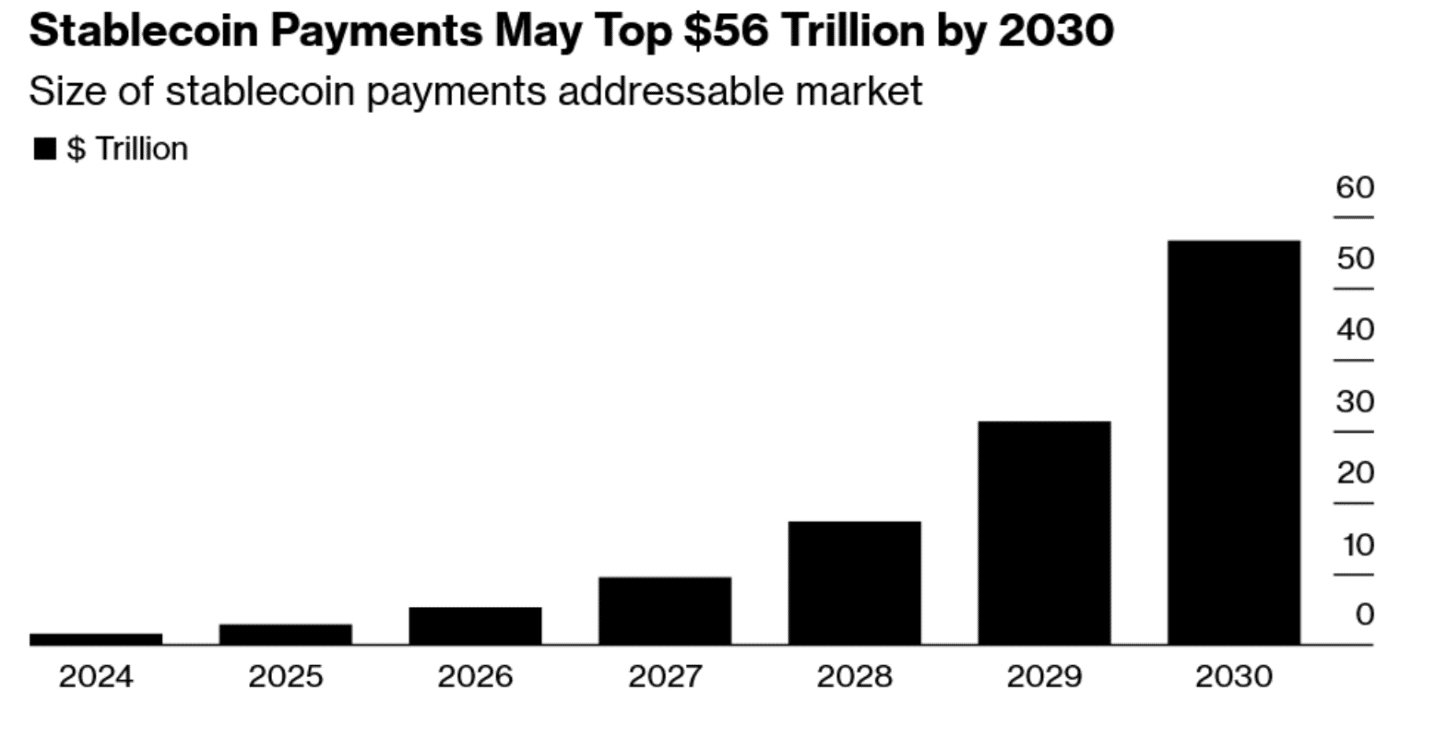

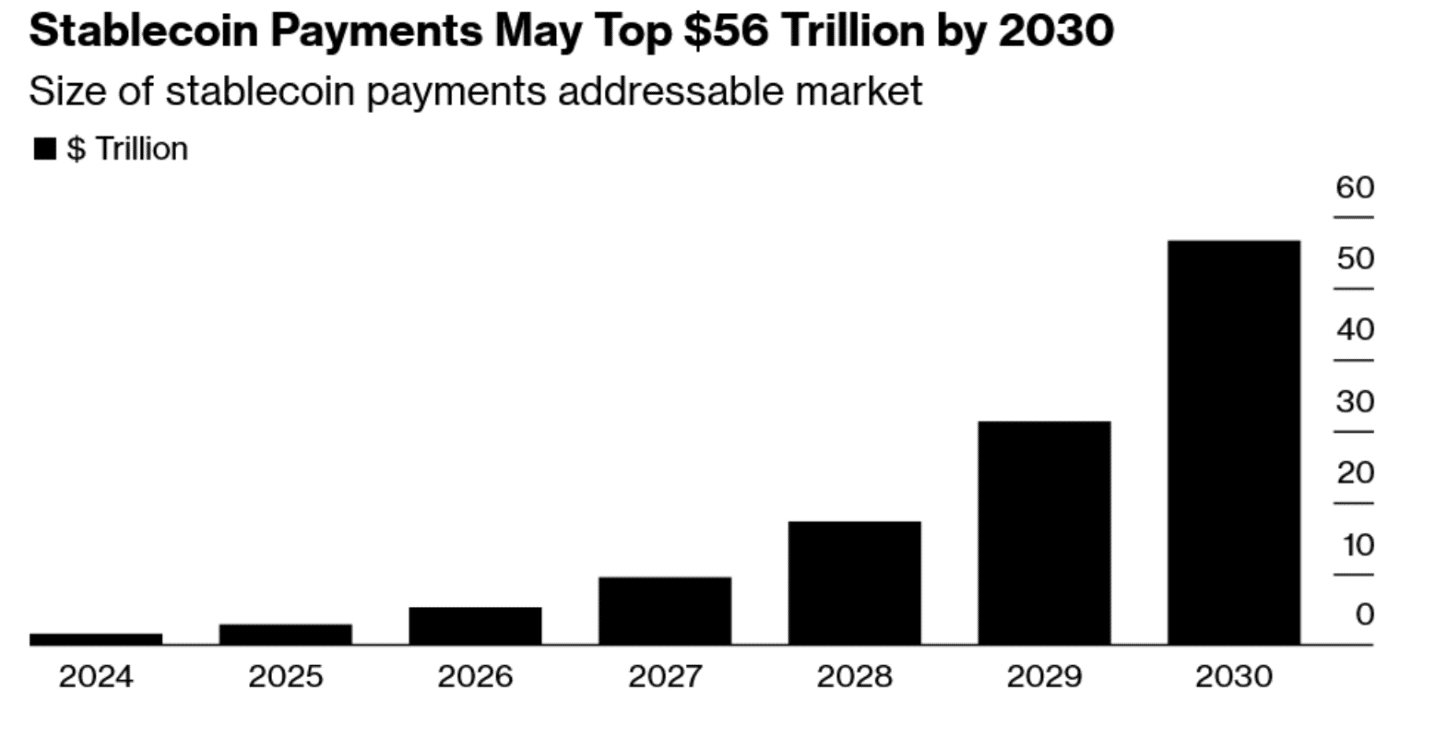

Stablecoins: $56T by 2030?!

By 2025, the numbers had already reached $2.9 trillion, a growth rate so steep it would make a rollercoaster blush. Eighty percent annual growth, a feat that would make even the most ardent capitalist weep with joy. 🎉📈

By 2025, the numbers had already reached $2.9 trillion, a growth rate so steep it would make a rollercoaster blush. Eighty percent annual growth, a feat that would make even the most ardent capitalist weep with joy. 🎉📈

In the land of the free and the home of the brave, the mighty Donald Trump hath spoken with a voice of thunder. “No pardon for thee, Sam Bankman-Fried!” he proclaimed, his words echoing through the marble halls of power. The former CEO of FTX, once a prince of the crypto realm, now lies in the dust, his dreams of clemency shattered like a cheap porcelain vase. 🏛️💔

In a display of judicial prowess worthy of a daytime courtroom drama, South Korea’s Supreme Court announced, with gusto, that Bitcoin on exchanges can be seized under the Criminal Procedure Act. Cue dramatic music. The stage was set with Mr. A, subject of a gripping money laundering plot, and his trove of 55.6 Bitcoins. Spoiler alert: It didn’t turn out well.

There’s a level of degeneracy in the crypto world that even the most weathered riverboat gambler couldn’t top-emotions, morals, and ethics often seem as useful as a chocolate teapot. Polymarket, however, while not entirely the boxing kangaroo from a previous sentence, provides ample material for raillery regarding its individualistic allure.

