Vitalik Buterin Pushes Gas Futures Idea for Ethereum

In his latest intellectual escapade, Buterin has proposed an on-chain prediction market that is “trustless,” which, according to him, will help users predict and secure future gas prices. After all, who doesn’t want to plan for volatility, instead of just reacting to it like a befuddled schoolmaster caught off-guard by a misbehaving pupil?

Shiba Inu’s Trillion-Dollar Blunder: Glitch or Crypto Coup? 🐕💸

Behold, the “routine” price action of SHIB: trapped beneath moving averages like a dog under a coffee table. No violent candles, no spreads stretched thin-just the serene indifference of a market that clearly didn’t get the memo about trillions of tokens allegedly changing hands. Volume? Unremarkable. Price reaction? Non-existent. Either traders collectively decided to ignore a sell-off of apocalyptic proportions, or… someone misplaced a decimal. 🤷♂️

Buterin’s Gas Gambit: Ethereum’s Time Machine? 🧙♂️⛽

Today’s fees, calm as a matron’s gaze, deceive the unwary. Buterin, with a sigh of foreboding, reminds us that stability is but a temporary truce. Poor souls relying on Ethereum for grand machinations face a future as readable as a Tolstoy manuscript after a vodka binge-chaotic, cyclical, and full of transactional heartburn. 🏋️♂️💸

Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

Upon a brisk December morn, CryptoOnchain – a fellow of no small repute in the market parlors – penned a note on the distinguished X platform. With the astuteness of a financial Sherlock Holmes, he proposed that Bitcoin might just be sketching out the dregs of a local demimonde, readying, as they say, for a cheeky bounce back. He observed that the erstwhile selling pressure, particularly from those crusty long-term holders, seems to be waning, much to the delight of speculative gentlemen.

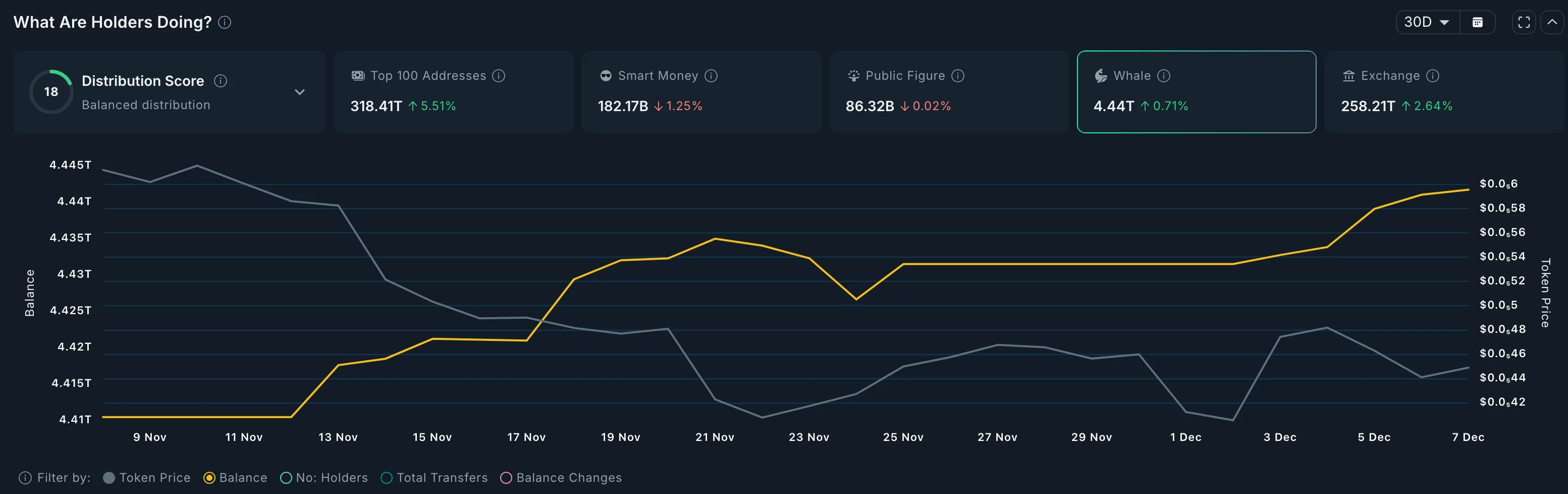

Pepe Coin: Whales Swim, Bears Dance, and Meme Dreams Drown 🌊💰

Pepe Coin (PEPE), the second fiddle in the Ethereum meme coin orchestra, has tumbled to $0.000004512, a fall so steep it makes Icarus look like a cautious climber. Down 85% from its yearly peak, it hovers near its lowest since April last year-a humbling reminder that even memes have their mortality. ☠️📉

JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

Global investment bank JPMorgan, ever the optimist, said bitcoin could advance toward $170,000 within the coming months, outlining a bullish scenario tied to its tendency to move like gold. The bank noted that recent risk aversion, shifting expectations for 2026 rates, and uncertainty around Strategy’s bitcoin stance have pressured sentiment. 🏦✨

Bitcoin Getaway: Florida Man’s $80M Scam Saga Sparks Court Drama & Clashes

Now, guess what? The court, in a rare display of digital justice, has decided that Johnny can keep chasing Binance in his quest for vengeance… or at least some semblance of accountability. Because apparently, claiming that a foreign company isn’t subject to local jurisdiction is so last decade. The latest ruling? Binance’s online antics and local marketing efforts mean they’re just as guilty as a Vesuvian espresso machine. 🍵

Shibarium’s Secret Reset? Blockchain Explorer Unveils Shocking Truth 🐕💥

Weeks prior, the Shiba Inu team, those enigmatic puppeteers of the crypto stage, unveiled an ongoing Shibarium RPC Migration Network upgrade-a grand performance involving the closure of a legacy endpoint, the old public RPC connection for Shibarium now reduced to a ghostly echo, its previous URL a tombstone for access. 🕯️

Ethereum ETFs Crying All the Way to the Bank: $75M Vanish into Oblivion! 😱

It appears that Ethereum’s darling ETF, BlackRock’s ETHA, took center stage in this tragic comedy, orchestrating the entire spectacle of outflows. Poor ETH, it’s been crying for days-losing nearly $80M since December 2, with only a brief intermission when Fidelity fed it a tiny morsel of inflows of $140 million on December 3. Talk about a rollercoaster, but with fewer thrills and more tears. 🎢😭