Bitcoin Drama: MSTR’s Wild Ride & IBIT’s Boring Debut 😱📉

When BlackRock’s IBIT options launched on Nov. 19, the trading world went bananas-$2 billion in volume on day one. That’s a lot of people throwing money around like confetti at a parade. 🎉💸

When BlackRock’s IBIT options launched on Nov. 19, the trading world went bananas-$2 billion in volume on day one. That’s a lot of people throwing money around like confetti at a parade. 🎉💸

Methodologically, 2025 marks a notable pivot. Chainalysis, in a fit of prudence, “removed the retail decentralized finance (DeFi) sub-index” after concluding it over-weighted a “relatively niche behavior,” and added a new institutional activity lens capturing transfers over $1 million, reflecting the post-ETF surge in professional participation. The aim, they write, is a “fuller view of global crypto engagement, capturing both bottom-up (retail) and top-down (institutional) activity.” One cannot help but admire their ambition, though one wonders if they might not be biting off more than they can chew. 🧐📈

Now, before we start popping champagne or throwing tomatoes, the market’s still got these “sell walls” standing taller than my Uncle Morty after three matzo balls. Will TON moonwalk up 50%, or just do the awkward shuffle in place? Grab your popcorn!

Now, hold onto your wallets, because Changelly is predicting that $BTC might soar to $125K by the end of September. That’s like a 14% return on investment! You know what they say: if you don’t ride the rollercoaster, you might miss the fun… or the panic attacks. 😬

Khi Dogecoin tiếp tục duy trì sự ổn định (và chúng ta phải thừa nhận, hơi nhàm chán), và Cardano thì đang liên tục “cố gắng vượt qua” những ngưỡng kháng cự, PropiChain lại đang âm thầm gia tăng sức mạnh. Thật dễ dàng để nhận ra lý do tại sao nó được dự đoán sẽ vượt mặt các đối thủ vào đầu năm 2025.

According to the official missive, Etherealize intends to fortify its position, expand operations, and develop a splendid array of high-tech wizardry. Among their ambitious projects are a zero-knowledge privacy infrastructure for tokenized assets-because who doesn’t love a bit of cloak-and-dagger?-a settlement engine tailored for institutional tokenization, and an assortment of applications to usher liquidity and utility into the realm of fixed income markets, all dressed up in the latest blockchain finery.

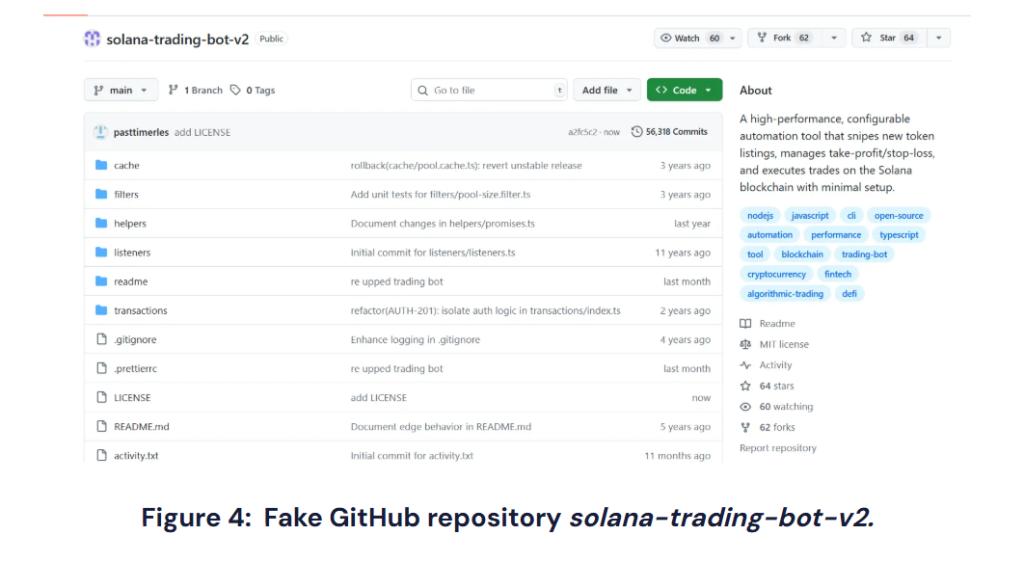

ReversingLabs, those digital detectives with too much time on their hands, stumbled upon two npm packages-colortoolsv2 and mimelib2-pretending to be innocent utilities while secretly moonlighting as malware delivery boys. Because why bother with honesty when deception pays better?

