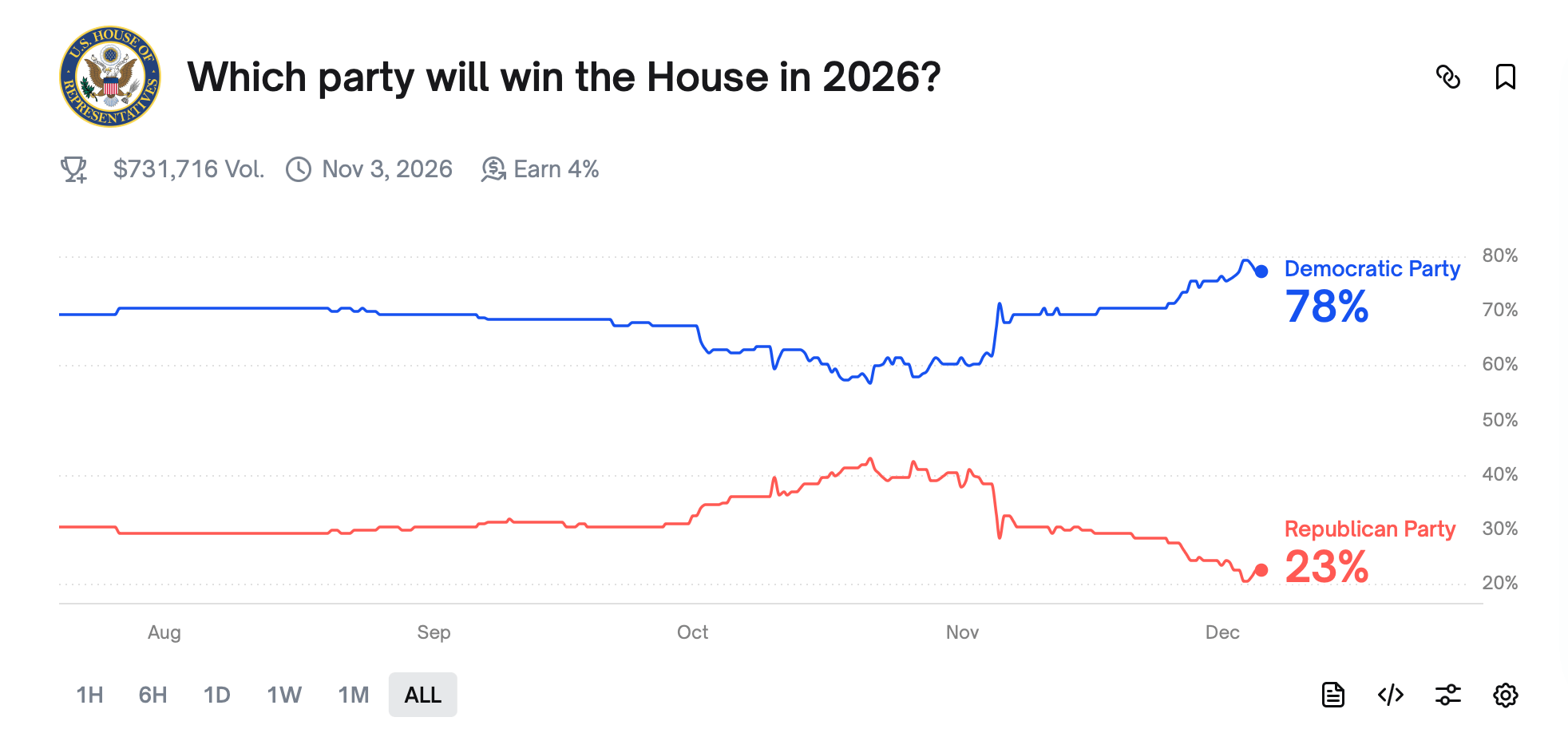

Democrats & GOP in 2026 Showdown: Will Congress Explode? 💣

Trump’s first year in office? Let’s just say it’s been a rollercoaster. After that initial burst of “I won!” euphoria, his approval ratings have dipped to the high 30s. By October, polls were all over the place, and November? Well, let’s just say he’s not exactly the people’s favorite anymore. NPR/PBS/Marist, Gallup, and Reuters all had him between 36% and 39%. Classic. You win an election, take the oath, and suddenly you’re the most hated person in America. Groundbreaking.