Cardano’s Vibe Coding Saga: Blockchain Meltdown or Just a Really Bad Tech Party?

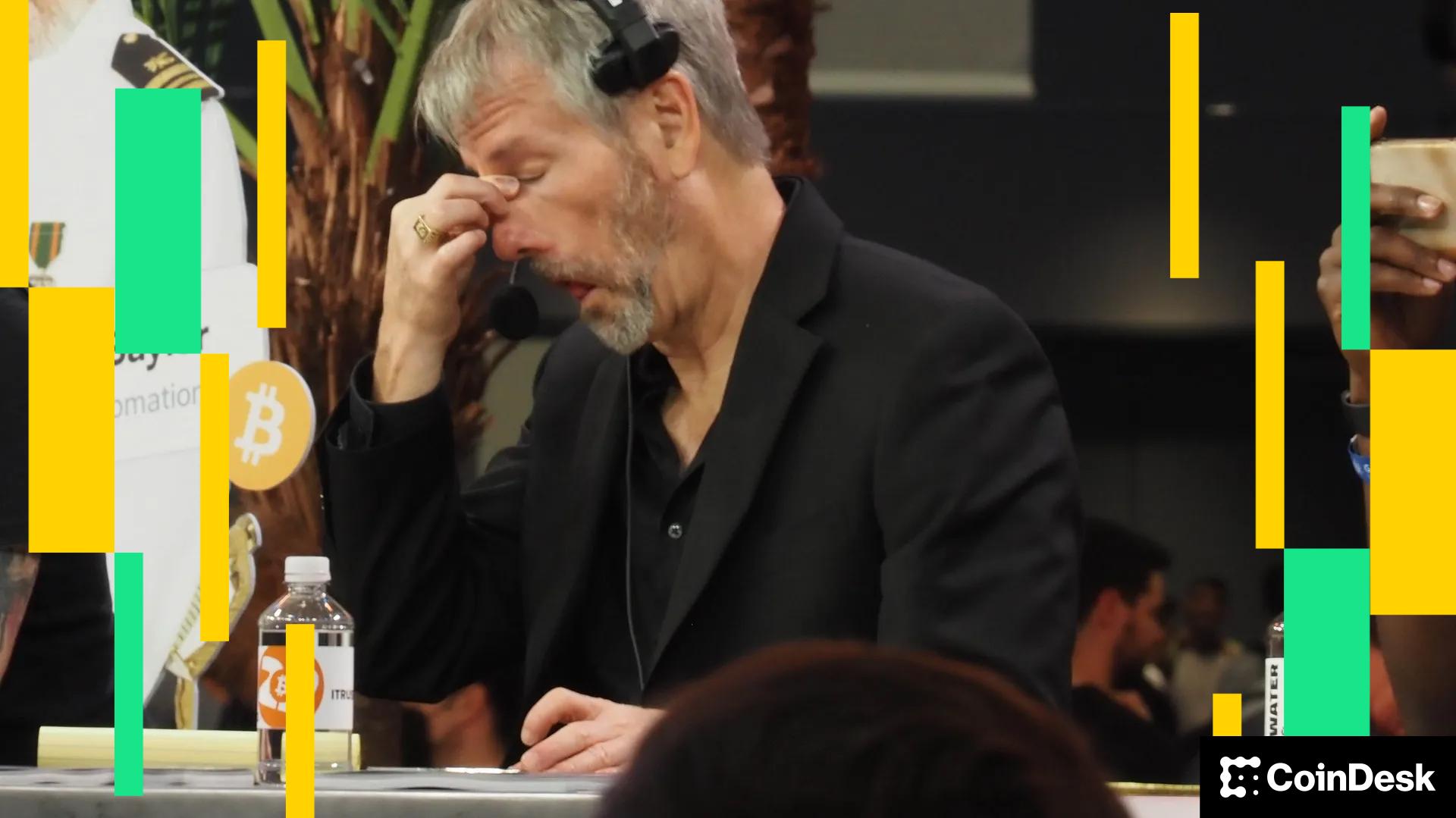

“This is an example of a narrative that is wrong on so many levels…” Hoskinson declared, probably while sighing theatrically into the void of the internet.

“This is an example of a narrative that is wrong on so many levels…” Hoskinson declared, probably while sighing theatrically into the void of the internet.

“Euphoria? Darling, we’re hardly at the champagne-popping stage of this cycle,” Alden quipped during a recent episode of the What Bitcoin Did podcast. “So, no, no major capitulation on the horizon. How utterly tedious for the doomsayers!”

Months they’ve toiled, measuring the anxieties of a nation against the cold logic of circuitry. Each chip, each line of code dissected with a precision born of fear. It’s all quite theatrical, really. A desperate attempt by Washington to exorcise the ghost of technological dependence. The very notion that one could control a nation by switching off… miners. Oh, the absurd grandeur of it all! 🙄

Alas, the multi-year ascending trendline-FLOKI’s metaphorical spine-has crumbled, according to our seer Cryptollica. This line once withstood market tantrums like a stoic but now lies shattered, exposing the asset’s structural integrity akin to a chocolate teapot. Price lingers beneath the trendline retest zone, a ghost haunting its former glory. Momentum? Lost. Buyers? In hiding. FLOKIUSD |

Schiff, the gold-loving economist (because who doesn’t love gold, right?), has some thoughts on Bitcoin’s future: “Bitcoin is finally having its IPO moment,” he said, as though Bitcoin had somehow been too shy to make its grand entrance before. It seems that the market is now flush with liquidity, which gives the OGs the perfect opportunity to cash out. Hooray for them, right? 🙃

As Bitcoin’s value nosedives, the calls for liquidation of Strategy (MSTR) are growing louder than a brass band at a funeral. With the company’s stock plummeting nearly 70% from last year’s high, some are questioning whether the firm can keep up with its financial obligations. 😱

Enter Homer J, a staking pool operator with a name that sounds like a punchline and a knack for mischief. Using AI-generated code, he tossed a pebble into the blockchain pond and watched the ripples turn into a tsunami. “My bad,” he said, probably while sipping coffee. Intersect, the Cardano fixer squad, scrambled to patch the software, urging node operators to update their tools. But by then, the damage was done: transactions got orphaned, double-spends floated like ghosts, and some users’ wallets wept quietly into the ether.

A former LAPD officer now faces charges after allegedly teaming up with a band of merry fraudsters to rob a teenager of his digital riches. The plot reads like a Netflix special-except with fewer explosions and more blockchain. 🎬

On Saturday, Nov. 22, the crypto oracle Ali Martinez unveiled some rather unsettling on-chain data. Apparently, over the last week, more than 20,000 BTC-worth nearly $2 billion-has been sloshing back into exchanges like a drunken sailor stumbling back to shore after a disastrous voyage. 🐋

Come Friday, November 21, Dara took to the social media megaphone-known as X-declaring his campaign and revealing a blueprint for his grand plans. His mission? End the “lawfare”-that fancy word for “legal bullying” – where current AG Letitia James seems to think she’s auditioning for a spot in political Hollywood rather than safeguarding the law. Apparently, her focus is less about justice and more about her upward climb. Athletic, no? 🏃♀️💼