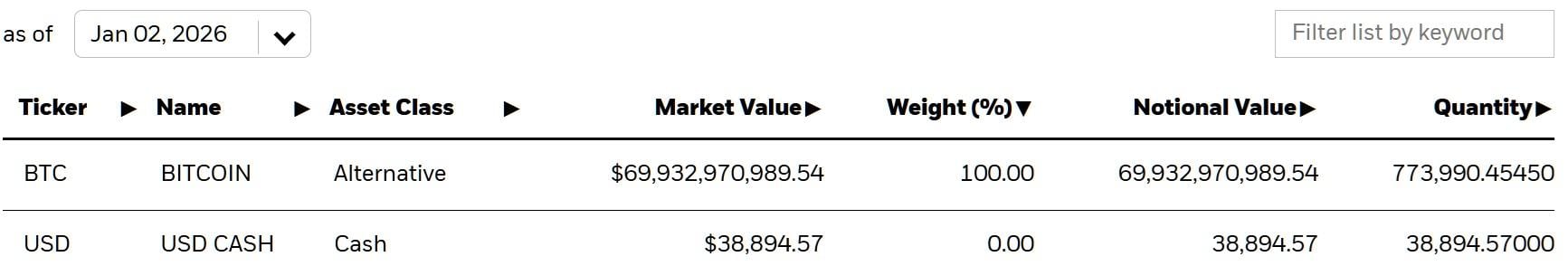

America’s Bitcoin Reserve: Sold, Not Stored!

According to a recent report by Bitcoin Magazine, the U.S. Marshals Service (USMS) may have sold Bitcoin forfeited by the developers of Samourai Wallet, even though an executive order says such Bitcoin should be held, not sold. Because nothing says “strategic reserve” like a last-minute sale to a crypto exchange. 🚀