Crypto Crash? 📉 Just Another Tuesday…

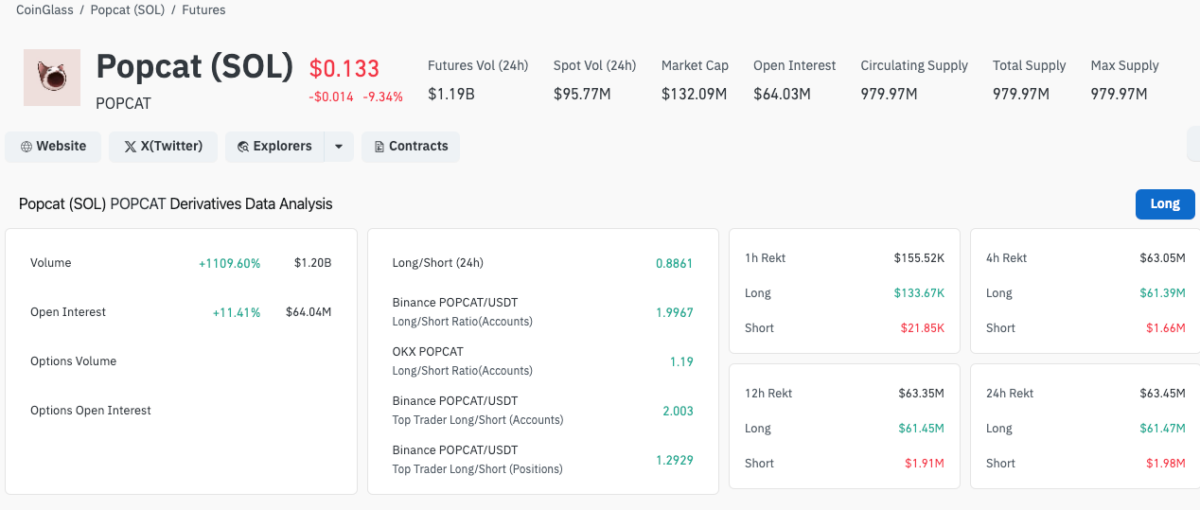

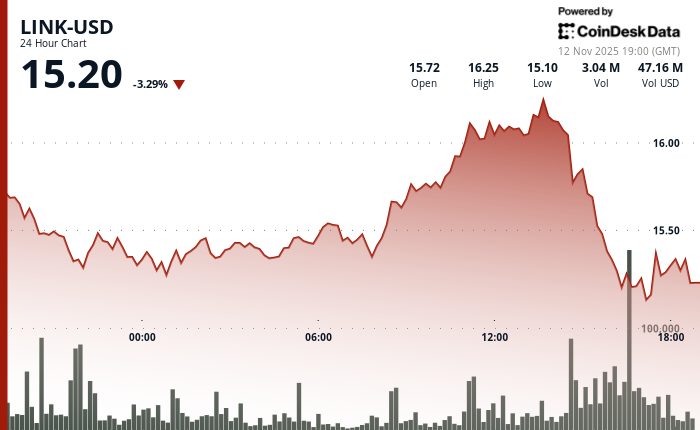

Ah, the cryptocurrency market. Such promise. Such… volatility. It seems to be experiencing a bit of a downturn, a little… discomfort, shall we say. The investors, naturally, are flustered. Bitcoin and Ethereum, those grand old men of the digital world, have stumbled, lost their footing, and are looking rather sheepish. They say it’s “corrective phase.” I say, it’s just life. 🤷\u200d♀️