Bitcoin’s Demand Dwindles: Bear Market? 🚨

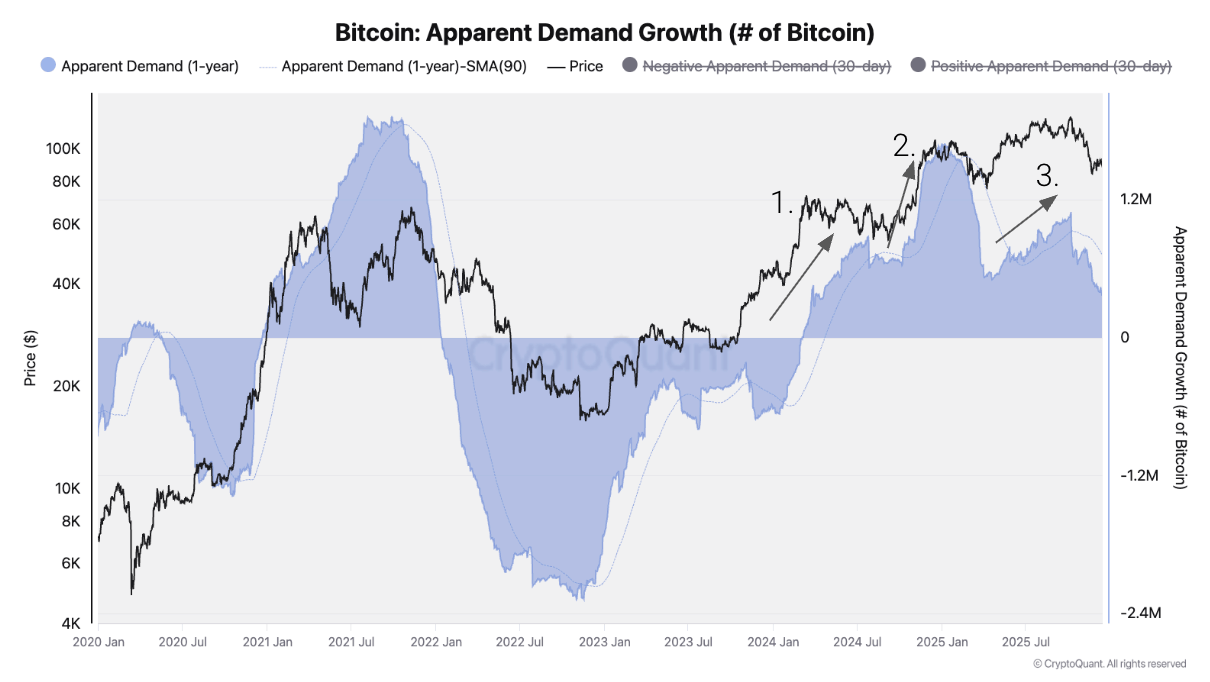

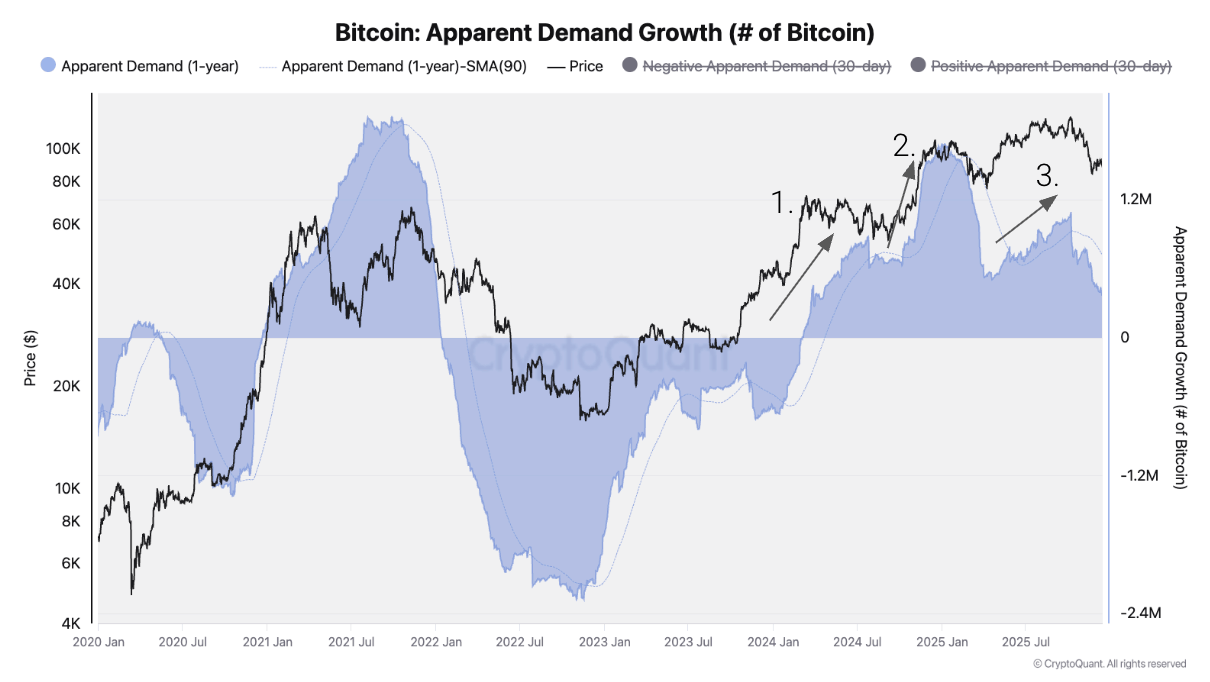

Cryptoquant’s latest report argues that most of this cycle’s incremental bitcoin demand is already in the rearview mirror, with growth slipping below its long-term trend since early October. 🚗💨

Cryptoquant’s latest report argues that most of this cycle’s incremental bitcoin demand is already in the rearview mirror, with growth slipping below its long-term trend since early October. 🚗💨

What a delightful shift! 🎉 A strategic pivot toward a faster release cadence, as if the blockchain world wasn’t already moving at the speed of light. 🚀

CryptoQuant’s data says Bitcoin’s latest party hat 🎉 has been on too long, and the buying power’s as exhausted as me after a Netflix binge. Apparently, the cycle turned in October 2025 when demand growth decided to take a nap. Zzz. 😴 No crash, no drama, just a slow fade into obscurity. How very millennial. 🌱

Solana and Ethereum-two old rivals squaring off like gunslingers in a Deadwood saloon. Solana, the spry upstart, keeps yapping about being the “Ethereum killer.” But is that just hot air? Let’s see if the cornbread lives up to the hype.

Lately, it’s become trendy to scoff at bitcoin’s four-year cycle and its predictable rollercoaster of boom and bust. 🤷♂️ But let’s be honest, fashionable people are often wrong. Just look at Crocs.

