Bitcoin’s Wild Ride: Will It Crash or Soar? 🚀

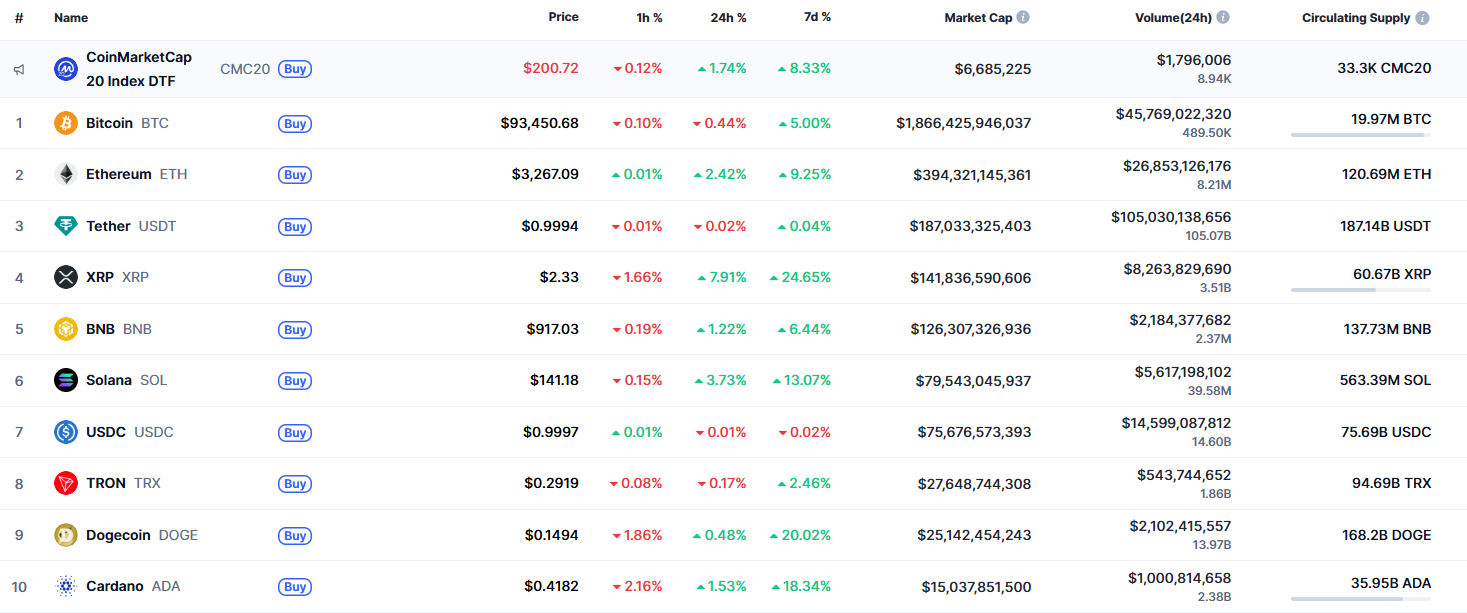

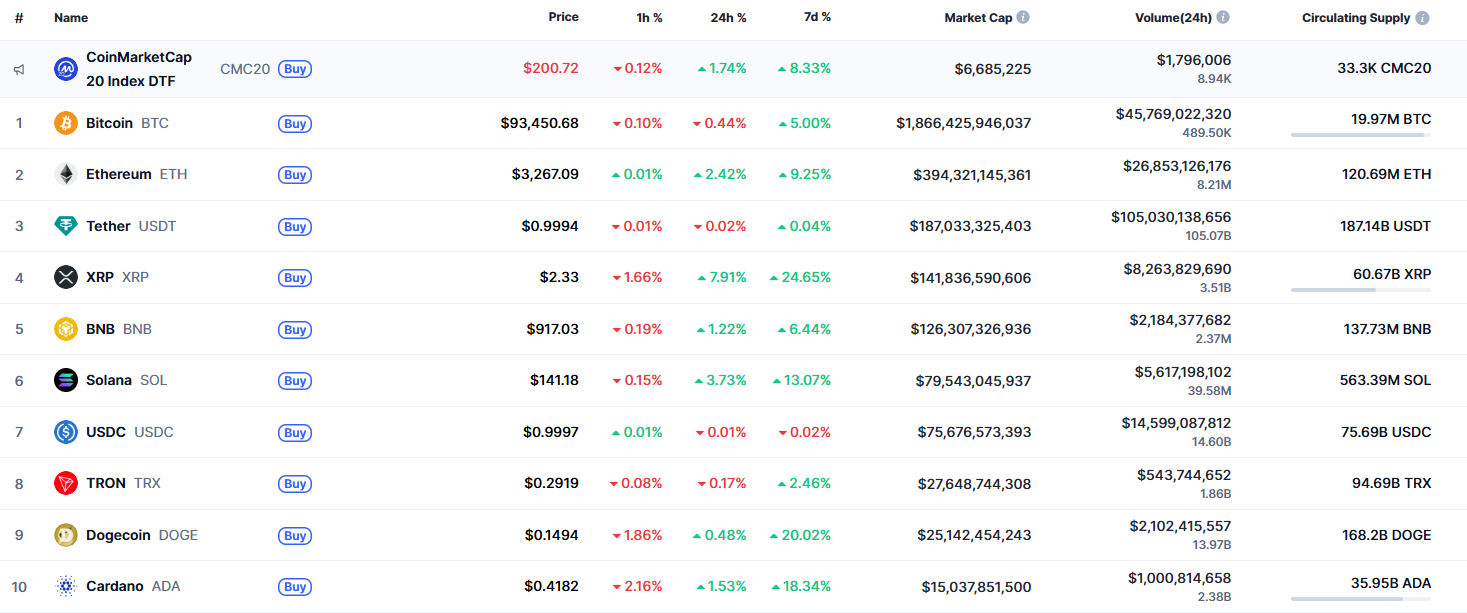

Bitcoin, that most obstinate of cryptocurrencies, defies the trend, plummeting 0.44% in the past day-proof that even the most resilient can falter. 🐢

