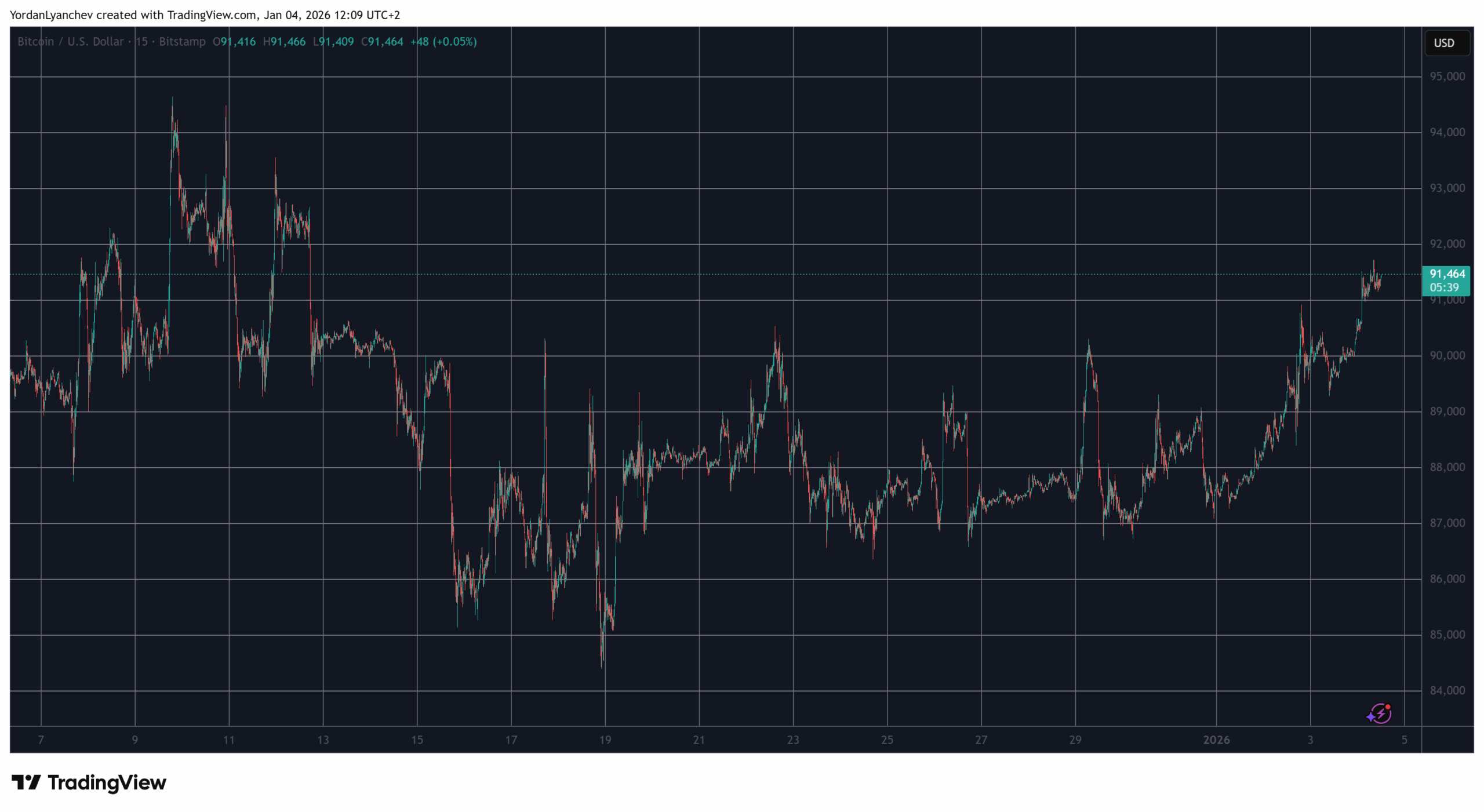

Cryptic Whales, XRP’s Liquidation Masquerade & Bitcoin’s $100k Waltz: 2026’s Sunday Spectacle!

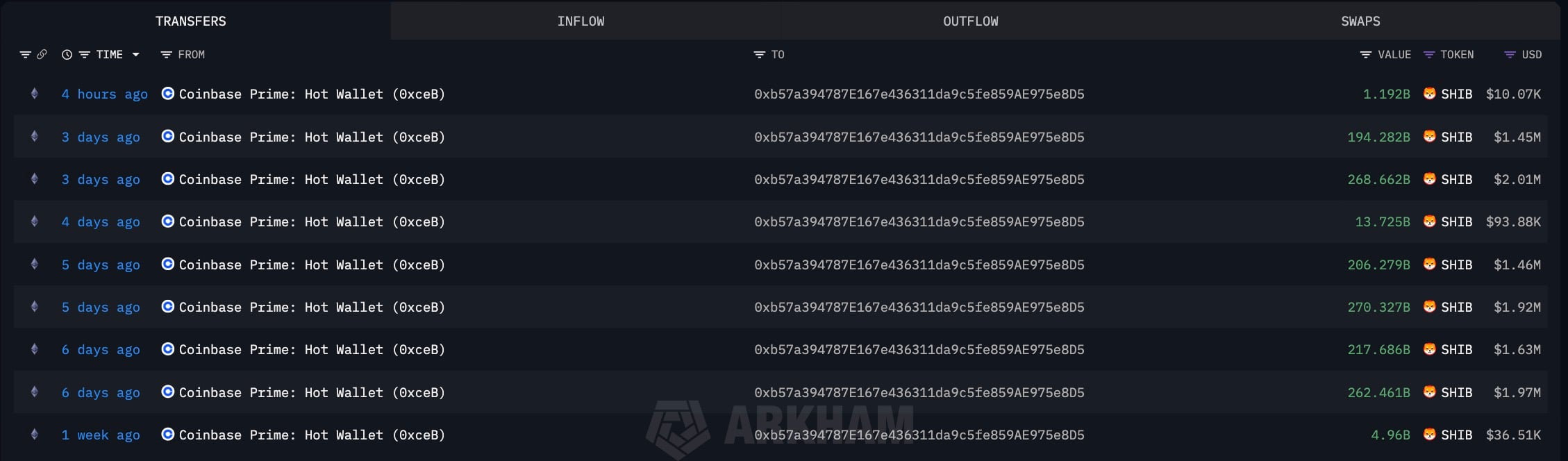

SHIB, that mischievous little token, decided Sunday afternoon was the perfect time to play hide-and-seek with Coinbase’s hot wallet. Nine transfers, one address (0xb57), and 1.439574 trillion SHIB later, we have a new whale in town. At $0.0000087 per SHIB, this haul is worth $12.58 million-enough to buy a small island, or at least a very expensive hat.