🚀 BitMine Splurges $105M on ETH – Who’s Counting?

Our brave titans of finance, BitMine, kicked off the year not with resolutions, but with a digital gold rush. 🎰 Why save for retirement when you can buy Ether and pray to the blockchain gods?

Our brave titans of finance, BitMine, kicked off the year not with resolutions, but with a digital gold rush. 🎰 Why save for retirement when you can buy Ether and pray to the blockchain gods?

Remember when XRP went from 0.0000179 BTC to 0.0001740 BTC in 120 days? That’s like a toddler learning to ride a bike-unstable, but so thrilling. 🚲 And guess what? It even outpaced Ethereum! 🤯 (But let’s be real, Ethereum’s just a slowpoke.)

In a sermon delivered to CNBC’s flock, Jeffery intoned, “The weakness? Merely a fleeting shadow. A temporary torment of the crypto soul!” He anointed Circle and Coinbase as his chosen vessels, their fates entwined with Bitcoin’s “immature” ambition-a nascent, trembling creature of finance with a paltry $1.9 trillion market cap. 🌱👹

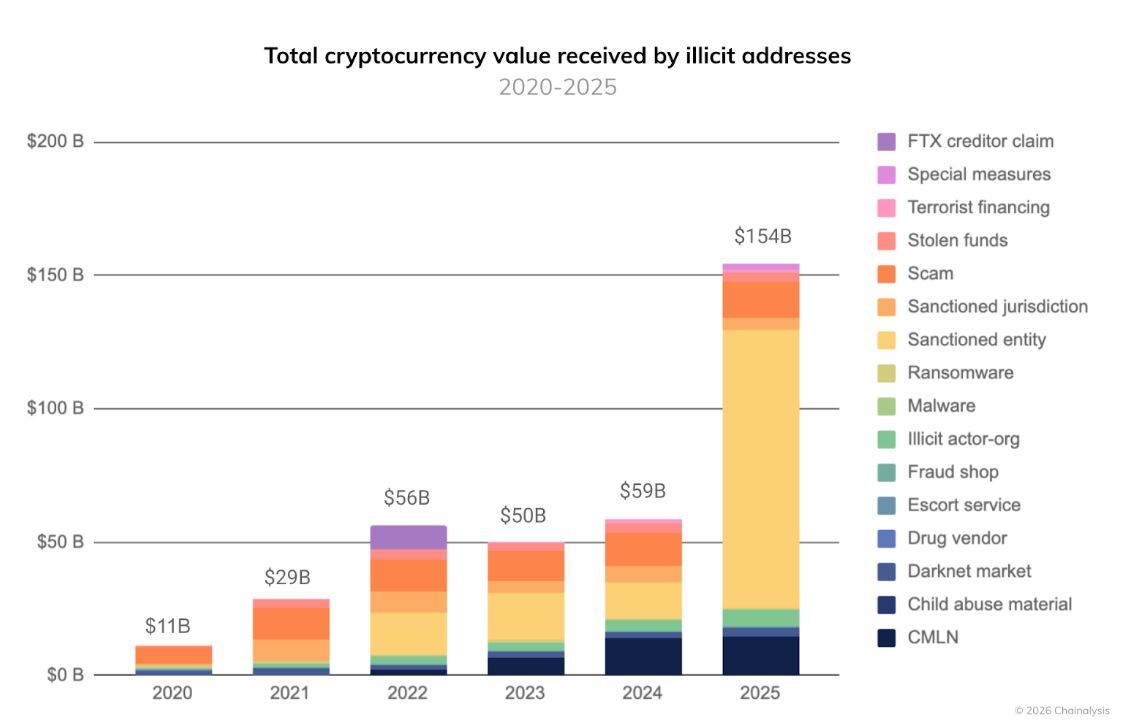

According to the ever-watchful eyes at Chainalysis, this shindig represents a 162% increase from 2024. Apparently, crypto crime is the only sector that’s not complaining about inflation. 📈 It’s booming across the board: scams, hacking, money laundering-you name it, they’ve got it. It’s like a criminal buffet, but with fewer finger sandwiches and more stolen Bitcoins.

While the market weeps and wails, its bearish tears flooding the altcoin streets, Ethereum stands firm, a stoic hero testing the very fabric of higher timeframe support. Oh, the irony! As the masses flee, it whispers, “I shall endure.” 😏

In a move that’s about as surprising as a wizard pulling a rabbit out of a hat, Solana Mobile has announced the launch of its SKR token on January 21, 2026. Yes, you read that right-2026. Apparently, the future is taking its sweet time. ⏳

In what can only be described as an announcement that rivalled the grandeur of a town square meeting, Governor Gordon waxed lyrical about the stablecoin’s noble purpose. It’s a fiat-backed creature, fully backed by the treasures of the realm – or rather, by public coffers – it was said. Quite a feat for the Good Natured State.

James Wynn is making headlines today because, apparently, 25x leverage isn’t enough of a thrill for him unless it’s on Ethereum. He locked in $87,594 in Bitcoin profits before diving headfirst into ETH. Oh, and let’s not forget his $172k floating profit from his $PEPE position. This guy’s portfolio is more aggressive than my ex-wife’s lawyer. 💼💥

It seems Bitmine’s traded in coolin’ computers for accumulatin’ digital assets. A curious pivot, if you ask me. But who am I to judge? They’re makin’ a spectacle of it, at any rate.

Now, let us speak of this wondrous contraption known as the “Fear & Greed Index.” A creation of Alternative, it serves as a barometer of sorts for the average trader’s emotional weather in the bustling bazaar of Bitcoin and its cryptocurrency kin. It endeavors to decipher the mental gymnastics of investors using five curious factors: trading volume, volatility (a charming little rascal), market cap dominance, social media sentiment, and Google Trends-yes, indeed, those very trends that decide the fates of many a hapless soul.