Canada’s Stablecoin Showdown: Budget on the Line!

The push comes as Canada faces mounting pressure to keep pace with global stablecoin regulation, particularly after the United States passed comprehensive stablecoin legislation earlier this year. Without clear rules, Canadian officials worry that investors will increasingly turn to U.S.-based stablecoins, sending money and financial data south of the border. How… convenient for the Americans. 😏

XLM’s $8 Hopes: A Tale of Bulls, Bears & Stellar Dreams 🚀

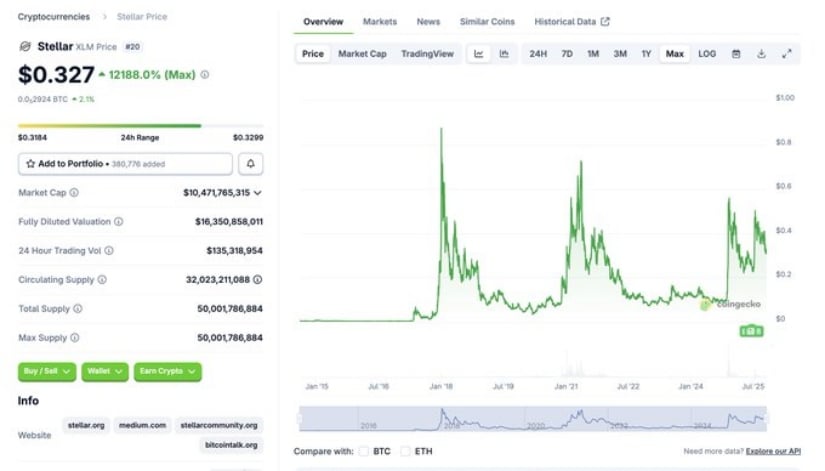

In a post that could either be prophetic or delusional, Crypto GEMs declared, “#XLM going to +$2 this cycle,” igniting a flurry of comments from traders who either believe in miracles or have too much caffeine. Supported by a snapshot of market data (because nothing says “trust me” like a graph), this bold claim has the altcoin community buzzing like bees at a honey pot. 🐝

Bitcoin vs. the World: Will It Crash or Conquer? 🚀

Sentiment stays positive, but price discovery hinges on how risk assets trade this week. Spoiler: They’ll probably crash. 💸

Eric Trump Gets Fired Up Over 1,414 Bitcoin Acquisition – And You Should Too! 🤑💥

So, Miami-based American Bitcoin Corp. (trading as ABTC)-which, by the way, is not just another tech startup but one with some serious Trump-family backing-has been building the foundation for America’s very own Bitcoin infrastructure. The company has just secured even more BTC through mining and some strategic purchases, and guess what? Some of them are even pledged under an agreement with Bitmain. 💼💥

US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

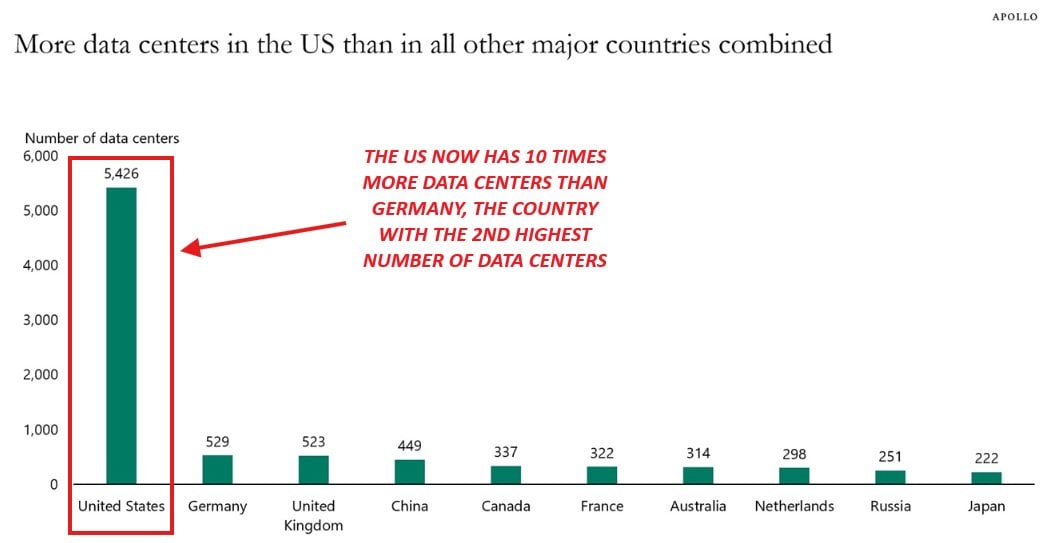

In a delightful thread posted to X, the oracle known as The Kobeissi Letter presented staggering figures that would make anyone’s head spin, even without the aid of vodka. It proclaimed that the U.S. now boasts an impressive 5,426 data centers-more than all the rest of the world’s major players combined. Now that’s what I call a robust collection of refrigerator-sized computer boxes! 😅

XRP’s November Rally: A Tale of Greed, Fractals, and Cold Wallets 🤑

XRP’s fractal, a ghost from the past, hints at a 12% to 18% rally in November-a mere flicker of hope in the abyss of uncertainty. 🌌

XRP at $3? Bollinger’s BTC Drama & SHIB’s Cry for Help 😱💸

So, XRP’s back at the crossroads, pretending it’s not obsessed with that $3 psychological level. The price action? Oh, it’s serving “I’m casually bullish” vibes, but we all know it’s plotting a full-on rally. Short-term weakness? Please, it’s just taking a dramatic pause before the grand finale.

How a Trump Bitcoin Boondoggle Turned into a Billion-Dollar Bedlam

This outfit aims to stay ahead of the game through their “minin’ operations” and what they call the “Trump Bump” – which, for all I know, might be a fancy way of sayin’ they’re gambling in the crypto wild west. But in these uncertain times, makin’ plans long-term is about as easy as catchin’ a greased pig at a county fair.

AntCoin: Alibaba’s Fintech Ant Marches Into Crypto 🦞💰

Why Hong Kong, you ask? Well, honey, it’s the new cool kid on the Web3 block, offering regulatory hugs where mainland China gives side-eye to crypto. 🇨🇳🚫 Ant Group’s like, “Oh, you want rules? We’ll take your rules and make them our runway.” Strutting into Hong Kong gives them a front-row seat to the stablecoin and tokenized finance party. 🎉🎟️