2026 Crypto Chaos: Europe’s Digital Future Revealed! 🚀

Who can convert licences, pilots, and whitepapers into safe, scalable products that win customers and preserve capital? 🧩💰

Who can convert licences, pilots, and whitepapers into safe, scalable products that win customers and preserve capital? 🧩💰

A turbulent two-month tale has seen these losses sway like a pendulum, from $3.5 billion to nearly $4.2 billion, as ETH found itself lodged in a lullaby of $2.6K-$2.75K-a descent of some 40% that would even have the most stoic scribe brought to laughter, tears, or both. 😂

The price was going down, down, down – 18% this month! A disaster! But then, BAM! Penguins on a sphere and suddenly it goes up? I’m telling you, the market is irrational. Completely irrational. It’s like people just see a cartoon penguin and throw money at it. 🤦♂️

Here’s the TL;DR 🤓:

He noted, with the grave solemnity of a man reading a will at a family reunion, that Bitcoin was clinging to its 50-week moving average like a drunk uncle to a karaoke mic. But alas, it was only a matter of time. The price would slip to the 100-week MA-the financial equivalent of joining a book club-and possibly even plunge toward the 200-week MA, which sounds less like a trading indicator and more like a medieval torture device. 🔗📉

Now, this isn’t the first time Nvidia has played this game-three months ago, they did the same with another startup. It’s like they’re collecting competitors like Pokémon. 🎮

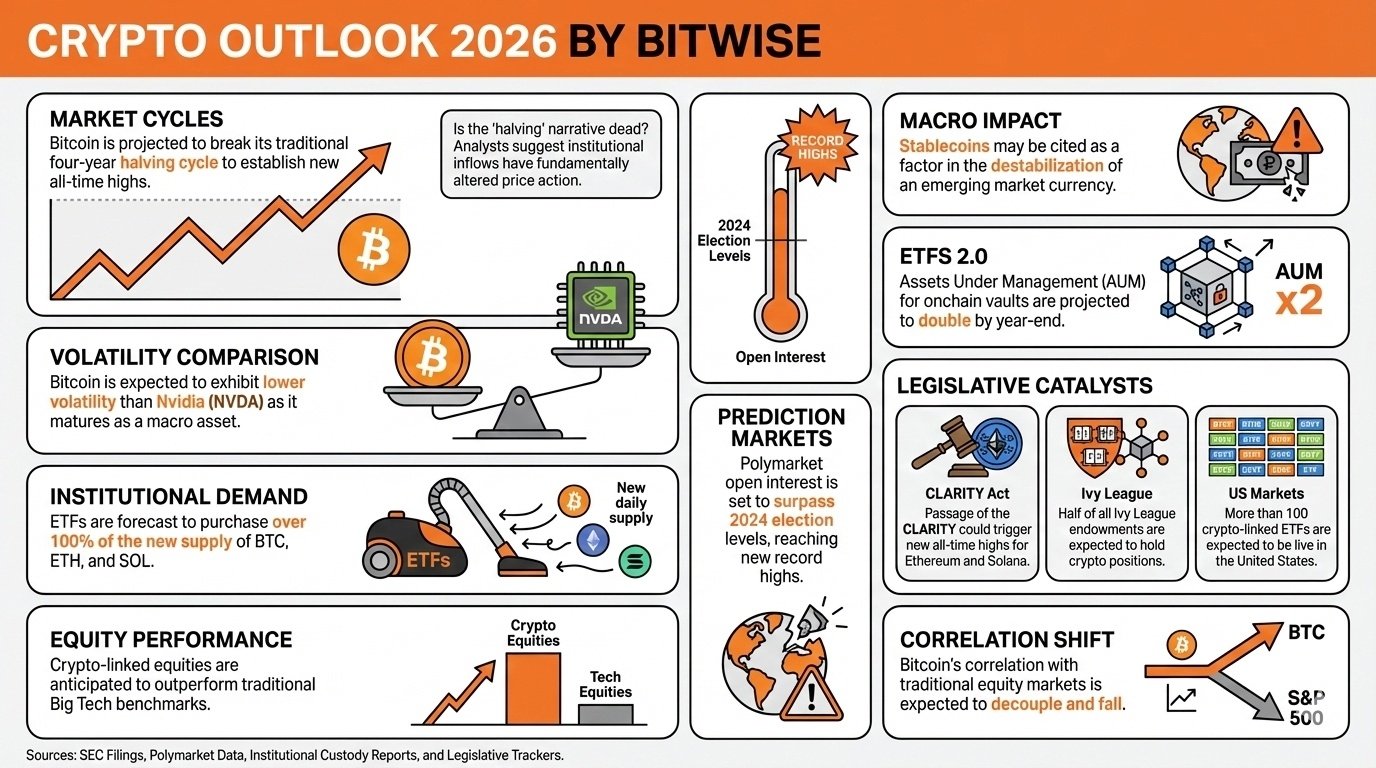

Bitwise Asset Management, that paragon of U.S. asset management, has published its “10 Crypto Predictions for 2026” report on Dec. 15, a document so bullish it makes a Siberian winter seem warm. Chief Investment Officer Matt Hougan and Head of Research Ryan Rasmussen, with the gravitas of Tolstoy dissecting peasant life, declare:

Yet, behold the irony! The Funding Rate, a sullen miser, sits deep in the red, whispering that the perpetual contract price lags behind the spot. Longs feast on funding, while shorts pile in like lemmings off a cliff. 🦵💥 Could this brew a short squeeze, or is it merely the market’s cruel jest? 🤡

The searches, executed on December 18th with the precision of a Swiss watch, fell under the Prevention of Money Laundering Act (PMLA). They descended upon the lairs of 4th Bloc Consultants and their dubious associates like a troupe of overcaffeinated ballet dancers. 🎩🐇

Arthur Hayes, co-founder of BitMEX, has been seen depositing Ether into exchanges with the grace of a man fleeing a dragon. On-chain data reveals a pattern so repetitive, it’s like watching a broken record play “sell, sell, sell.” Investors, ever the gullible, speculate he’s selling ETH with the fervor of a man who’s just discovered the Pope is a robot. But let us not forget-this is a strategy of portfolio rebalancing, a dance he’s performed before, like a conductor of chaos.