The Devil’s Bargain: DeFi’s Struggle Against Centralization 🎩🔥

still stumbling through the purgatory of performance woes, like sinners awaiting absolution 🧨📉

still stumbling through the purgatory of performance woes, like sinners awaiting absolution 🧨📉

What began as a genteel retreat has devolved into a full-blown stampede. Traders, clutching their portfolios like a life raft, are abandoning ship faster than a fashionably late guest at a charity gala. Volatility, that old mischief-maker, has spiked, and sentiment? Well, it’s as cheerful as a Monday morning meeting. Support levels are being scrutinized with the intensity of a Shakespearean critic-will Bitcoin stabilize, or is there a deeper abyss awaiting? Only time, that fickle flibbertigibbet, shall tell. ⏳

UBS, that paragon of fiscal responsibility and existential dread, has declared war on “settlement friction.” Their weapon of choice? A tokenized fund called uMINT, which sounds like a cryptocurrency for mint-condition vintage cars. By using Chainlink’s Digital Transfer Agent (DTA)-a magical spell that makes tokens behave-UBS has proven that blockchain can turn the fund industry from a bureaucratic quagmire into something resembling a board game. Minus the snakes and ladders, obviously. 🐍

Is Bitcoin’s descent below the hallowed $100,000 mark a harbinger of doom? Not so, proclaim the sages of the crypto oracle. A 20% dip, they declare with a wink, is but a mere flirtation with gravity, a buying opportunity in disguise. After all, this is crypto, not the somber bond market, where a 20% drop is less a catastrophe and more a dramatic gesture. 🎢

Litecoin’s recent stumble from its ascending channel-like a drunkard falling off a curb-has amplified the groans of short-term sellers. Analysts, those modern-day soothsayers, note the coin’s failure to hold the $86 midline with the grace of a toddler clutching a balloon. The 4-hour chart now sees LTC below its 9-period EMA, a technical sign as clear as a foghorn in a hurricane. And volume? A whisper, barely audible over the sound of bulls collectively shrugging. Bravo.

Behold, the Google search trends, once ablaze with fervor, now flicker like dying embers. The altcoins, those wayward siblings, have succumbed to the void, their sentiment a desolate wasteland of -81. Oh, how swiftly the tides of fortune turn! In this realm of speculation, where reason is but a fleeting shadow, price is but a mirror to our collective psyche. And yet, the on-chain data, that cold and unyielding oracle, speaks of strength beneath the chaos. Aye, the network endureth, its heart unbroken, even as the crowd dances to the tune of panic.

In a post that left the crypto world gasping, Butcher claimed that Binance and Wintermute have been running a game so devious, it would make even the most seasoned of stockbrokers blush. Apparently, in the last 30 days alone, these two fine establishments have exchanged a staggering $34.5 billion between themselves. 😱 How does this tale unfold, you ask? Well, Binance, ever the gracious host, sends off chunks of Bitcoin and Ethereum-ranging from a humble $10 million to a princely $100 million-to Wintermute’s wallets, just hours before every market plunge. A little premeditated, don’t you think?

Yet, amid this chaos, there strolls the illustrious Anti-CZ Whale-a figure both revered and ridiculed. Recall when this aquatic titan shorted ASTER after CZ’s grand announcement? A masterstroke! The coin soared, then nosedived, gifting the whale a fortune in profits and a reputation thicker than a blockchain’s ledger. Now, in a twist worthy of a Gogolian farce, the whale flips its sails from Ethereum shorts to a staggering $109M long position. Is this the dawn of a new era… or merely the whale’s midlife crisis?

MSTR’s debt? Mostly convertible senior notes with a “holder put” option expiring Sept. 15, 2027. According to Woo’s calculations, MSTR’s stock needs to trade above $183 by then to avoid selling Bitcoin to pay the piper. That’s roughly equivalent to Bitcoin hitting $91,502 if we assume a mNAV of 1.0 (a number so arbitrary, it’s practically a cosmic joke). The good news? They can settle conversions with cash, stock, or a mix-because nothing says “financial stability” like a buffet of options. 🤷♂️

