Bitmine: The ETH Hoarder with a Calculator and a Dream 😎💰

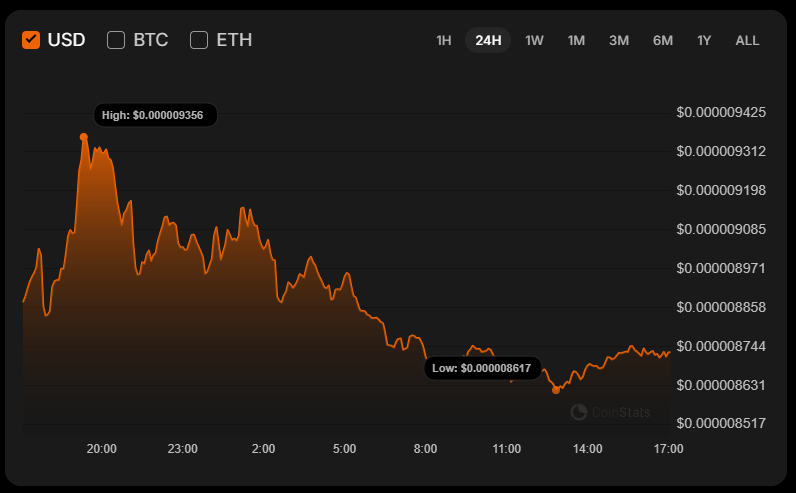

Bitmine Immersion Technologies announced on Monday that their total assets-crypto, cash, and equity-now sit at a cool $14.2 billion. Their ethereum stash alone is 4.144 million ETH, which is roughly 3.43% of the circulating supply. Fun fact: they’re basically the Oprah of ETH-“You get some ETH, and you get some ETH, and YOU get some ETH!” 🎁