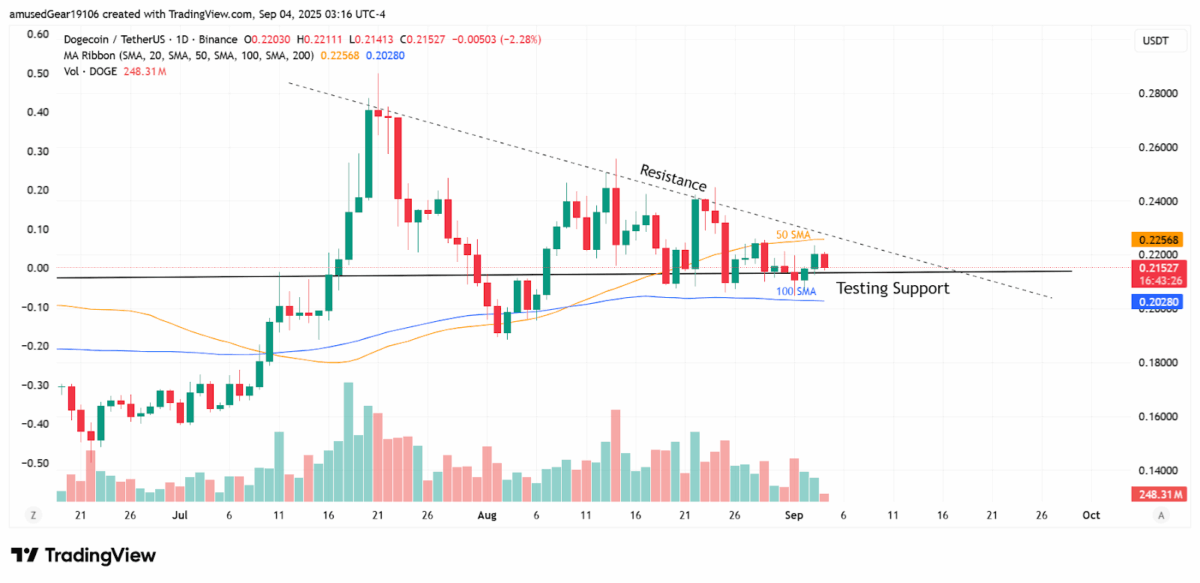

On a peculiar day in the land down under-September the 4th to be precise-the price took an unexpected nosedive during their charming Asian trading session. It barely touched $0.223 like it was winking at some stranger before slipping away. The trading numbers, frolicking around on binance as per some chap named TradingView, were at $0.2143, happily poking at a crucial support level as if testing a fence within a guarded castle. Meanwhile, CoinMarketCap whispered tales of a trading volume reaching 1.78 B in just the past twenty-four hours.

The bill even tries to be “flexible” by not taxing crypto-to-crypto trades. Because nothing says “progressive” like letting people dodge taxes by swapping Bitcoin for Dogecoin. 🤡 Coincidence? I think not.

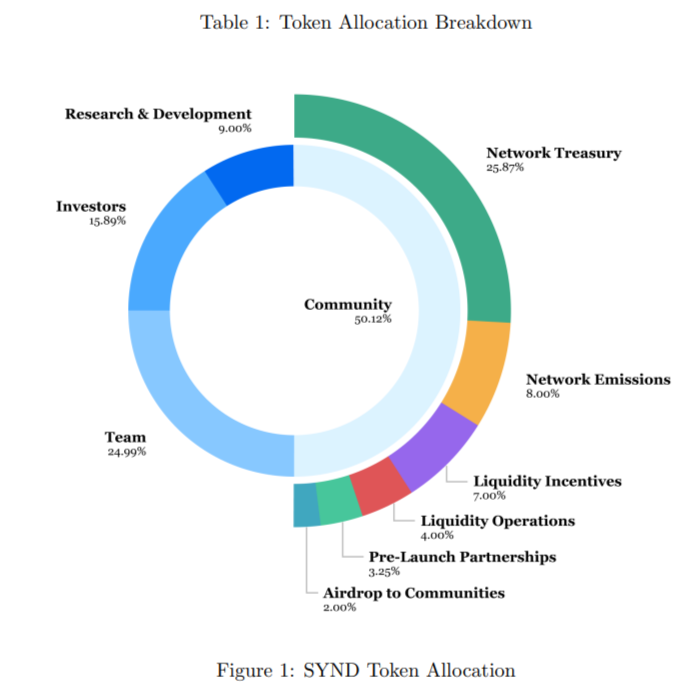

On the hallowed grounds of X (formerly Twitter), Syndicate’s corporate oracle announced SYND’s Ethereum-based arrival, allocating 501.2 million tokens to the “community”-a term so vague it could describe a group of raccoons sharing a pizza. This does not include the 2% airdropped on August 15, a digital scavenger hunt for appchain enthusiasts and developers who forgot what “real life” looks like. 🐉