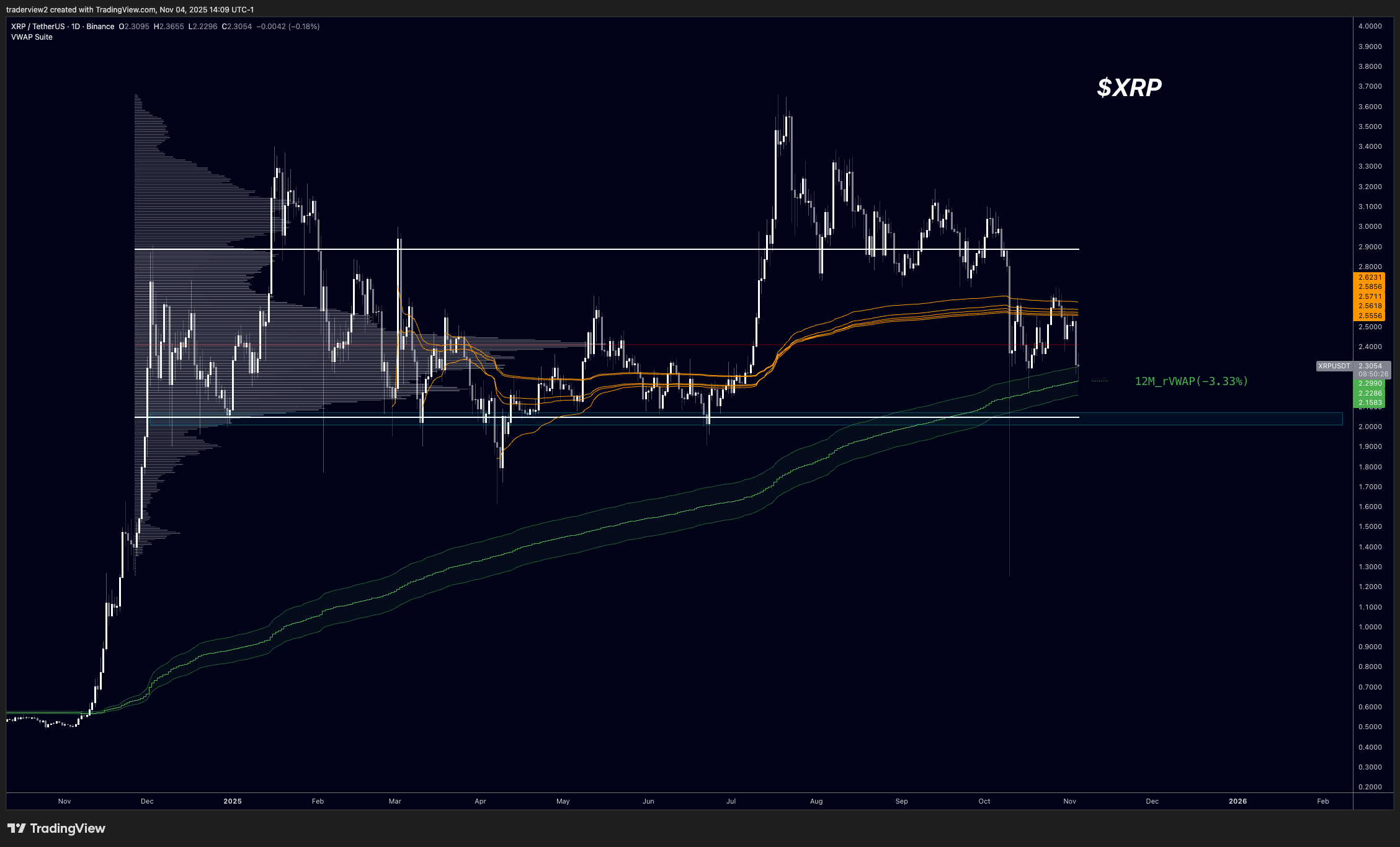

According to the ever-optimistic trader Dom (@traderview2), XRP has “reached the 12M rVWAP for the first time this year.” A level, he says, that we “really don’t want to be trading under for too long.” In his cheerful warning, he added that if the bulls lose the 12-month rolling VWAP, we could be heading straight to the $2 mark. You know, the land of “meh,” where things can only go either way. But hey, a quick recovery would need $2.50 to break free of the dreaded danger zone. Can we do it? Probably not. But let’s hope. 🙄