Unbuckled Ada, $1 Tease & Trump’s Ghost: The Cardano Fever-Dream! 🪩💸

Yet beware: RSI, that neurotic nurse, flutters at 69.7 (nice), screaming, “We’re so overbought I’m seeing double!” Every time she shrieks, a bull turns into a rug-pull meme. 🍌

Yet beware: RSI, that neurotic nurse, flutters at 69.7 (nice), screaming, “We’re so overbought I’m seeing double!” Every time she shrieks, a bull turns into a rug-pull meme. 🍌

Now, all the crypto shenanigans-stablecoins, tokenized securities, API bank-non-bank speed dating-will just be smeared across the usual roll of regulatory parchment. Because why bother with a dedicated program when you can just call it “business as usual” and hope it all doesn’t go sideways during lunch?

But here’s the kicker: Analysts are saying that Solana’s fleeting flirtation with the $200 mark is actually a sign of something more substantial than just another speculative pop. It’s like when you finally clean your room, and it turns out there was a whole other layer of floor under all that clutter. 🏡✨

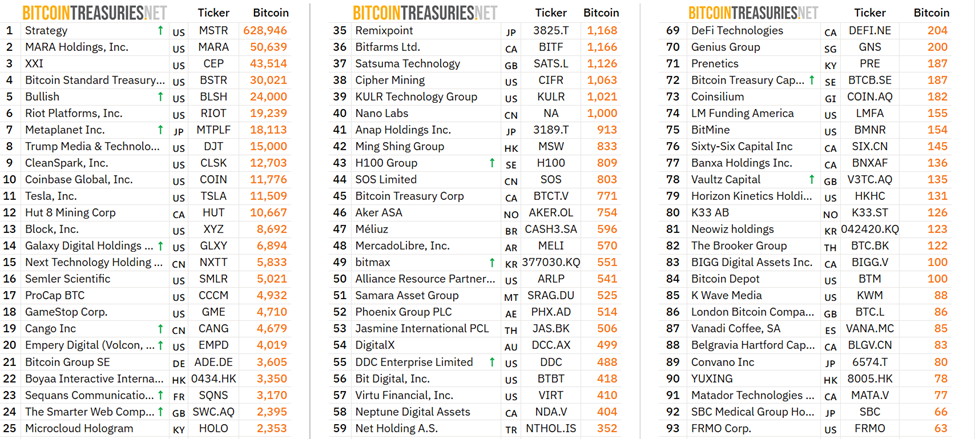

The philosopher CryptoGucci, whilst idling on X (the stage formerly known as Twitter), presented to all a vision: Joseph Chalom, our CEO of infinite optimism, prophesied with the gusto of a market astrologer. He foretells a world where tokens dance with stablecoins, where RWAs-not to be confused with Very Serious Bankers-will stuff $100 trillion into their fine velvet waistcoats.

Analyst Fresh thinks the current price is a “huge discount.” I mean, who doesn’t love a good sale? He’s projecting a rise to $0.40 in two months. That’s over 70% upside potential! But let’s not get too excited. Short-term resistance is hanging out in the $0.265-$0.27 range. Break above that, and we might just test $0.30. But if we can’t hold $0.25? Oh boy, we’re looking at a retest of $0.24. It’s like a bad relationship-just when you think it’s getting better, it drags you back down. 😩

Apparently, Citigroup-commonly known as Citi, because we’re all about brevity-has realized that digital assets aren’t just a passing fancy. According to those thrill-seeking rebels at Reuters, Citi is after the promising world of stablecoins and bitcoin-related ETFs, aiming to support high-quality, “seriously trustworthy” digital products. Think of it as the bank’s way of saying, “We see your wild crypto ride and raise you a Fortress of Solidity.”