Now, let us not get too carried away; this expiry is rather reminiscent of last week’s orchestrated event, where derivatives trading ambled along at a pace more suited to a tortoise than a hare. As such, one would be wise to temper expectations of any dramatic upheaval in spot markets. In fact, nothing says excitement like the sound of crickets chirping in unison with our beloved crypto market! 🎶

According to SoSo Value’s data, U.S. Spot ETFs witnessed $729 million in outflows on Tuesday and Wednesday – a financial exodus that would make even a fleeing tsar blush. The market’s descent? A tragicomedy of errors, where hope and hype collided in a cloud of digital dust. 😂

On this fateful Wednesday, John Snyder, a man of questionable sanity, unveiled House Bill 1039, a document so convoluted it could make a philosopher weep. The bill, with its grandiose promises of hedging against inflation and securing the future, is but a mirage in the desert of economic uncertainty. 🧠🌀

The prediction markets, those modern-day soothsayers, are wagging their tongues like a pack of gossiping aunts. 🧙♂️💸

The official blog post, penned with the solemnity of a prophet, declares that “Optimism earns revenue from the Superchain,” a statement as profound as it is enigmatic. 📜 The Superchain, that labyrinth of L2 chains, including Base and Unichain, all contributing their share to the grand treasury. A veritable feast for the foundation’s coffers. 🍽️

Our esteemed Governor Mark Gordon, with a flourish of his quill, proclaimed that FRNT is “the first fiat-backed, fully-reserved stable token to be issued by a public entity in the United States.” One must applaud the nearly ten years of legislative preparations that hath birthed this marvel, with over 45 blockchain-related laws passed since the glorious year of 2016! 📜