Trump’s Tariff Tango: Will Bitcoin Do the Salsa? 🎶💰

BREAKING: President Trump announces 30% tariff on the European Union and Mexico.

BREAKING: President Trump announces 30% tariff on the European Union and Mexico.

Ripple’s stealing the spotlight again, Ethereum’s cozying up to corporate giants, and the Fed might need some therapy after all this drama.

Amidst the fretting, crypto analyst Dr. Altcoin steps forward with the kind of optimism usually reserved for someone hoping their lottery ticket might actually win. He postulates that these delays are mere threads in a grand tapestry, one that might just shield Pi’s future from the stormy seas of market chaos.

According to the updated settlement portal, the company will provide this compensation to those who were affected by the cybersecurity attack, which occurred in February 2024. One can only imagine the countless hours of anxiety and frustration that ensued as hackers merrily danced through Prudential’s systems, making off with sensitive information such as names, dates of birth, account numbers, Social Security numbers, driver’s license numbers, addresses, phone numbers, and email addresses 📝.

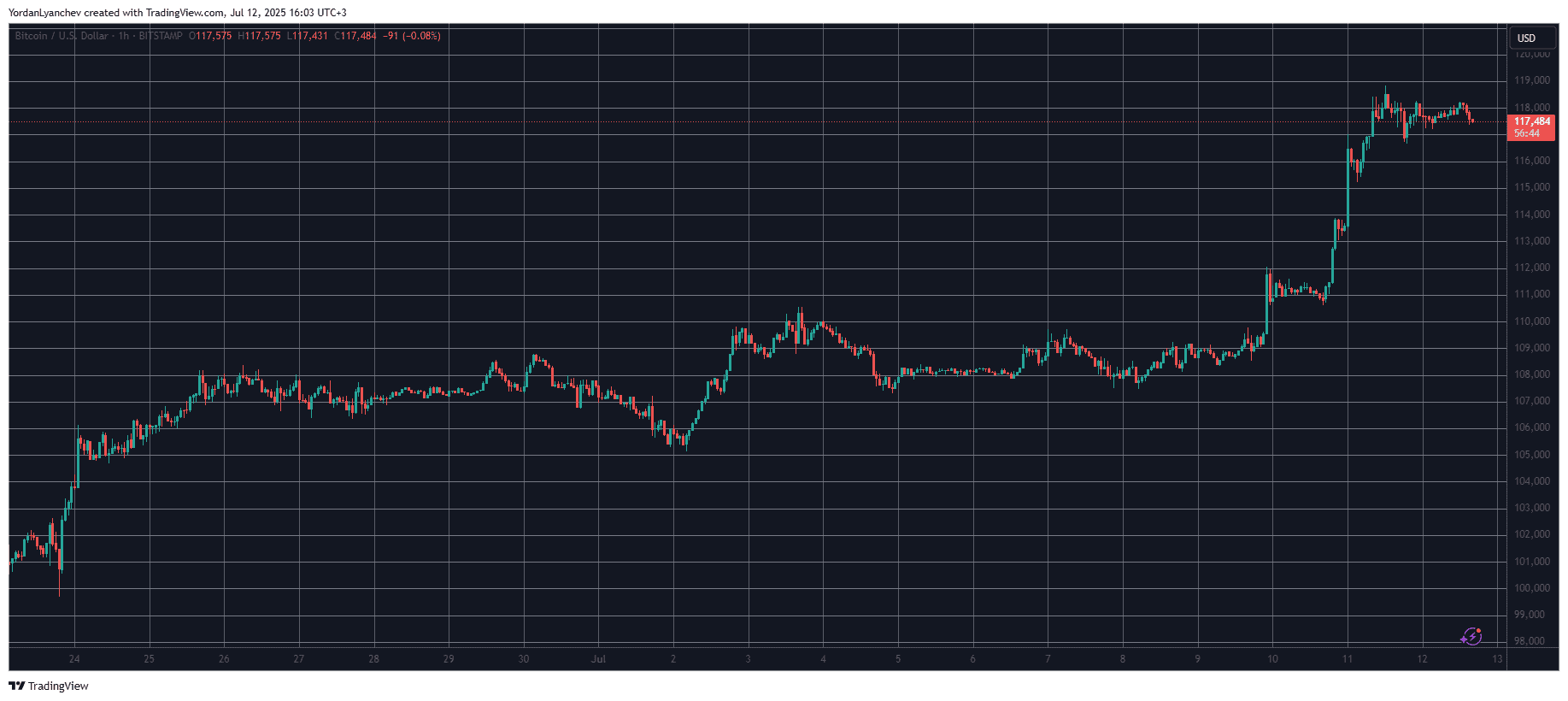

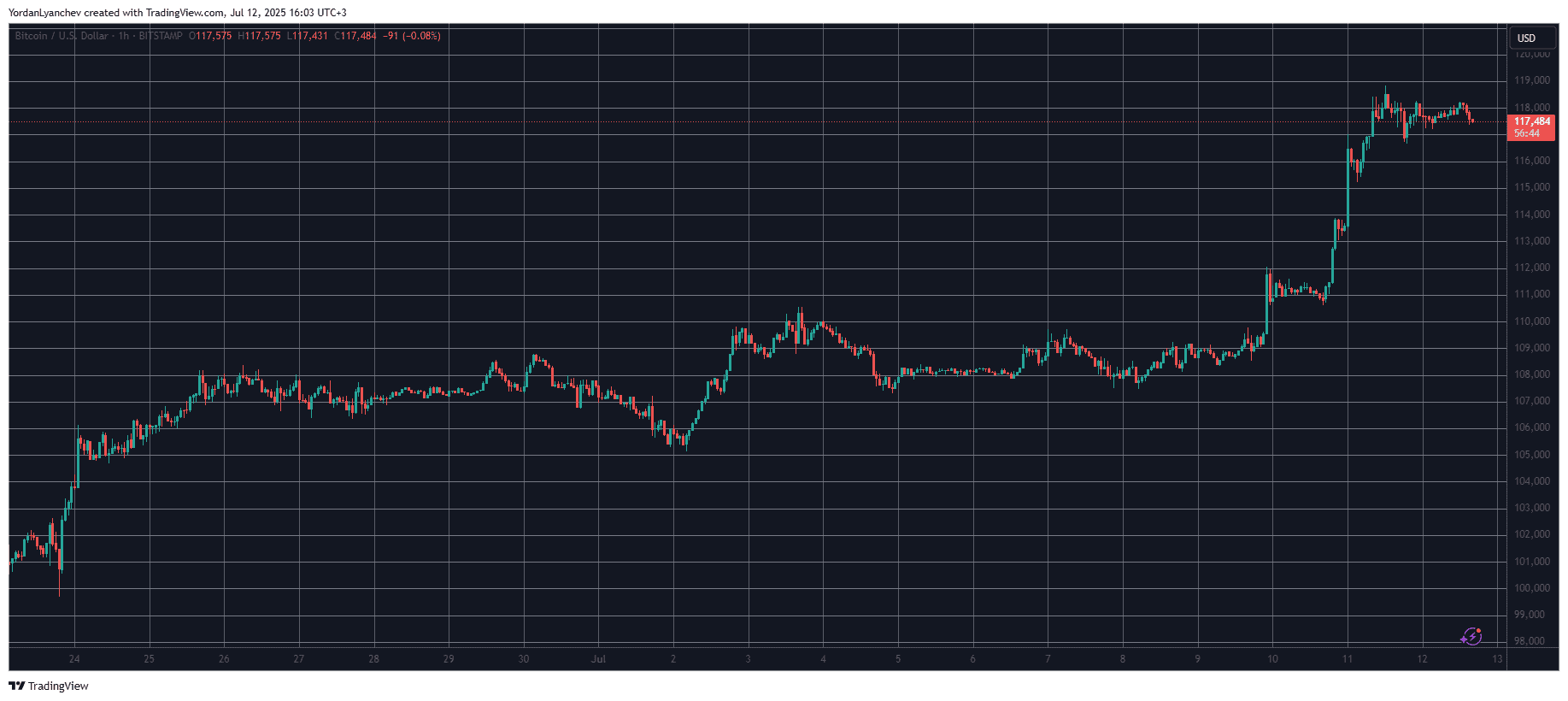

As the price frolics near its lofty heights, analysts, with an alarming enthusiasm resembling that of a schoolboy in a sweet shop, now gaze longingly towards the ambitious target of $135K. It appears our dear Bitcoin market is preparing for a monumental shift—stay with me as we delve into the reasons therein—if you can bear the suspense! 🎢🌟