Bitcoin, that most obstinate of cryptocurrencies, defies the trend, plummeting 0.44% in the past day-proof that even the most resilient can falter. 🐢

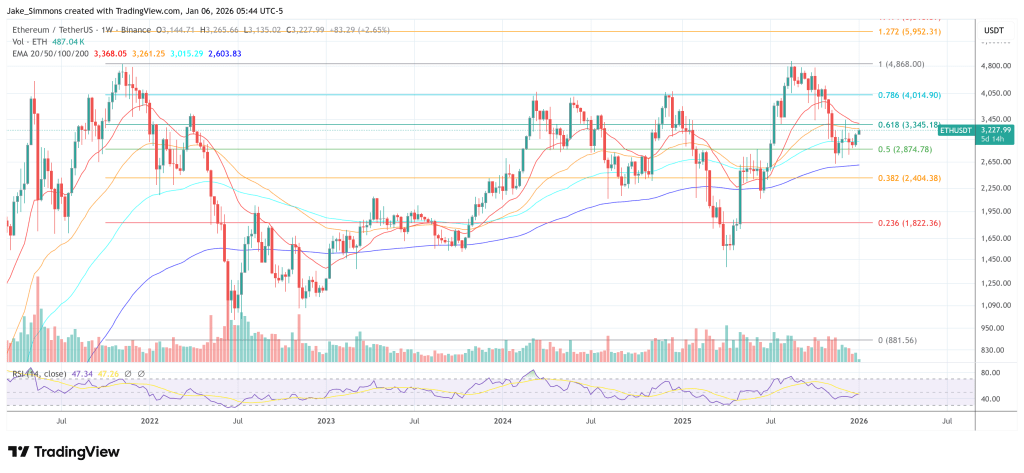

In a post as scintillating as a Coward cocktail, Raman declares 2026 the year Ethereum transitions from a credibility build to a commercial deployment era. “From 2026 onward,” he trills, “Ethereum will become the best place to do business,” as regulatory posture, institutional precedent, and infrastructure maturity converge. How utterly spiffing! 🎩✨

This triumph follows the firm’s recent Form 8-A filing with the U.S. SEC, a document as enigmatic as a Mr. Darcy’s gaze. With assets under management akin to a wealthy estate, Bitwise continues to expand its reach in the realm of regulated altcoin ETFs. 🏛️💰

As the price ascends, the traders, those modern-day prophets of the blockchain temple, fixate on the horizon, where resistance looms like a fortress of stone. Will the walls hold? Or shall the tide of greed crash against them, leaving only ruins in its wake? The 21-Day Moving Average, that ancient oracle, has been tested, and the serpent, ever cunning, has slithered back, its tail coiled around the 0.035 BTC mark.

According to the wise folks at Santiment, this grand feast of the whales while the minnows bail is a sure sign of more upside. 🌕 Or, as the Ankh-Morpork Stock Exchange might put it, “When the big fish buy, the market’s gonna fly!” 🚀

Grayscale announced that its Ethereum Staking Exchange-Traded Fund (ticker ETHE) will make a distribution of $0.083178 per share to shareholders, reflecting proceeds from staking rewards earned between October 6, 2025 and December 31, 2025. The payout is scheduled for January 6, 2026, based on share ownership as of the record date on January 5, 2026. Because nothing says “I care about you” like waiting almost a year for a snack. 🐢⏳

It’s been nearly two years since the first spot Bitcoin ETF strutted onto the American stage, and already the air is thick with competition. Morgan Stanley, ever the latecomer to the revolution, now seeks to dip its gilded fingers into the crypto pie. Reuters, that trusty herald of the financial world, tells us the winds have shifted since Trump’s return to power. Suddenly, crypto is no longer the devil’s plaything but a golden calf to be worshipped. Hallelujah! 🙏

Key Takeaways (Because Everyone Loves a Checklist, Right?)

In a jolly X post, SMQKE let slip that SWIFT, once as risk-averse as a chap with a umbrella on a sunny day ☂️, is now eyeing cryptocurrencies like XRP as the regulatory fog lifts. He pointed to a rather dusty document featuring the former SWIFT CEO, Gottfried Leibbrandt, who once claimed crypto was as uncertain as a Bertie Wooster scheme. But times, my dear reader, are a-changing! ⏳

The trades at the decentralized perpetuals exchange, Lighter, have seen its currency, the LIT, ascend by more than 18% this Monday, in a manner reminiscent of a young lady ascending the ranks swiftly in a country ball. Indeed, the zealous speculation runs rampant that the platform may have engaged in a token buyback programme.