Bitcoin’s Blushing Bride: Roxom

Roxom, those San Francisco scallywags, claim their exchange will “reflect the Bitcoin white paper’s original vision of a global, permissionless store of value.” How frightfully noble of them, don’t you agree, dear? 🙏

Roxom, those San Francisco scallywags, claim their exchange will “reflect the Bitcoin white paper’s original vision of a global, permissionless store of value.” How frightfully noble of them, don’t you agree, dear? 🙏

Believe it or not, this EU regulatory package has been in effect for almost 200 days, and guess what? A bunch of prominent exchanges have decided to set up shop in Europe. It’s like a crypto renaissance! 🌱

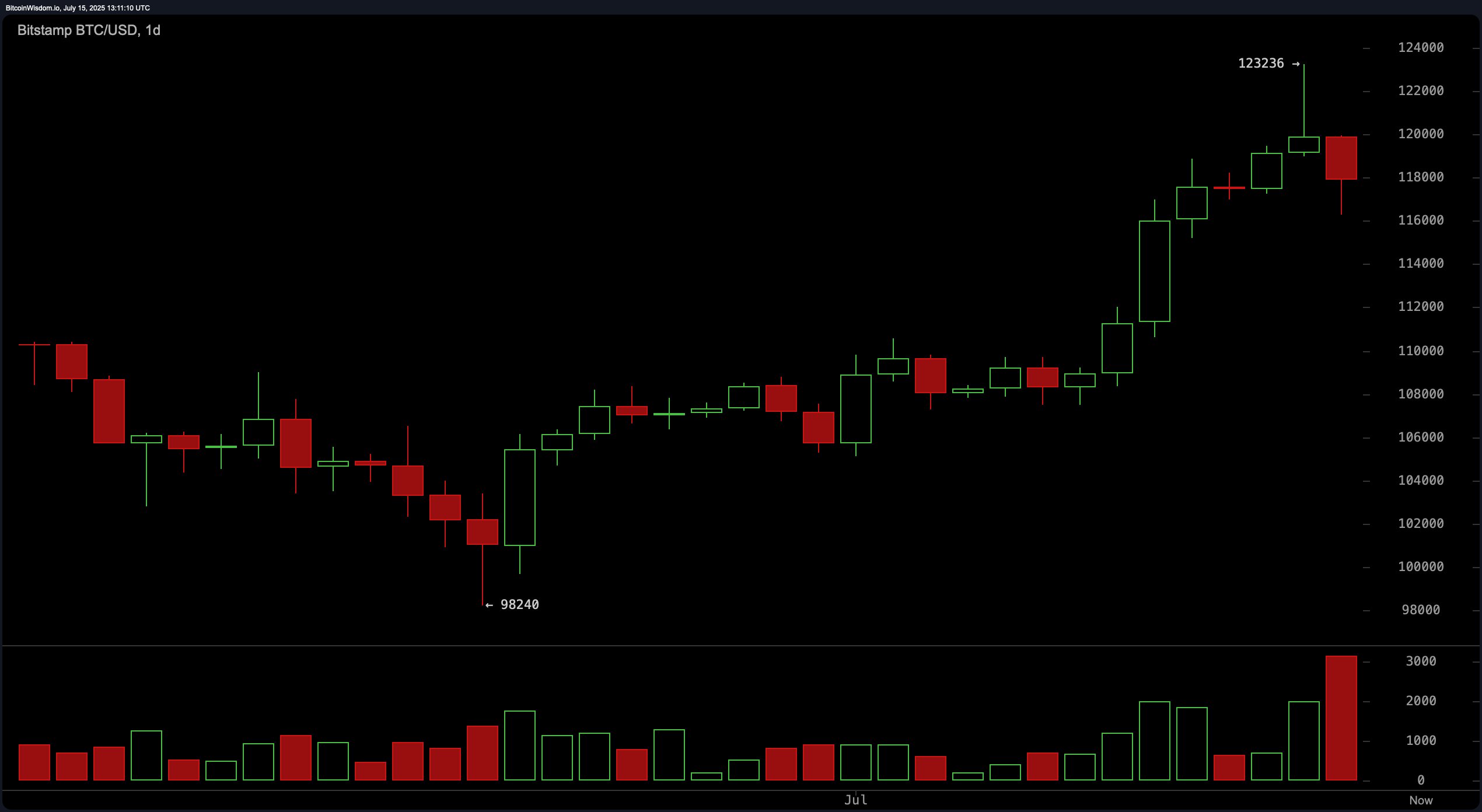

On the daily bitcoin chart, the recent bearish engulfing pattern indicates a potential reversal following a parabolic rally. This high-volume bearish candle signals panic selling or institutional distribution, with a confirmed key support level at approximately $116,000. The critical resistance stands near $123,236, the recent wick top. If bitcoin breaks below the $115,000 mark on significant volume, downside targets could extend to $112,000 or even $109,000. Conversely, a bounce from the $115,000–116,000 zone could warrant long entries if volume subsides and stabilizes. 🐻📉

In a thrilling exchange with CryptoMoon, a Ripple spokesperson casually dropped the news that they aim “to become MiCA-compliant,” as if getting a stamp of approval from the EU was as easy as obtaining a library card. It’s like they discovered a “significant opportunity” in Europe—much like I discovered that croissants taste better in Paris! 🥐

Circle’s spectacular IPO debut in June saw its stock surge over 500% since its NYSE listing, proving there’s major investor appetite for crypto-related public companies. It seems Grayscale wants to follow that success story, and who can blame them? After all, who wouldn’t want to be the belle of the crypto ball?

This move marks Bit Digital’s grand shift from its Bitcoin mining roots to becoming a dedicated institutional Ethereum holder and staker. Oh, the drama! In June, the firm revealed it had been accumulating ETH since 2022, a secret well-kept, one might say. 🤫

“If you don’t see the irony here, I don’t know what to tell you,” Geraci said, hinting it’s high time Vanguard opened its doors to crypto ETFs. 😉

Last month saw a 0.3% increase in the Consumer Price Index (CPI), as anticipated by economists, while it was slightly lower at 0.1% in May. Compared to the same period last year, CPI experienced a 2.7% rise, matching the projected figure and slightly higher than the 2.4% growth seen in May.

According to the oh-so-trusty DeFiLlama data on July 15, 2025 (so mark that date, folks), Sui’s TVL sits at a jaw-dropping $2.19 billion. Can we talk about a full recovery here? It bounced back from May’s pathetic low of $1.5 billion and has re-established itself among the VIPs of Layer 1 chains. Who knew a few zeros could bring so much joy? 🤩

Bitcoin’s (BTC) upward momentum slowed down, leading to a drop in prices by approximately 5% from its peak. This typical pullback in a bull market also affected other parts of the market, but some exceptions such as BONK and PUMP managed to rise by 5%, defying the overall trend within the past 24 hours.