Among these magical tokens, Virtuals Protocol, Ethena, and Dogwifhat stand out like the Oompa-Loompas of the crypto world, ready to deliver the goods. Let’s dive into the enchanting world of these tokens and see what makes them tick. 🎩✨

YZi Labs, a global investment firm with a $10 billion portfolio across web3, AI, and biotech, announced its support for 10X Capital’s latest initiative: the launch of the BNB Treasury Company. This new U.S.-based firm will focus on BNB asset accumulation and ecosystem support, with plans to pursue a public listing on a major U.S. stock exchange.

At the epicenter of this legislative maelstrom are three major proposals, each a veritable tempest in its own teapot. The GENIUS Act, having already secured the Senate’s seal of approval, is on the cusp of becoming the nation’s first law to govern the enigmatic world of stablecoins. This act seeks to establish a clear and coherent framework for the issuance and oversight of these digital tokens, thereby providing the sector with the long-sought-after legal certainty it so desperately craves. Complementing this is the CLARITY Act, a legislative marvel designed to resolve the jurisdictional quagmire that has long plagued the relationship between the SEC and the CFTC, delineating with surgical precision the regulatory boundaries of each.

In a spirited rebuttal on X, Zhao branded the article a “hit piece (sponsored by a competitor)” riddled with “so many factual errors” that he “doesn’t even know where to begin.” With a hint of a smile, he added, “Might have to sue them again for defamation.” 📜

They’re saying RLUSD is going to be the hero of the $685 billion remittance market, which is like saying it’s going to be the new black, but for money. 🤑