And yet-miracle upon miracles-it rose! From the shameful depths of $11.7, like Lazarus with a cold wallet, Chainlink now flutters near $12.5! Though, let us not celebrate too soon: down 8.78% this week, 9.25% this month-its investors weep into their overpriced coffee. ☕😭

The downward trend in inflation offers a glimmer of hope that the Federal Reserve may, oh, dare I say, consider lowering rates by the year 2026. We brave plural to 2026, no less! 🎭

A simple copy-paste mistake cost a cryptocurrency user $50 million in USDT. According to blockchain analytics platform Lookonchain, the incident involved a user identified as 0xcB80, who became a victim of an address-poisoning scam when he intended to transfer 50 million USDT.

While the prices boomed, the market was split like a game of “Spot or Nope,” with spot investors slipping away from trading decks faster than my pre-show prayer. But fear not! Leverage expanded like my waistline during the holidays, and perpetual futures traders were bullish as if they had two cafés instead of one: FRUIT! CAFFEINE FREE!

According to our brave hero Coinbase, these so-called prediction market contracts are just fancy derivatives, which, by the divine laws of Congress (and probably a few bedtime stories), belong to the mighty Commodity Futures Trading Commission (CFTC). The company argues, quite sternly, that those state regulators should mind their own business and let the federal folks handle it. Because, obviously, states trying to regulate? What a monumental fuss! 🚫🎲