This marks the first time a public company in Taiwan has put its money where its mouth is, betting on a business whose strategy is as risky as a game of poker with a one-armed bandit. WiseLink chipped in $2 million through convertible debt-a fancy way of saying they’re keeping their options open, like a farmer hedging his bets on the weather. The rest came from U.S. investor Chad Koehn and four shadowy figures who prefer to stay in the background, probably sipping whiskey and watching the chaos unfold. 🥃

Most recent episode? Today’s blockbuster transfer: 16.71 million XRP, roughly $51.8 million in real money (or at least in your favorite cryptocurrency), saunters from an address with about as much traceability as a ninja in a fog. This isn’t happening by accident. No, this transfer aligns suspiciously well with the “slice size”-a cryptic digital chunk that keeps popping up in the wallets of major U.S. exchanges. It’s almost like a secret handshake that only invisible wallets know. 🤔

Grab your coffee (or perhaps something stronger, depending on how the markets are treating you today) because the world’s largest sovereign wealth fund has just made a move that could either be genius or the financial equivalent of trying to microwave a metal fork. ⚡️🍴

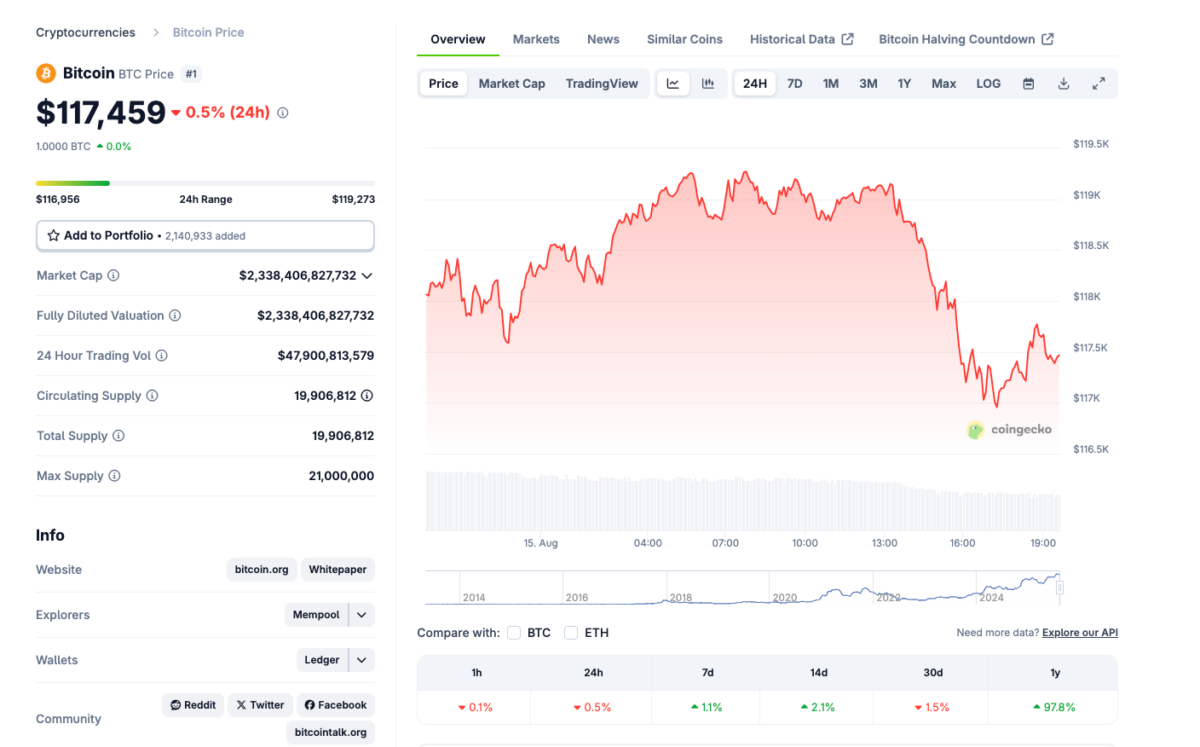

BlackRock’s Bitcoin and Ether ETFs casually splashed over $1 billion Thursday-because who doesn’t love a little chaos while prices plummet 5%? 🎢