Whale’s $14.8M Bet: Will TRUMP Sink to $4.80? 🐋📉

This transfer signals capitulation, rather than profit-taking. Especially since the exit occurred far below the original entry price. What a delightful spectacle! 🎭

This transfer signals capitulation, rather than profit-taking. Especially since the exit occurred far below the original entry price. What a delightful spectacle! 🎭

Key Takeaways 🗝️

Joshua Dalton, founder of Triblu (an unfunded IT services company, natch), posted on X that XRP holders could become millionaires, billionaires, trillionaires, and even quadrillionaires. He said Bitcoin fans, like Michael Saylor, might as well be chasing rainbows. Meanwhile, XRP folks? They’re gonna strike it rich, by gum! 🚀

Now, picture this: Morgan Stanley’s suits are tellin’ their clients to toss some Bitcoin into their portfolios like it’s confetti at a parade. Even Grandma’s retirement fund might get a sprinkle of crypto magic. And let me tell ya, when the supply’s as fixed as a mule’s opinion, even a tiny nibble from these big players can send the price through the roof. 🏠💸

So, XRP’s been doing this downward spiral thing for a few weeks now-classic October vibes, right? Just when you think it can’t get any worse, it does. But guess what? Our big-time investors are starting to show some positive vibes. It’s like watching a soap opera; you think it’s over, then BAM, plot twist! 🎭

At the heart of this despair, WPA Hash appears-like a benevolent yet slightly mischievous deity-claiming to transform those boring passive holdings of BTC, XRP, and SOL into income-generating, perhaps even laughable, assets. Through hashrate-based participation models, it dares to promise stability in this chaotic sea of volatility.

“Midnight’s gonna be the Manhattan Project of PET, Chain Abstraction, and Smart Compliance,” he declared, then cackled, “2026’s body ain’t ready!” 🧪💥

As we meander into the year two-thousand-and-twenty-six, our bet-loving denizens-not to be outdone by the swift-footed Agatha Christie novel protagonists-consider clopping along on platforms that leverage cryptocurrency, which, blinking and gasping like a newborn digital babe, are laden with convenience, safety, and effectiveness. Picking the right digital coin becomes akin to choosing the most dapper waistcoat for the shindig, both improving the pace and the affordability of transactions with enough finesse to make a veteran auctioneer swoon.

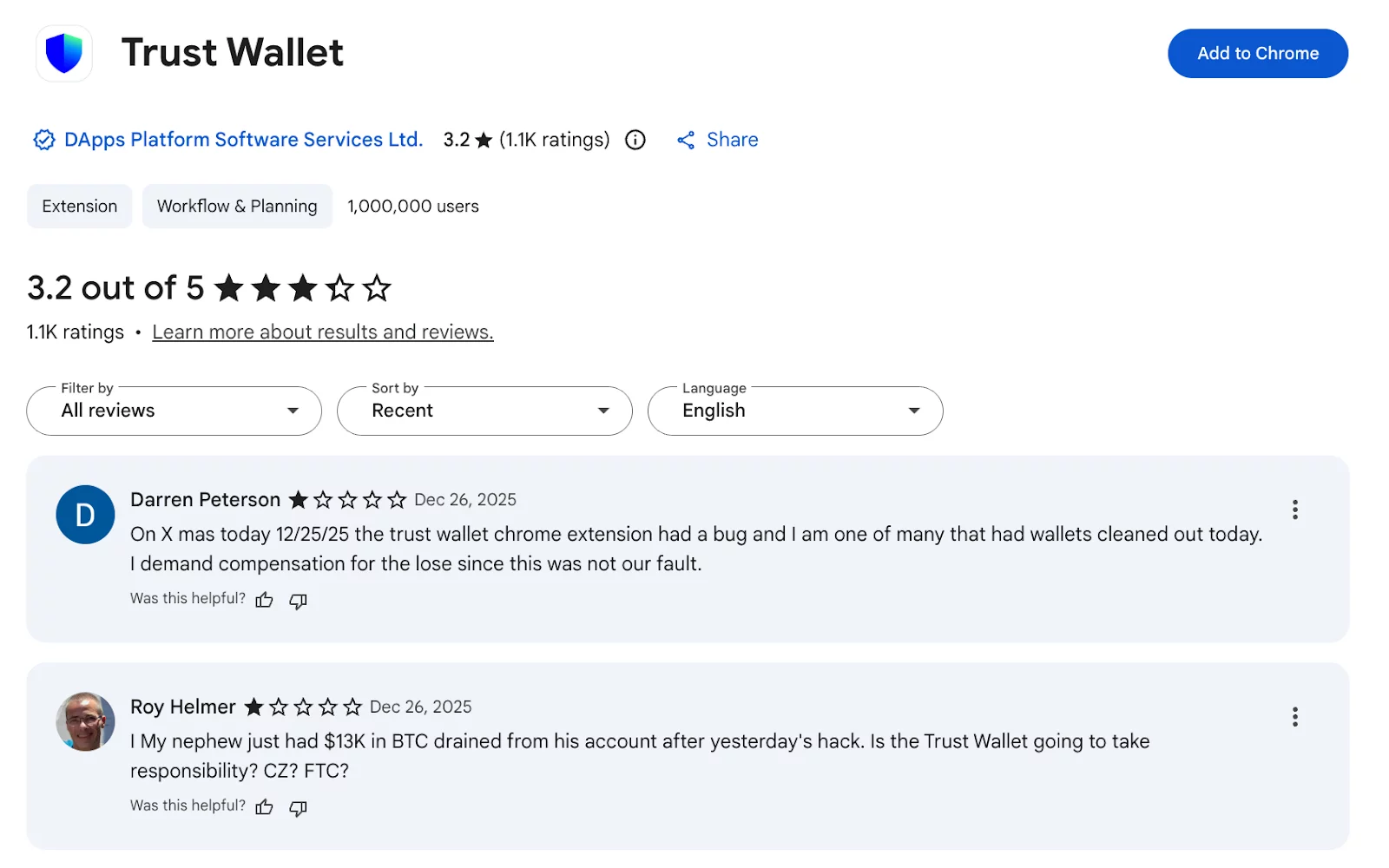

Our dear friend, the on-chain detective ZachXBT, was the first to sniff out the trouble-reporting unauthorized outflows while Trust Wallet was still blissfully unaware. Quite charming that they didn’t bother to comment before the ink dried, but perhaps they were too busy crafting a convincing excuse. Meanwhile, a staggering $6 million has skedaddled out of user wallets-charming in its own sad way.

Mike Novogratz-yes, that slightly mysterious figure from Galaxy Digital-says he’s not exactly convinced that the secret sauce in XRP’s recipe is big institutional piles of cash. No, apparently it’s its passionate community that’s the real hero here. The so-called “XRP Army” has somehow managed to carry this digital token through more market ups and downs than your average roller coaster, even while Bitcoin gets all the flashy headlines and ETF attention.