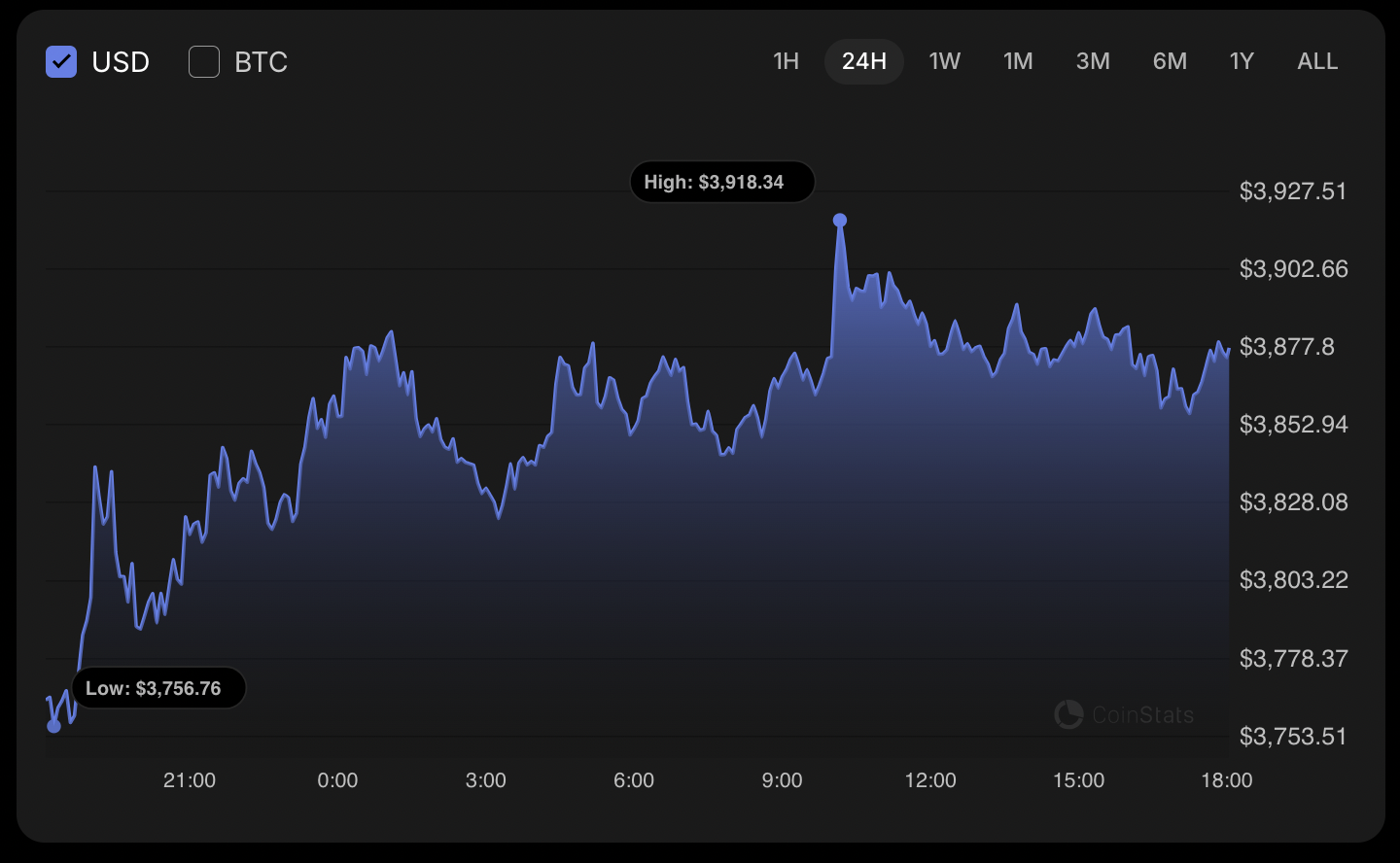

Bitcoin to the Moon? Billionaire Projects 14x Surge! 🚀

The optimism surrounding Bitcoin is catching like wildfire! Investors are beginning to see it as the fortifying bulwark against the relentless gnashing teeth of inflation and the devaluation of fiat currencies. On October 16, the ever-eloquent Ricardo Salinas Pliego, chairman of Grupo Salinas (and, might I add, a self-proclaimed ‘gold bug’ turned crypto crusader), took to the social media stage to declare Bitcoin’s imminent rise. Honestly, the way he speaks, you’d think he found the Holy Grail of finance tucked behind his couch. 🏆