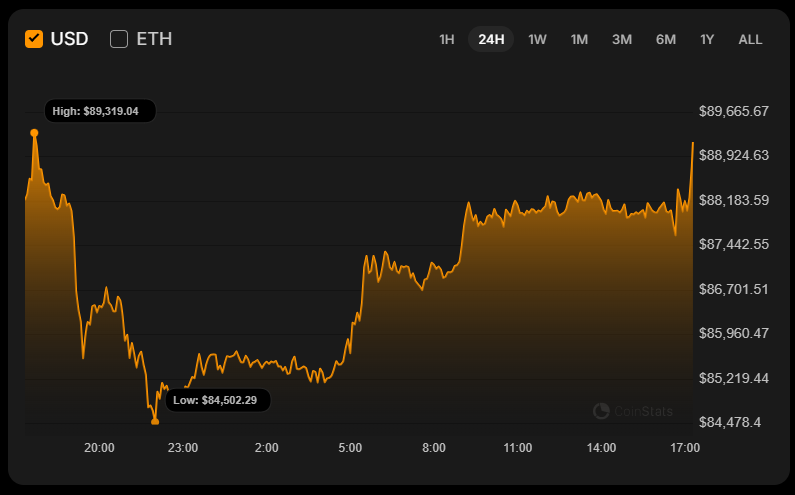

Bitcoin, the so-called king of the digital realm, has risen by a glorious 0.11% in the past day. Truly, a revolution in the making. 🤑

Bitcoin, the so-called king of the digital realm, has risen by a glorious 0.11% in the past day. Truly, a revolution in the making. 🤑

“Volatility? Pah! We’re as bullish as a bull in a china shop!” declared the analysts, led by the ever-optimistic Peter Christiansen, in their Friday report. 📈🐂

Lo! The bill now journeys to the Senate, that hallowed chamber where wisdom and bewilderment dance a perpetual waltz. Should it emerge unscathed, Poland’s financial sentinel, the KNF, shall wield dominion over crypto realms, a power both divine and dread. Yet one wonders: is this harmony with MiCA, or merely a masquerade? 🎭

Ethereum developers have finally given a proper name to post-Glamsterdam 2026, calling it “Hegota.” The name is a combination of Execution-Layer Bogota and Consensus-Layer Heze, and it is expected to arrive shortly after Glamsterdam in 2026. Good luck pronouncing it-my cat does it better. 😼

📉 Bitcoin’s RSI: The “I Give Up” Button for Traders. Historically tied to rallies? Sure. A reliable indicator? As dependable as a screen door on a submarine. 🚪

The native token of Hyperliquid, that paragon of decentralized perpetuals, has plummeted by a staggering 60% from its September zenith, a descent as dramatic as a falling star in a twilight sky. Yet, the crypto world, ever eager to anoint new kings, was convinced that Hyperliquid would not only supplant centralized exchanges but ascend to the heights of parabolic glory. 🚀

In a world where social media is basically the new official government briefing (we’re not joking), Sacks tweeted from his secret lair that a markup-because what’s more exciting than a meeting with bipartisan promises?-is scheduled for January. Mark your calendars, or don’t, because all you really need to know is that these guys are planning to slap labels on different crypto goodies: digital commodities (go CFTC!), investment contracts (hello SEC!), and stablecoins that are probably less stable than your aunt’s Wi-Fi. 📱

Its treasury, a fortress of Zetrix tokens, stands guard to ensure the blockchain kingdom runs like a well-oiled machine. ⚙️🛡️

In a move that screams, “Look at me, I’m transparent!” Ledn, one of the globe’s most prominent bitcoin lenders, has unveiled its Open Book Report. This document, as dry as a martini but twice as revealing, lays out the nitty-gritty of its BTC loan book, collateral levels, and loan-to-value ratios. The inaugural report boasts $868 million in outstanding loans, backed by 18,488 BTC, with every last satoshi verified by The Network Firm LLP. Because, you know, trust but verify. 🔍✨

The top crypto exchanges of December 2025 are closing out the year with such momentum, one might think they’re training for the Olympics of blockchain. Trading volumes remain high, liquidity improves like a well-aged wine, and platforms roll out new products faster than a meme coin’s price drop. 🎢